3 Min Read

Stewart Sutton/ThinkstockPhotos

With the latest July 6 deadline for the next round of U.S.-China tariffs come and gone, grain markets are left wondering how these moves will affect U.S. grain exports. If the week ending July 12 is any indication, the results haven’t proven disastrous, with weekly volumes mostly holding their own so far.

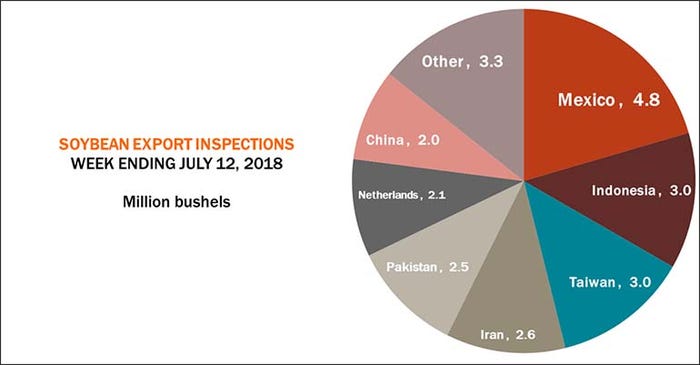

Soybean export inspections reached 23.4 million bushels last week, down slightly from the prior week’s total of 24.5 million bushels and on the high end of trade guesses, which ranged between 11 million and 29 million bushels. The total more than doubled the same week a year ago, with 11.0 million bushels, and kept the weekly rate needed to reach USDA forecasts in check, now at 23.9 million bushels. The 2017/18 marketing year-to-date totals continue to lag 4.4% behind last year’s totals, reaching 1.873 billion bushels.

Mexico was the No. 1 destination for U.S. soybean export inspections last week, with 4.8 million bushels. Other top destinations included Indonesia (3.0 million), Taiwan (3.0 million), Iran (2.6 million) and Pakistan (2.5 million). China also appeared on the list, clocking another 2.0 million bushels.

“China continues to load on soybean shipments, despite the tariffs,” notes Farm Futures senior grain market analyst Bryce Knorr. “The Cemtex Pioneer left the PNW bound for the Rizhao port in China with 2 million bushels. The Peak Pegasus is still anchored off the Dalian port while the Star Jennifer remains at sea, also bound for Dalian.”

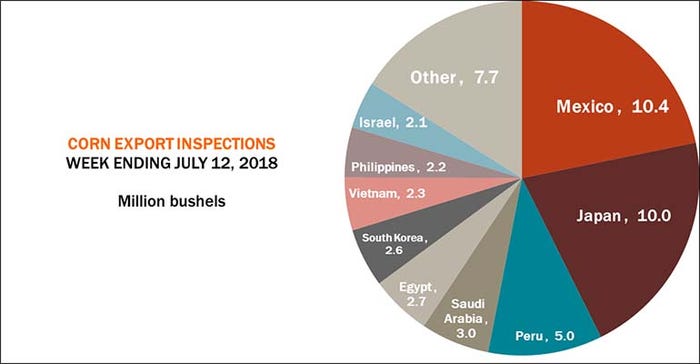

Corn export inspections found 47.9 million bushels last week – moderately lower than the prior week’s total of 57.8 million bushels, but in the middle of trade guesses, which ranged between 35 million and 59 million bushels. The weekly rate needed to reach USDA forecasts increased slightly, to 49.0 million bushels, and the 2017/18 marketing year-to-date total remains 4.7% behind last year’s cumulative total, with 1.908 billion bushels.

Mexico was the top destination for U.S. corn export inspections last week, with 10.4 million bushels – followed closely by Japan’s 10.0 million bushels. Other top destinations included Peru (5.0 million), Saudi Arabia (3.0 million), Egypt (2.7 million) and South Korea (2.6 million).

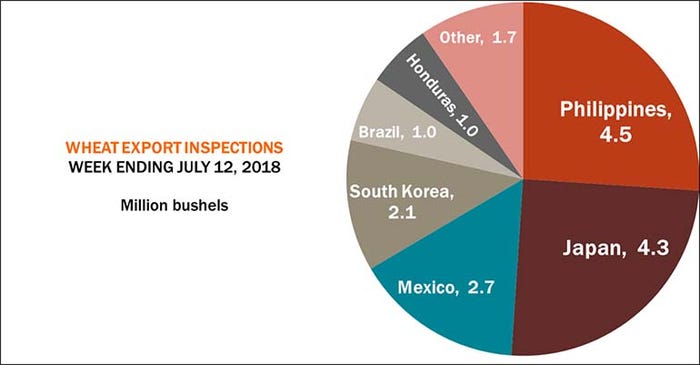

Wheat export inspections leaped forward last week, with 17.3 million bushels. That was well above the prior week’s total of 9.9 million bushels and ahead of the average trade guess, which ranged between 7 million and 14 million bushels. Still, the weekly rate needed to reach USDA forecasts inched ahead to 18.5 million bushels, with the young 2018/19 marketing year (which began July 1) down 43% from the prior year, with 82 million bushels.

The Philippines was the No. 1 destination for U.S. wheat export inspections last week, with 4.5 million bushels. Other top destinations included Japan (4.3 million), Mexico (2.7 million), South Korea (2.1 million), Brazil (1.0 million) and Honduras (1.0 million).

About the Author(s)

Subscribe to receive top agriculture news

Be informed daily with these free e-newsletters

You May Also Like