November 9, 2018

By Troy Schneider

Many of you will soon begin meeting with your accountant to do year-end tax planning for your farm. The Tax Cuts and Jobs Act made substantial changes to tax laws for 2018. It is good to be aware of these changes so you can make appropriate plans for your farm now and over the next several years.

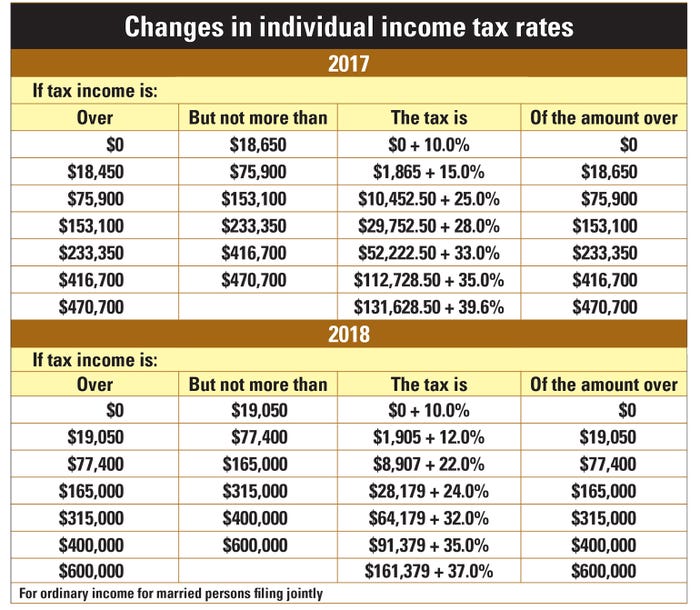

The charts below show the changes made to individual income tax rates for ordinary income for married persons filing jointly:

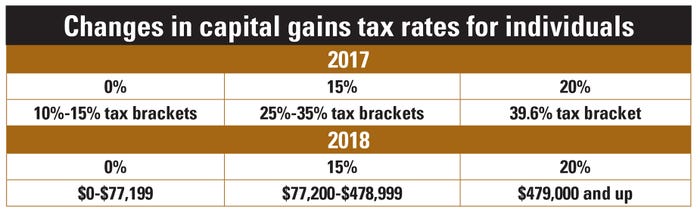

The changes made to capital gains rates by the Tax Cuts and Jobs Act are fairly minor. Under the TCJA, long-term capital gains tax rates of 0%, 15% and 20% still apply. However, the way they are applied has changed slightly. Under previous tax law, the 0% rate was applied to the two lowest tax brackets, the 15% rate was applied to the next four, and the 20% rate was applied to the top bracket. Under the TCJA, the three capital gains income thresholds don’t match up perfectly with the tax brackets. Instead, they are applied to maximum taxable income levels.

The charts below show the changes made to capital gains tax rates:

Section 199A deduction

Under the TCJA, IRC Section 199A provides for a qualified business income (QBI) deduction of up to 20% of qualified business income, applied at the individual level. For example, a taxpayer of $100,000 of QBI would receive a deduction of $20,000 against that income. For high-income individuals, the QBI deduction begins to phase out.

QBI means income connected with a trade or business in the U.S. QBI does not include such things as wages, salaries and guaranteed payments. As you know, in an S corporation, limited liability company or partnership, the income and expense of the farm or business is “passed-through” to the owners, and each owner must put his or her share of the net taxable profit or loss on his or her individual tax return. Each owner will also claim the QBI deduction on his or her individual tax return.

An individual must compute a separate QBI deduction for each identifiable trade or business. When businesses are operated as separate entities, an owner may aggregate operations of multiple entities together. An entity that operates a business may also be aggregated with a leasing entity. For example, a combined QBI deduction may be made for a real estate LLC that owns farmland and leases the farmland to a dairy farm LLC, so long as the entities share common accounting, transportation and management services.

What type of entity is best?

I am sure many of you will be asking the advice of your accountant and/or attorney as to what type of entity your farm should be after the TCJA. To review, under the TCJA, the C corporation tax rate is now a flat 21%. S corporations, partnerships, and LLCs which are taxed as an S corporation or partnership receive a Section 199A deduction. In general, a farm that reinvests all its income back into the farm and is highly profitable should consider operating as a C corporation. On the opposite side, a farm that distributes its cash or plans to sell in the future likely should operation as a pass-through entity.

A farm, more than ever, may consider a “multi-entity” approach. This means that a farm, for example, may have a C corporation operate the farm business and own a minimal amount of farm assets. The farm may have several pass-through entities own the farm assets, which assets then would be leased to the C corporation. This can provide income taxable at the maximum 21% C corporation tax rate during higher-income years and the ability to individually use losses and the Section 199A deduction during lower-income years.

With the new tax laws come more rules and exceptions to rules. It is more important than ever to assemble a good team of farm financial advisers to assist you.

You May Also Like