While U.S. farmers aren’t ready to make major changes to corn and soybean rotations in 2018, they plan to plant more of what paid best in 2017, according to Farm Futures latest survey of intentions for the coming spring.

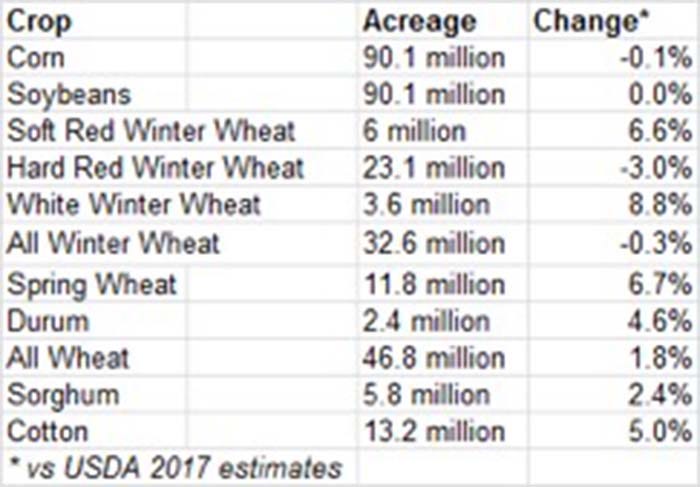

Farmers said they wanted to plant more soybeans than corn for the first time since 1983, when the government’s PIK program idled millions of corn acres. But the difference wasn’t much, just 35,000 acres. Growers plan to put in around 90.1 million acres of both crops, little changed from 2017.

The survey of 925 growers nationwide showed them ready to seed 11.8 million acres of spring wheat, up 6.7% form 2017. Spring wheat yields plunged due to drought on the northern Plains, sending prices for high protein varieties sharply higher. Minneapolis futures still command a premium to winter wheat, which attracted almost as many seedings as the previous year, according to USDA’s first survey released Jan. 12. That could take total wheat acreage for harvest in 2018 to 46.8 million, up 1.8% from 2017.

Farm Futures first survey of 2018 intentions, released in August, showed farmers wanted to boost corn acreage and cut back on soybeans, while adding even more wheat. But price relationships have changed substantially in the past four months.

Farmers in the South and West also plan to boost cotton acreage this spring to 13.2 million, up 5%. Cotton was one of the few bright spots in the crop community in 2017. Strong exports and growing world demand boosted prices, making the fiber an attractive alternative.

Another crop popular in western states could also attract more acres this spring. Farmers want to put in 5.8 million acres of sorghum in 2018, up 2.4% from 2017. While prices of the feed grain remain depressed, it’s a more drought tolerant crop than corn or soybeans, and parts of the southwest Plains are already dry. And unlike corn, sorghum has escaped some of the export restrictions China imposes on corn, says Farm Futures market analyst Bryce Knorr.

“Of course, all of these plans are subject to both changing prices and weather,” says Knorr. “Soybeans show an advantage on average to corn on a profit per acre basis, though both crops pencil out to a loss on paper right now.”

Rising fertilizer prices, especially for nitrogen, could also be a factor as corn demands that nutrient.

“Sorghum has become something of a niche crop and farmers remember what happened a few years ago when exports to China exploded and took prices sharply higher,” Knorr says.

Results of the survey were released today on the first day of Farm Futures Business Summit 2018, which is being held in Coralville, Iowa. Growers were invited by email to complete a survey from Dec. 4 to Jan. 3. USDA releases its annual survey of planting intentions March 30.

About the Author(s)

You May Also Like