August 17, 2022

Research indicates the current price is the single best predictor of future prices. However, the same research shows that the best predictor (current price) is not very accurate. The projected 2023 wheat harvest price (Medford, Okla.) is $8.25, but it has the potential to be as low as $6.50 or as high as $13.

At this writing, the Chicago Board of Trade Hard Red Winter July 2023 Wheat Futures Contract (KEN23) price is $8.90. In Medford, Okla., wheat may be forward contracted for 2023 harvest delivery for $8.25 (KEN23 –65 cents), $8.40(KEN23 – 50 cents) in Perryton, Texas, and $7.90 (KEN23 –100 cents) in Snyder, Okla.

While today’s price is the best predictor of a future price, the actual price at some future date will either be above or below the current price. The potential price range may be estimated by reviewing current supply and demand conditions and potential changes in supply and demand.

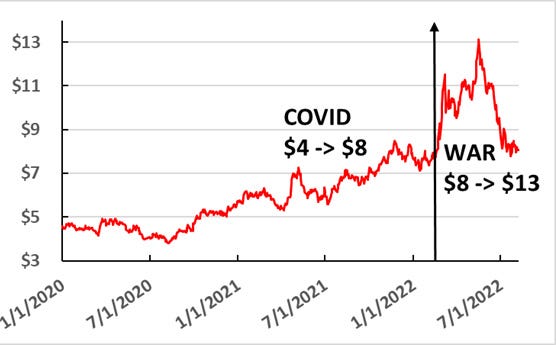

Changes in the world’s wheat supply and demand conditions caused Medford, Oklahoma wheat prices to rise from $3.84 (August 2020) to $13.13 (March 2022) (Figure1). The $4 to $8 price increase was mostly driven by demand and was correlated with COVID. The price increase from about $8 to $13 was mostly driven by supply and was correlated with the Russian-Ukraine war.

For the 2019/20 wheat marketing year, world wheat production was 28 billion bushels (Bb), use was 27.4 Bb, and ending stocks were 11 Bb. These were all new records. The average 2019/20 U.S. wheat marketing year price was $4.58.

World wheat production set new records in 2020/21 (28.5 Bb) and 2021/22 (28.6 Bb). World wheat use was also at a record high in 2020/21 (28.6 Bb) and in 2021/22 (29.1Bb). For the 2022/23 wheat marketing year, world wheat production is projected to be 28.6 Bb and use is projected to be 29.0 Bb. For the third consecutive year, use is projected to be higher than production, and ending stocks are projected to decline from 11 Bb in 2019/20 to a projected 9.8 Bb for 2022/23.

The stocks-to-use ratio (ending stocks divided by use) was 40% in 2019/20 and is projected to be 34% in the 2022/23 marketing year. The lower ending stocks and stocks-to-use ratio were primarily caused by a dramatic increase in use stimulated by COVID’s hoarding.

Figure 1. Medford Oklahoma Daily wheat prices. Source: Equity Marketing Alliance, Enid Oklahoma.

Figure 1. Medford Oklahoma Daily wheat prices. Source: Equity Marketing Alliance, Enid Oklahoma.

Another reason for the $4 to $8 price increase may have been higher transportation and handling costs. COVID had a negative impact on all aspects of the wheat handling and shipping systems.

When Russia invaded Ukraine, the world’s supply of exportable wheat was reduced by 30%. This means the price movement from $8 to $13 was supply driven.

The recent price movement from $13 to $8 is mostly supply-driven. Increased supply of exportable wheat was from a reduction of COVID’s impact on the wheat marketing system and the increased supply of exportable wheat from the Black Sea region.

The current tight wheat supply situation is signified by world ending stocks of 9.8 billion bushels and a stocks-to-use ratio of 34%.

After Argentina and Australia’s 2022 wheat harvest (already included in current supply numbers), the next exportable wheat to be harvested is the 2023 U.S. winter wheat crop. Thus, the world’s tight wheat stocks situation probably won’t change until the U.S. winter wheat and the world’s 2023/24 crops are being harvested. This implies that wheat prices should remain relatively high into the summer of 2023.

Below average 2023/24 world wheat production could drive the wheat prices up to $13. Projected above average 2023 U.S. winter and world wheat production could cause the 2023 wheat harvest prices to be around $6.50.

About the Author(s)

You May Also Like