Corn prices are slightly higher this morning on a wide spread heatwave across the U.S. and talk that Agroconsult has lowered their Brazilian corn crop production estimate to 82 MMTs, which is down -17% from the 99 MMTs produced last year.

For what it's worth, in their most recent June report, the USDA reduced their Brazilian corn crop estimate from 87 down to 85 MMTs. So I suspect the USDA may still have another cut coming. Unfortunately, the corn market isn't paying all that much attention, deeming these was frilly well advertised. Keep in mind, the DEC18 contract posted another fresh new contract low close yesterday down at $3.65^4. Just like I've been saying the past couple of weeks, be careful thinking the low is in place, that seemed like the obvious and way too easy of a response.

Once the market has fully absorbed the first major wave of speculative "bottom pickers", you always have to ask where the next round of "buy-paper" will come from? We still have the trade concerns and negative headlines hanging overhead, as well as a very cooperative U.S. weather pattern. In other words, the bigger ticket items the bears have been betting on are still in play.

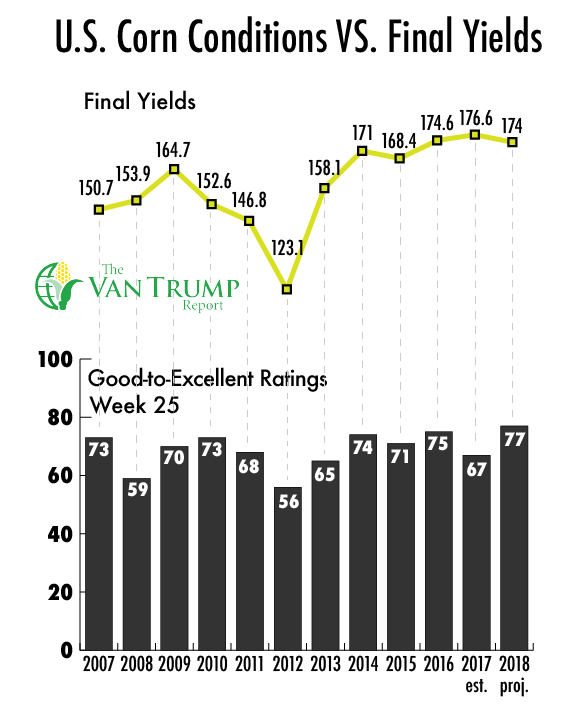

Demand remains strong, but neither the bears or the bulls have been disputing that fact. The debate is the negative lean from the macro players who are cross-hedging against a possible full blown trade-war, a stronger U.S. dollar, and all bets on U.S. weather to this point going to the bears. The U.S. crop has clearly reduced a large majority of its risk. The debate is no longer about if the U.S. producer will grow much of a crop in 2108, a debate we could have proposed a few months back, the debate now is if the U.S. crop will generate another record yield?

Most of my friends inside the trade have gone from debating a plethora of "what ifs", to now debating a crop yield of between 172 and 180 bushels per acre. Keep in mind, that's a much different debate and argument than was being proposed just a few weeks back. Be careful not to let the human psychology of the "recency effect" broadly impact your thoughts. In other words, don't get tripped up in the natural tendency to recall and focus on where prices WERE, rather than recognizing and adjusting to the new imminent threats that may exist.

In all markets, I constantly ask myself what has happened during the past few weeks, which is now in my rear view mirror, and how is that affecting my current judgment while looking out the front windshield. I promise, it certainly colors how we view the markets moving forward. I continue to look for any change in weather and Washington...

Technically, I'm hoping the DEC17 contract can hold support down in the $3.50 to $3.60 range. Upside resistance still remains in the $3.80 to $3.90 range. Don't lose sight of the fact the debates in the market have changed, and clearly the bulls have lost leverage as the weather has mostly cooperated and no resolution to trade has come about.

CHECK OUT ALL THE DAILY INFORMATION IN THE VAN TRUMP REPORT

About the Author(s)

You May Also Like