February 12, 2019

By Matt Stockton

and Randy Saner

What is a respectable value to pay for a beef replacement heifer for the coming 2018-2019 production season? Like many decisions, this can be complicated by many factors.

It is important to have a handle on these factors to make the best production and business choices for success of the ranching operation. The University of Nebraska Beef Economics team has made some preliminary forecasts of heifer values using available projected price and costs scenarios.

When buying replacement heifers, many factors should be considered. Three primary factors need to be carefully considered when making a cow purchase decision:

• The purchased/grown replacement cow's ability to stay in the herd as a productive unit (longevity)

• Current and future expected difference between costs and revenues (calf price and costs differences over the cow's productive life)

• Genetic compatibility with herd mates and the operator's goals and management style

Since it is difficult to anticipate and quantify all the possible conditions, types and choices that might occur in the future, five general cost scenarios and three herd types were used to create a total of 15 forecasts. Factors left to be considered by the buyers are related to other variables such as genetics and management style.

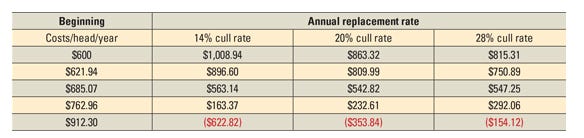

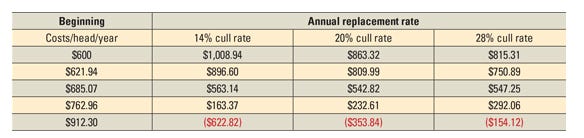

Forecasted breakeven values for replacement cows (2018/2019) production season, by cull rate and initial costs/head/year.

The five different cow cost structures were identified on a per cow basis for the initial 2018/2019 calving season and then adjusted by the Food and Agricultural Policy Research Institute index. The lowest cost was $600 per head, selected to determine the high mark for replacement cow value.

Three Nebraska prices were $621.94 per head for the Sandhills low costs pasture, $762.96 per head for Sandhills midrange costs pasture and $912.30 for Sandhills high costs pasture. The fifth cost was $685.07 per head and was taken from the FAPRI estimates.

FAPRI had forecasted costs for each of the 10 years listed in its report. The FAPRI costs were used to create an index to adjust the other four initial costs to the appropriate year in the model.

Revenues are based on FAPRI calf and cow forecasts for the next 10 seasons for March-born calves. The productivity and animal information were derived from ranch records of the University of Nebraska-Lincoln's Gudmundsen Sandhills Laboratory.

Capturing the longevity of any one animal is a difficult proposition at best. Therefore, the idea that the current herd production performance is the best predictor of future performance was adopted for this model.

Since longevity is key in valuing any particular animal, a statistical model of life expectancy and productivity was created using the GSL data and three different expected cull rates: the lowest is a 14% cull rate with an average cow age of 5.88 years (older cows), the mid cull rate is 20% with cow age averaging 4.95 years (medium cows) and the third cull rate is 28% with cow average age at 4 years (young cows).

Results will be reported in two different ways: 1) as the actual forecast by scenario type and 2) as marginal changes.

The scenario where replacement rates and costs are lowest has the highest available replacement value, $1,008.94 per head, whereas the highest replacement rate with the highest cost structure has a negative value.

This means it wouldn't be wise to buy heifers with this cost structure as they would lose money every year these cows were in the herd. Also, notice that those with a higher cull rate lose less because the cow is in the herd for a shorter time frame, therefore losing less money per year (-622.87 vs -154.12).

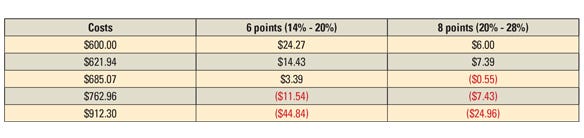

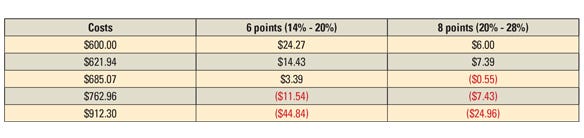

Dollar decrease in cow replacement value for every 1% increase in cull rate.

As the costs of production per calf increases, the amount producers are able to pay for replacements decreases, and vice versa. The breakeven value for cow replacements varies depending on cost level. For instance, a 2% decrease (19% to 17%) in replacement rate at the $600-dollar cost is ($24.27 x 2), which would decrease the forecasted cow value by $48.54. At the $912.30 cost, the same 2% decrease in replacement rate would be (-$44.84 x 2), which would indicate you would have a negative decrease, an increase in forecast cow replacement value of $89.68.

This last example is somewhat deceiving. A better way to interpret the negative change replacement value is to recognize that it is an indication that short-lived cows lose less money. Buying cows at negative values means someone must pay you to take them to breakeven, which is not a formula for success.

The relationship between costs and replacement rate is not constant, making production and cost choices critical to consider when paying for replacement cows. As longevity of cow replacements increase, average herd age increases and breakeven values also increase except in high-cost scenarios. Low-cost, low-replacement herds can afford higher valued replacement costs. The key to buying higher priced, profitable replacements is based on individual cost structure and herd replacement rate.

For a complete analysis, visit farmcents.unl.edu/subject-areas. For further information or a more in-depth explanation, the authors refer you to the whole document or welcome any questions or comments.

Stockton is a Nebraska Extension ag economics specialist. Saner is a Nebraska Extension educator.

This report comes from UNL BeefWatch, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like