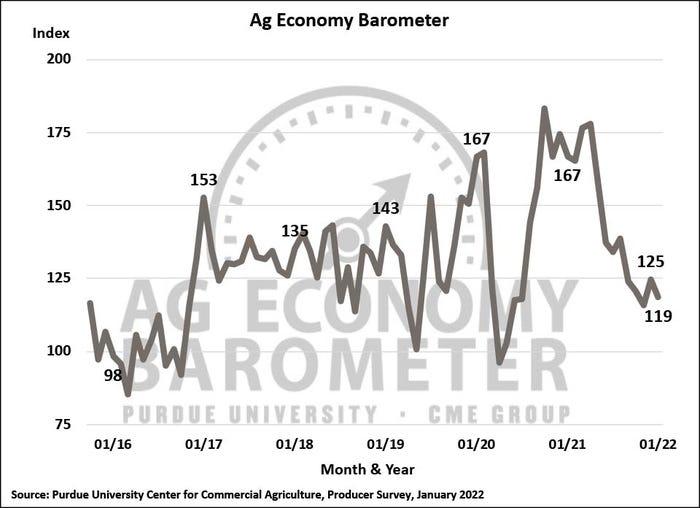

Farmer sentiment weakened in January as the Purdue University/CME Group Ag Economy Barometer declined 6 points to a reading of 119.

“Rising farm input costs and ongoing supply chain disruptions appear to be contributing to producers’ weaker perception of current conditions and expectations of their farm’s financial performance in 2022 when compared to last year,” says James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

Supply chain challenges

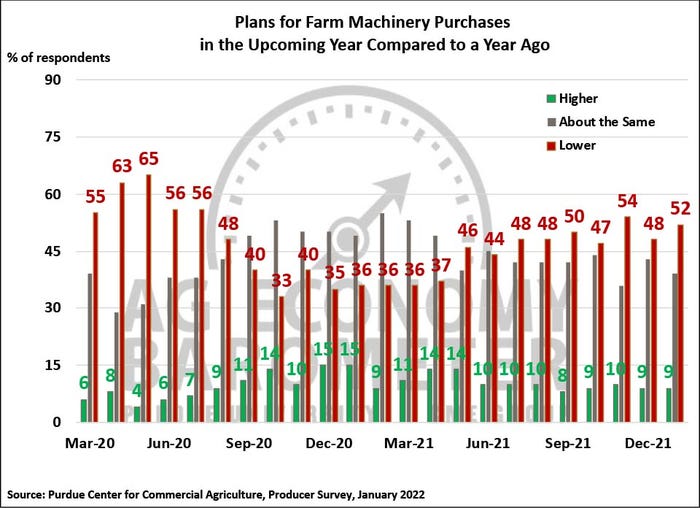

The Farm Capital Investment Index also weakened this month, falling 4 points to a reading of 45.

In January, 52% of respondents said they plan to reduce their farm machinery purchases in the upcoming year. Supply chain issues continue to hamper farmers’ investment plans as, for the third month in a row, over 40% of producers reported that low farm machinery inventories were holding back their purchase plans.

Farm construction plans were also weaker this month as 66% of respondents reported reducing their construction plans in the year ahead versus last year.

The disruptions extend to input availability. In January, 28% of producers responding to the survey said they have had difficulty purchasing crop inputs from suppliers for the 2022 crop season. Respondents reported difficulty in purchasing a broad spectrum of crop inputs including herbicides, insecticides, fertilizer, and farm machinery parts.

Financial outlook

The Farm Financial Performance Index fell sharply in January to a reading of 83, a 30% decline compared with a year earlier, and 27% lower than in December 2021. The financial index is generated based upon producers’ responses to whether they expect their farm's current financial performance to be better than, worse than or about the same as the previous year.

“The sharp drop in the financial performance index this month indicates producers expect a sharp decline in income in 2022 compared to 2021,” says Mintert. “In the December survey, producers were focused on comparing a very positive income year, 2021, to 2020, which really supported the index at year end.”

Disruptions in the supply chain for many farm inputs, coupled with strong demand, are pushing production costs higher. Fifty-seven percent of survey respondents in January said they expect farm input prices to rise by 20% or more in 2022, and 34% of producers said they expect prices to rise by 30% or more.

Prices for nitrogen fertilizer have skyrocketed over the last year. According to the U.S Department of Agriculture, anhydrous ammonia prices in Illinois during January 2022 were nearly triple what they were in January 2021.

Although a majority (57%) of corn producers said they intend to use the same nitrogen application rate in 2022 as in 2021, 37% said they intend to reduce their nitrogen application rate compared with last year.

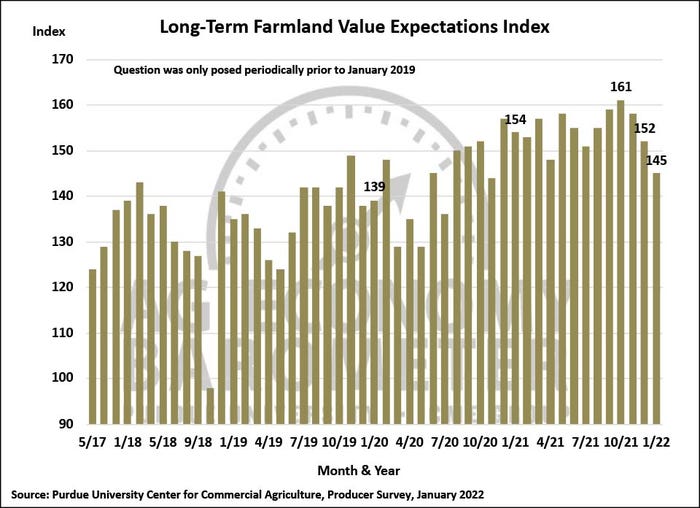

For the second month in a row, both the short-term and long-term farmland value indices declined. The Short-Term Farmland Value Index declined 11 points to an index value of 142, while the Long-Term Farmland Value Index declined 7 points to a reading of 145 in January. Both indices have fallen about 10% compared with their fall 2021 peak values.

“Recent weakness in both indices could reflect recognition of how much farmland values have increased over the last year or more, tempering expectations for further price increases,” Mintert said.

Read the full Ag Economy Barometer report. The Ag Economy Barometer is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted Jan. 17-21.

Source: Purdue University and the CME group, USDA, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like