January 26, 2021

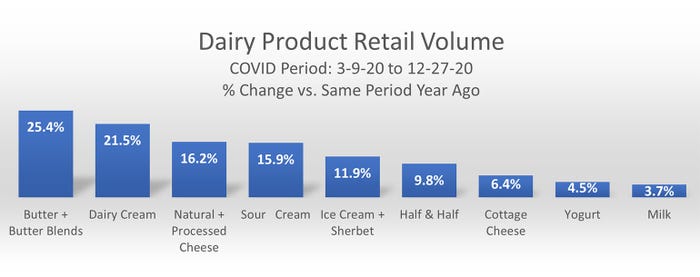

Dairy consumption rose in 2020, according to the latest data released by the National Milk Producers Federation. Retail dairy purchases, which jumped at the beginning of the pandemic, stayed strong throughout the year.

With more meals being prepared at home, consumers picked up more butter for baking and more cream or half-and-half for their coffee or breakfast cereal.

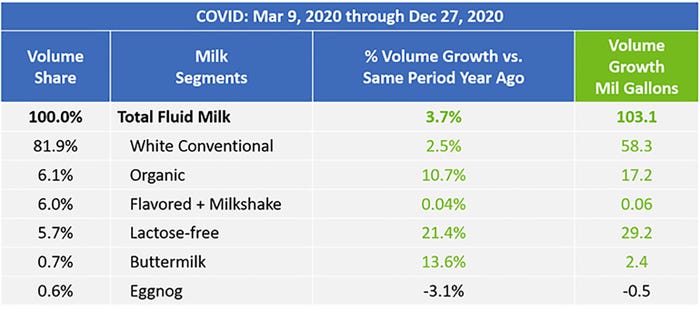

Milk consumption gained across several categories, with lactose-free milk, buttermilk and organic milk posting the biggest gains in 2020.

Plant-based milk posted a larger percentage gain during 2020 than dairy milk, which is normal, according to the National Milk Producers Federation, because plant-based milk builds from a smaller sales base. In dollar growth, dairy milk topped $1 billion, compared to nearly $400 million for plant-based milk.

For 2020, the average U.S. all-milk price peaked in November, according to Dairy Management Inc. The U.S. all-milk price and isn't expected to reach similar levels until the second half of 2021.

Milk production continues to rise in 2021, compared to a year earlier. In November 2020, U.S. milk production was 3% higher than a year earlier, total milk solids production was 3.3% higher and total U.S. dairy cows were up by 62,000. All three were the highest rates of increase in several years.

Growth in total domestic commercial use of milk in all dairy products ticked up during September-November. A lull in government purchases of dairy products at the end of 2020 was accompanied by a drop in the monthly survey cheese price of more than 80 cents a pound from November to December 2020. This took the Class III price down by $7.62 per hundredweight from the previous month. That development reestablished a relatively normal relationship between December federal order class prices, generating mostly positive producer price differentials in the seven component pricing orders for the first time since May 2020.

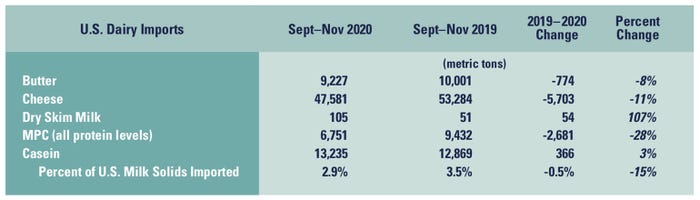

Exports continued to be a bright spot in the dairy economy. Exports for 2020 remain on track to hit a record level of milk solids exported during a calendar year, in spite of a weak showing in November.

Looking ahead

The weekly National Dairy Product Sales Reports prices for cheese dropped to around $1.60 per pound at the end of December and remained there into early January. The daily CME cash cheese market prices, a leading indicator, rose on news in early January of another round of Food Box purchases. The CME cheese futures contracts for the first quarter of 2021 followed suit, but beyond this, they recede slowly at levels well below their average during the second half of 2020.

The prospect of strong milk production growth and pandemic- depressed food service use of dairy products well into this year continues to make any strength in the cheese and butter price outlook dependent on news of additional government food assistance purchases. The mid-January dairy futures indicated that milk prices would generally stay at around $18 per hundredweight until next summer, when rising prices of products other than cheese are expected to begin to lift them above this level. DMC margins are expected to remain below $9.50 per hundredweight until then, reflecting continued challenges in aligning demand with supply as the economy continues to suffer from the pandemic’s overhang.

Source: National Milk Producers Federation, Dairy Management Inc., which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like