April 30, 2018

Source: University of Illinois.

By Michael Langemeier and Michael Boehlje, Center for Commercial Agriculture Purdue University

There are numerous motivations for farms to expand their businesses. Even in today's environment of tight margins, many farms are exploring expansion options. When exploring these options, it is important to address key questions pertaining to the farm's strategy. A previous article (farmdoc daily August 5, 2016), discussed ten questions that should be addressed when examining challenges and opportunities associated with farm growth. This article focuses on the ninth question: what are the start-up challenges?

Cash Flow Shortages and Depleted Working Capital

In the long-run, it is important to make decisions that generate earnings and profits (Briggeman and Boehlje, 2009). Having said that, it is important to remember that it is cash flows, not profits that are received by the farm. Also, cash flows, not profits, are reinvested. The farm's profits and cash flows often do not occur together. Capital purchases, such as the purchase of grain bins, livestock buildings, or machinery and equipment, are depreciated and incur benefits over several years. However, cash flows associated with the purchase are often front-loaded, with a large portion of the cash outflow occurring in the first year. For this reason, farms need to examine the impact of a new venture on cash inflows and outflows.

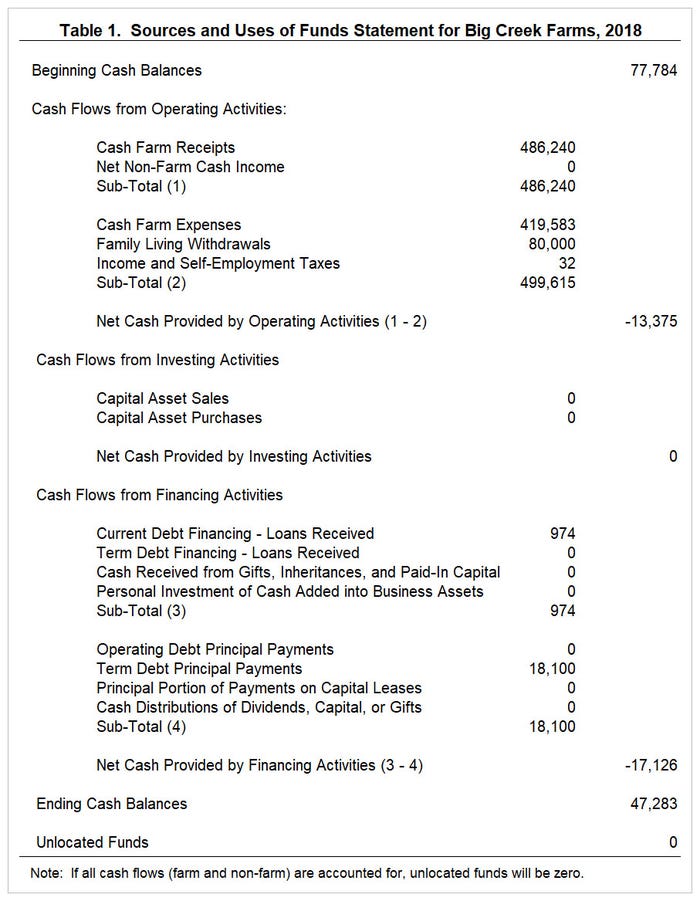

Farms that are growing rapidly often run into cash flow shortages and deplete their working capital. To help gauge the farm's use of cash, it is imperative that a farm utilize pro-forma financial statements. Most farms are familiar with the use of cash flow budgets. Another useful pro-forma statement is a sources and uses of funds statement. Table 1 presents a pro-forma sources and uses of funds statement for a case farm. Cash flows are separated into cash flows from operating activities, cash flows from investment activities, and cash flows from financing activities. This enables us to clearly see whether the cash flows from operating activities are large enough to pay for at least a portion of capital purchases. If cash flow from operating activities are insufficient to pay for capital purchases, which is often the case due to the fact that cash outflows occur prior to cash inflows and we are only looking at the first year's sources and uses of funds statement, term debt financing may be needed. For the case farm depicted in table 1, expected cash flows in 2018 from operating activities are negative so the farm is not projecting any capital purchases during the upcoming year.

