Oh, it's whining time again as government bureaucrats struggle with budgets in hard times.

The ultimate problem is caused by an entitlement attitude on the part of voters and their representatives alike, and nowhere is this more plain than in agriculture.

The latest budget suggestions from the President's office suggest some cuts to agricultural "programs" such as subsidized crop insurance, and the wailing and gnashing of teeth is loud and long.

In my home state, Oklahoma, which depends on oil and gas and agriculture for most of its state government revenues, there is more wailing. It's particularly loud from those public servants in education, which received only a 1.8% cut, despite a 12% shortfall of roughly $800 million in a $6.8 billion annual budget.

This is all voter-based whining, mind you.

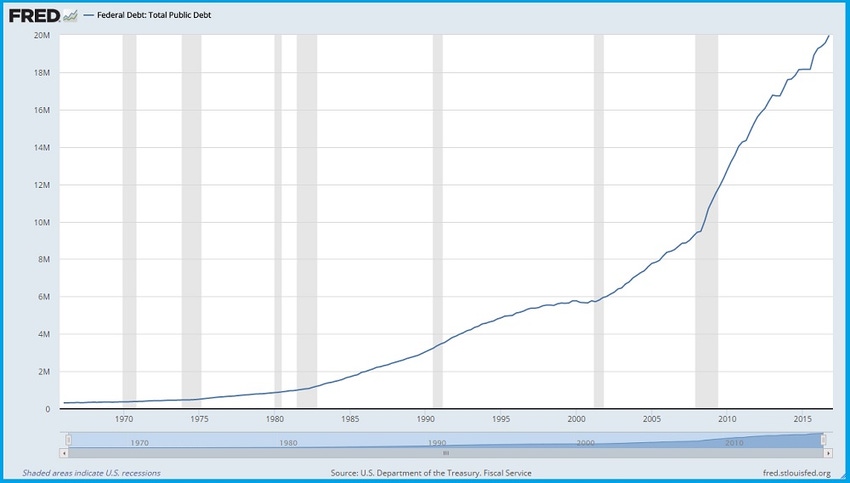

The most significant difference I can see between the situations is the state has a balanced-budget requirement, while the federal government does not. This means where the federal government is concerned, the voters can never get enough of other people's money, and there is no end to it.

I've harped on this before, but it seems to never change. As voters, we need to grow up and realize we're contributing to the problem -- indeed causing it -- by demanding government handouts, which the government must ultimately take by coercion from other people. This is in fact the origin of government's power.

You'll rarely hear this from your elected representatives, however. They take their leadership from you, another fact they deny by calling themselves "leaders."

Here's an example of that, again from my home state. Legislators plan to make up about half the "shorfall" between what they budgeted and what it appears they will have by raising taxes. One of those is called the gross production tax (GPT) on oil and natural gas. It was for many years set at 7%, then lowered in 1994 in the early days of lateral well drilling to 1% to help exploration companies with the extreme financial risks of drilling these expensive wells. In 2014 it was raised to 2%, and this year they plan to raise it further. That's the background.

The story is that one state representative named David Perryman-D wrote an article in which he said, "Oklahoma’s lucrative tax breaks to the industry cost upwards of $300 million per year."

Think about those words ...

Tax breaks don't cost anything unless you think someone else's money belongs to you.

I suggest a more honest appraisal would be that Perryman believes the oil industry can afford to pay higher GPT and wants to charge that rate. Neither he, nor anyone else who is not actually earning that money, bearing any costs from whatever tax rate is being charged. Put another way, taxes cost only those being taxed.

But as agriculturists, let's briefly examine the effects (beyond handing immense power to bureaucrats) of one of President Trump's proposed budget cuts. His team suggests cuts to the crop insurance subsidy program. This should set most beef producers cheering. The crop insurance subsidy system is an indirect subsidy clearly giving grain producers an advantage over beef producers in the race for land. Since land is the most limiting resource for every agricultural producer who raises crops or beef cattle, this is clearly an unfair advantage. Several studies on crop subsidies and on the ethanol subsidies over the years have clearly shown a significant portion, perhaps a majority, of the money paid as subsidy ultimately flows back down the chain to the owners of the most limiting resource -- land. In turn, that drives up land prices. Yet who pays for that subsidy? All taxpayers, including profitable beef operations.

Of course, the Trump budget only suggests caps on these subsidies, not elimination, so the industry howling seems to me particularly unwarranted. Yet as we should all understand by now, handouts are deemed an entitlement by those who receive them. They will make every illogical argument about why they "need" these things.

On the flip side, the only negative for most beef producers I can see is the price of grains and related feeds could rise a bit, which would likely dampen bids for feeder cattle.

In the end, we'd all be better off without the government maligning so many markets with social engineering via the tax code or direct subsidies.

In this video, the late economist Milton Freidman talks about these issues.

About the Author(s)

You May Also Like