May 5, 2017

Perception versus reality is an important concept comparison in many aspects of life. That’s particularly true in market price analysis. The perception that fundamentals are going to change can have more impact on price changes than the actual change in fundamentals.

Thus, once planting is under way and the crop starts to grow, the perception of weather problems is just as important as if they actually occurred. Time length of the price move differs considerably.

Price moves based on perception only are not going to last very long, whereas in the case of a drought, if the perception turns into reality, the price move can be longer and more substantial.

Wet Weather

As this is written, the concern among farmers and grain traders is planting delays in the heart of the Midwest due to wet conditions. Planting delays are always important, but not quite as important today as they were 20 years ago.

Why? Changes in equipment and technology. Twenty years ago not that many producers had the 24 row+ corn planters that can now plant an entire crop in less than a third of the time that it took 20 years ago. So, delays in planting can be more readily remedied at this point in history.

Currently, the fundamentals in corn are quite bearish. With an expected carryover supply this year of 2.32 billion bushels versus last year’s 1.737 billion, the amount of corn hanging over the market to be sold between now and Sept. 1 is significant. But that news is also well-known and built into the current price structure.

It’s also well-assumed on the bullish side that planted acreage this year is going to drop from 94 million to approximately 90 million acres. That’s a big move, and it could be even a larger reduction. So then we need to focus on the yield and obviously, planting dates have a big influence on final yield.

Six months from now we will all know how this is played out and with 20/20 hindsight it will look easy — or should have been. But with the above fundamentals in place, what are the odds that cash corn prices and futures are going to move higher?

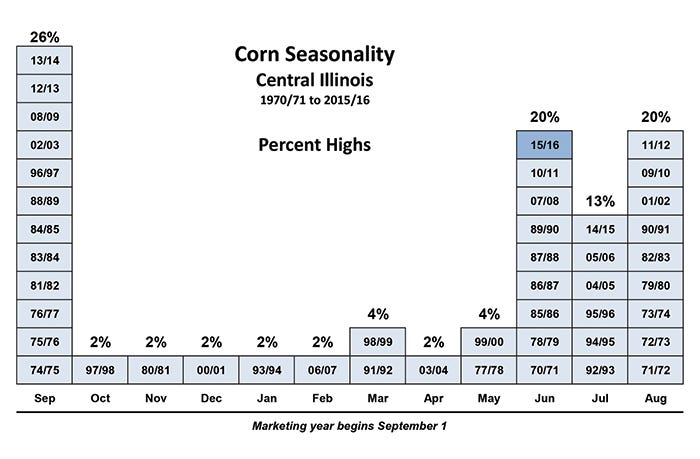

The accompanying graphic reveals a rather interesting story.

Since 1970, cash corn prices have made their highest price of the year (during the marketing year starting Sept. 1) in the month of September 26 percent of the time. If corn prices don’t peak early, they normally peak late, specifically between May and August.

So far this marketing year, the highest price of cash corn in central Illinois occurred in the month of February. I’m not saying that that can’t be the top of the year, but I will point out that the odds are low that the February high is the highest price of the year.

Why? It’s only happened once since 1970 and that was in February 2007.

With April now being history, odds start to increase as we move into May with a high having occurred two times. Then comes June, when 20 percent of the highs have occurred. So between May and June, 24 percent of the absolute highs have occurred.

What would a betting man plan on in this market? It would take an incredible production problem for the market to continue higher into August with the carryover supply at 2.32 billion bushels. I am not saying it can’t happen, but the odds are not very good.

With the perception of delays in planting, the odds are reasonably good that the highs could occur in the month of May or June. Perceptions of problems normally get discounted into prices quickly. So if this market spikes higher in the next eight weeks, odds could favor producers who are aggressive sellers during that timeframe. Just a thought.

About the Author(s)

You May Also Like