A pro-forma sources and uses of funds statement also illustrates the change in cash balances from the beginning to the end of the year. This information could be used along with changes in anticipated crop inventories, accounts receivable, and supply inventories to create an expected change in working capital from the beginning to the end of the year. For the case farm in table 1 cash balances are expected to decline approximately $30,000 during 2018.

Operational Inefficiencies

Operational inefficiencies often occur when adopting new technology (e.g., precision agriculture technology) or producing a new commodity. In other words, the farm faces a learning curve, a curve depicting the relationship between per-unit cost and experience, typically measured in terms of cumulative output. A steep learning curve would imply that per-unit cost declines rapidly with experience while a flatter learning curve would imply that per-unit cost declines slowly with experience.

The important point here is to build higher per-unit costs into your enterprise budgets involving new technology or the production of a new enterprise, particularly in the early years of the project. In most instances, the shape of the learning curve is unknown. In these instances, scenarios involving different assumptions regarding the decline in per-unit costs with increases in cumulative output should be examined.

Management Bottlenecks

Start-up challenges can also be compounded by a management team that is not ready for a new venture. Weak management teams often have a poorly thought out strategy or execution plan. As a farm grows, it becomes increasingly important to prioritize decision making. A few relevant questions are as follows. Has your management team allocated enough time for the new venture? What is important to making the new venture work? What is stopping the farm from successfully growing?

In response to management time issues, farms often respond by hiring a key employee or employees to assist with the new venture. Knowing the skills needed and knowing how to find the "right people" may dictate whether the new venture is successful. Delays to finding key employees or the inability to find these people could lead to severe bottlenecks, and may create a learning curve that is much steeper than it would have been if these problems did not occur.

Once a new venture starts to generate positive net cash flows and profits, it is important to decide whether the farm should scale-up production. For example, a farm that is successfully producing organic crops on 80 acres or that is producing finished hogs under contract through the utilization of two barns needs to decide whether it wants to expand production or scale-up. Key questions to address are as follows. How will expanding production impact the management team? Will we need to hire additional employees to expand production? How will we pay for expansion, or what proportion of the funds for expansion will come from operational activities versus new loans? These questions should sound familiar. Many of these questions were initially addressed when choosing the new venture.

We would be remiss if we did not include a discussion of the impact of a new venture on the management team's comfort zone. How far out of our comfort zone does the new venture take us? How much do we want to push ourselves? Can you make a convincing pitch to lenders to help fund your new venture?

Concluding Thoughts

Start-up challenges may include cash flow shortages and depleted working capital, operational inefficiencies, and management bottlenecks. Comparing and contrasting these challenges among expansion options helps mitigate potential start-up challenges. In particular, if a particular growth option creates large cash flow shortages and depletions in working capital, a plan needs to be put in place to deal with these issues.

The start-up challenges noted above are not insurmountable. We discuss these issues so that farms can take these issues into account when evaluating new ventures. Being the first to adopt a new technology or produce a new enterprise creates challenges. However, it is important to remember that early adopters often reap above average returns. As with other decisions, the tradeoff between benefits and costs is relevant to the analysis of new ventures.

The next article in this series will discuss a farm's sustainable growth rate. In other words, how fast can a farm safely grow from a financial perspective?

References

Boehlje, M., and M. Langemeier. "Farm Growth: Challenges and Opportunities." farmdoc daily (6):148, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 5, 2016.

Briggeman, B.C. and M.D. Boehlje. "Cash is King - But Profitability is the Kingdom." Journal of the American Society of Farm Managers and Rural Appraisers, 2009.

Originally posted by University of Illinois.

You May Also Like