September 27, 2016

One of the first adjustments a farmer or rancher makes in light of tight financial conditions is holding off on farm capital expenditures. By running their equipment longer or using their building for a few more seasons, farmers can often defer capital investment in tough times.

Because of this, capital expenditures are an important financial metric to track and observe. This week we are taking a look at the USDA’s latest estimates for farm capital expenditures.

Farm capital expenditures

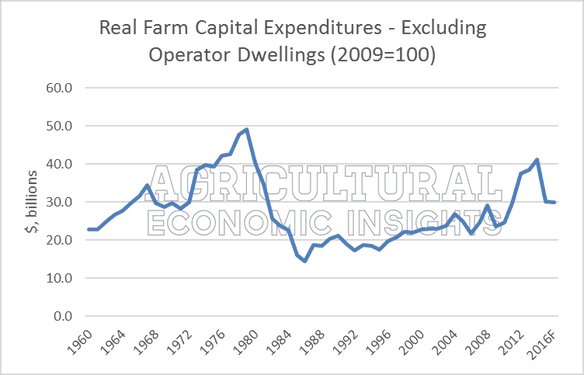

The USDA recently forecast real farm capital expenditures in 2016 at nearly $30 billion (2009 dollars; $33.3 billion nominally). The current 2016 estimate is nearly unchanged from 2015 levels. Both of these years represent a sharp contraction from highs reached in 2014, when real farm capital expenditures reached $41.2 billion as net farm income began to soften (net farm income peaked in 2013).

Prior to the recent boom in agriculture, farm capital expenditures were substantially lower than the large capital investments made in the 1970s. Before farm financial conditions collapsed in the early 1980s, real capital expenditures reached $49.2 billion in 1979; substantially greater than recent highs. Furthermore, real capital expenditure in the 1970s were strong for several years, exceeding $40 billion five consecutive years (1976-1980).

In contrast, real farm capital expenditures in recent years exceeded $40 billion only one year (2014) and were nearly $40 billion in 2012 and 2013. In other words, the recent run-up in farm capital expenditures was smaller than those in the 1970s in both magnitude and duration.

Large adjustment

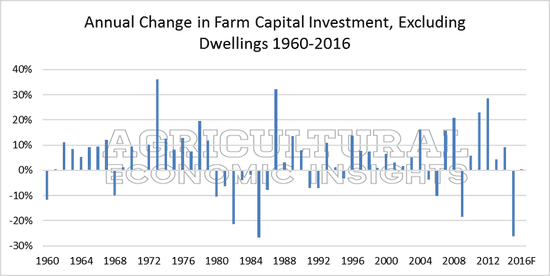

From 2014 to 2015, farm capital expenditures contracted 26% (nominal values).

At an annual change of nearly 27 percent, the contraction in 1985 was only slightly more intense than 2015. It’s worth noting, however, that the record decline in 1984 came after five years of contraction. In the most recent contraction, the large drop was the first year of decline. In fact, the decline in capital expenditures in the 1970s/1980s was persistent, lasting 7 years.

Changes by category

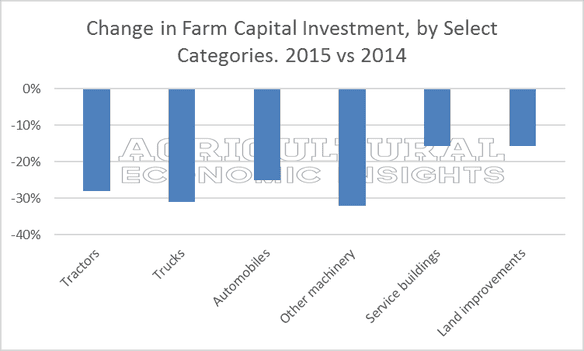

In addition to the total estimates, the USDA also provides estimates of farm capital expenditures by category.

For vehicles and machinery – tractors, trucks, automobiles, and other machinery – changes ranged from -25 percent for automobiles to -32 percent for ‘other machinery.’ Overall, vehicle and machinery expenditures down significantly and across the board.

The other main categories of capital expenditures – buildings and land improvements – were both 16 percent lower in 2015. At this point, it seems building and land improvement expenditures have been slower to contract.

Looking ahead

A natural question when considering these data is what a “normal” level of farm capital expenditures might be. Real capital expenditures have been on an upward trend since the late 1980s making a “normal” level difficult to define. However, from 1990 to 2003 real farm capital expenditures were fairly stable at a period average of $20.1 billion (ranging from $17.3 billion to $23.7 billion).

Current real capital expenditures ($29.9 billion) is still considerably greater than these prior “normal” levels. More precisely, a return to 1990-2003 levels would be a 31percent decline from current 2016 levels and a 50 percent drop from the highs reached in 2014.

Wrapping it Up

The USDA recently estimated a sharp decline in farm capital expenditures. The latest estimates reveal a sharp drop in investments in 2015, a decline much greater than initially forecasted when Brent first looked at these data a year ago. The declines in farm capital expenditures in 2015 was a magnitude only slightly smaller than the largest drop of the 1980s.

Recent declines in farm investment, in our view, underscores the financial difficultly that producers are facing and highlights the challenges that ag manufactures and retailers are facing in the current financial environment.

While the current estimates show a near status-quo outlook for farm capital investments in 2016, it’s very possible these estimates will adjust. The argument for lower capital expenditure in 2016 could easily be made given the USDA’s estimate for lower net farm income and lower cash receipts across grain and livestock production.

Originally posted by Center for Commercial Agriculture at Purdue University.

You May Also Like