As conversation about the 2018 Farm Bill gears up, farmers and other stakeholders are tuning in, debating merits and making cases for what’s important, especially for their farm or region.

And while many recognize the farm bill covers crop insurance, commodity titles and conservation, they may be less likely to consider the nutrition portion of the legislation, long tied to the farm bill to secure support from urban legislators.

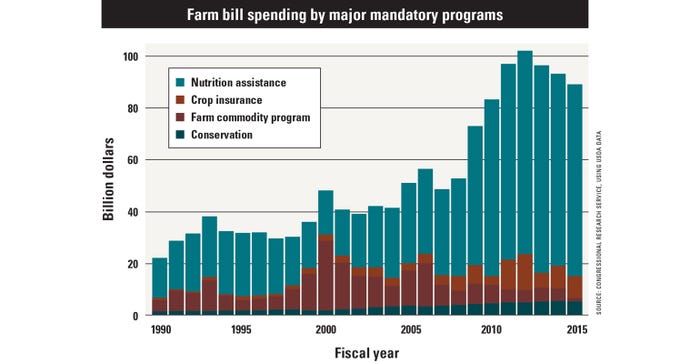

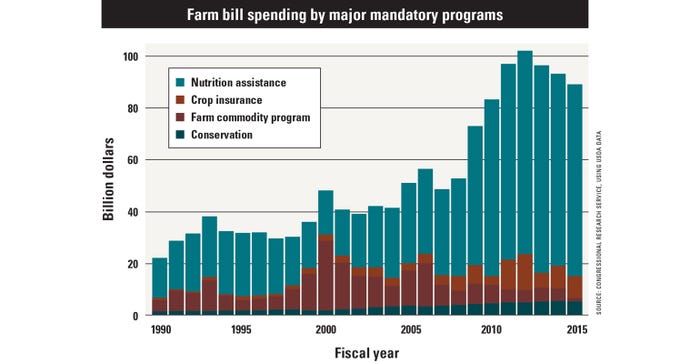

Gary Schnitkey, University of Illinois ag economist, says farm safety net spending in the farm bill over time is stagnant to declining. The SNAP, or nutrition, portion of the budget has increased considerably, as the chart below shows, courtesy of the Congressional Research Service.

Why? The 2008 recession created economic conditions that caused more people to be eligible for the Supplemental Nutrition Assistance Program, and those hardships continue.

“This is the political divide you see now: Our economy is doing well, but there are people who have been left behind,” Schnitkey says. “There are still a good amount of people who haven’t experienced good economic times and need food assistance.”

SNAP works in similar fashion to the Agriculture Risk Coverage/Price Loss Coverage programs; parameters are set, and if you qualify, you receive a payment. So both SNAP and ARC/PLC could make big payments or could not, depending on the situation in a given year.

DOLLAR DISTRIBUTION: Nutrition programs have captured a steadily larger percentage of the federal farm bill allocation since 2001.

DOLLAR DISTRIBUTION: Nutrition programs have captured a steadily larger percentage of the federal farm bill allocation since 2001.

Schnitkey doesn’t expect to see any increases in the total farm bill budget, noting that when you look at crop insurance and commodity titles together, they are very stable. They vary individually because they are risk management tools, but they’re not trending up.

“Over time, the real level of support provided by the federal government to agriculture is going down,” he adds. And while that means farm programs will become less important economically in the long term, that doesn’t correlate perfectly with political importance. Farm bills have historically passed with widespread bipartisan support, though Schnitkey says the budget environment suggests the whole farm bill will come under budgetary pressure.

As a percentage of the total budget, farm programs are but a footnote. Schnitkey says spending for farm safety net programs — commodity title, crop insurance and disaster assistance — represents 0.2% to 0.3% of total federal outlays in recent years.

“If you’re concerned about the federal budget, it’s not even worthwhile to think about cutting the farm bill,” he adds. “If we eliminated farm program spending, it would not be noticed.”

Overall, the federal government provides several safety nets throughout the economy: bank account insurance (FDIC), flood insurance, unemployment insurance. “The farm program is not the only safety net, nor the largest,” Schnitkey adds.

And while the public generally supports the farm bill, their concerns also reflect current public opinion about food and farming — and their detachment from agriculture. Namely, they’re more concerned about the environment than farm income.

“People are concerned with the way food is produced and its effect on conservation,” Schnitkey observes. “Over time, I expect more emphasis on those issues than on providing a safety net for farmers.”

Cotton effect?

Cotton was not part of the ARC/PLC programs in the 2014 Farm Bill, because of a chain reaction of events due to a Brazil cotton trade case.

“Cotton is trying to get back into ARC/PLC,” Schnitkey says. “Doing so will cost money. In an environment where you want to keep the budget the same, you have to cut somewhere else.”

In effect, if cotton gets back in, cuts will be made elsewhere.

“You can see this setting up: If you want to maintain and add cotton, what do you do to the crop insurance program to cut costs?” he asks.

The effect for Midwestern farmers could be severe — namely by cutting subsidies for crop insurance premiums.

“That could cause crop insurance premiums to go up a couple bucks,” Schnitkey says.

Farm bill: Listen in

The University of Illinois College of Agricultural, Consumer and Environmental Sciences hosted a Twitter chat on the farm bill last week, moderated by ag economists Gary Schnitkey and Jonathan Coppess. Here, they expand on their 140-character responses in a podcast, “Figuring out the Farm Bill.”

About the Author(s)

You May Also Like