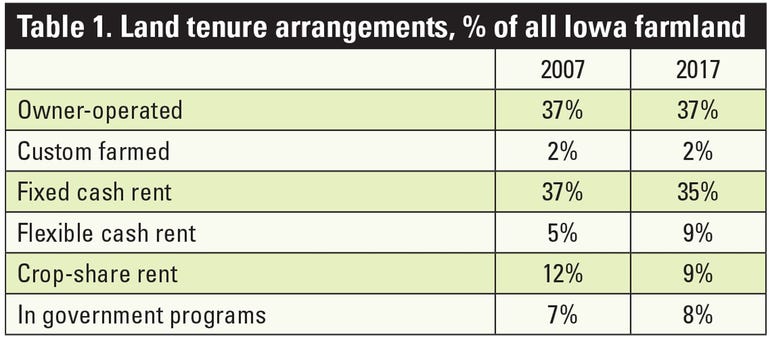

The proportion of Iowa farmland operated by the landowner has stabilized at about 37%, according to the most recent farmland ownership and tenure survey conducted by Iowa State University. What has changed, however, is the popularity of different types of farm leases.

From 2007 to 2017, traditional crop-share leases decreased from 12% of total farmland acres to only 9%, while flexible cash rent leases increased from 5% to 9%. The acres rented under a fixed cash rent lease fell by 2%. Flexible cash rent leases allow the tenant and landowner to share in the financial and production risks in crop farming without the need to divide the crop and input expenses.

Source: ISU Extension Ag Decision Maker File C2-15

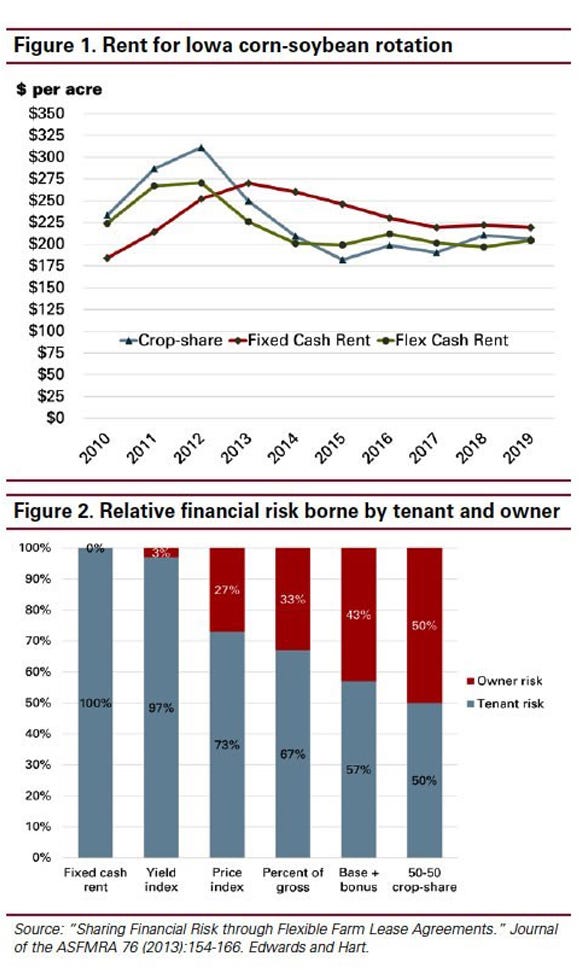

How have returns to fixed cash, flexible cash and crop-share leases compared in recent years? Figure 1 shows estimated rents per acre realized by the landowner for the past 10 years for a 50-50 corn-soybean rotation. Of course, actual rents will differ for each farm. The fixed cash rent values are the statewide average cash rents paid in Iowa each year, based on Iowa State University Extension’s annual survey. The flexible cash rent values are estimated at 30% of the gross revenue per acre from corn and 40% of the gross revenue per acre from soybeans. See Ag Decision Maker File C2-21 on the ISU Ag Decision Maker website.

Gross revenue is calculated by multiplying the state average corn and soybean yields for each year by the state average cash prices in October, November and December of the same year. USDA commodity payments and multiple peril crop insurance payments received each year are also included.

The value of the crop-share rent is estimated as one-half of the gross revenue for each crop, minus one-half of the costs typically shared by the landowner (seed, fertilizer, pesticides, drying, hauling and storage), based on ISU Extension typical cost of crop production budgets (Ag DecisionMaker File A1-20) and leasing surveys.

From 2010 to 2012, crop prices were rising. Crop-share and flexible rents rose immediately because they were directly tied to current prices. Fixed cash rents lagged behind for about two years, and then caught up. In 2013, the crop-share and flexible cash rents both nose-dived in response to the lower corn and soybean prices for the 2013 crop, whereas most cash rents were negotiated before the price decline was apparent. In the most recent years, all three rents have been very close, as prices and yields have both been steady.

Another recent ISU study examined the amount of variation in net returns to the landowner and tenant under different lease arrangements, based on yield, price and production cost patterns in Iowa over the past several decades. Because cash rents are based on expectations of yields and prices for the coming year, rather than actual results, they change more slowly than flexible or crop-share leases.

Many fixed cash rents are not renegotiated each year. This results in a more stable, albeit slightly lower, average rent over time. The landowner knows with certainty at the beginning of the year how much the rent will be. All the variation in net returns caused by unexpected changes in yields, prices and production costs is borne by the tenant, as shown in the first bar in Figure 2.

Flex leases share risk differently

At the other extreme, under a 50-50 crop-share lease, the tenant and landowner share financial risks equally, as shown in the bar on the far right in Figure 2. The other bars show how financial risk is shared under several types of flexible cash leases.

The “yield index” bar represents a lease for which the rent paid each year depends on the actual yield attained, only. The “price index” bar represents a lease for which the rent varies with year-to-year market prices, only. The yield index lease transfers very little risk to the owner because in Iowa, at least, yields have been more stable than prices in recent years.

Some flexible leases set the rent each year as a fixed percent of the gross crop income each year. As shown by the “percent of gross” bar, this reduces the tenant’s net income variability even more because the rent automatically adjusts up or down with both prices and yields. The “base plus bonus” bar represents a flexible lease in which rent is equal to a fixed base rent plus a percent of the tenant’s return over production costs. By incorporating costs into the rent equation, the tenant’s net return varies even less, and the sharing of risk approaches that of a 50-50 crop-share lease.

It is important to note that as landowners take on additional financial risk, their returns will increase in years of higher-than-expected profits, as well as decrease when overall returns decline. Both owners and tenants should select a lease type that reflects their individual abilities and desires to bear risk and reap rewards, versus their needs for more stable income.

More resources on farmland rental arrangements can be found on the Ag Decision Maker Leasing page.

Edwards is a retired Iowa State University Extension ag economist and former member of the Wallaces Farmer Timely Tips panel. Contact him at [email protected].

About the Author(s)

You May Also Like