June 29, 2022

At this writing, wheat prices in northern Oklahoma and the Texas Panhandle are near $11. Southern Oklahoma wheat prices are in the $10.35 price range. These relatively high wheat prices did not just happen when Russia invaded Ukraine. Even though wheat prices didn’t start the uptrend until during the 2020/21 marketing year, the foundation for higher prices may have been established during the 2018/19 wheat marketing year.

A review of world wheat production and use compared to U.S. average annual wheat prices will help explain why wheat prices are $11 and when prices may decline.

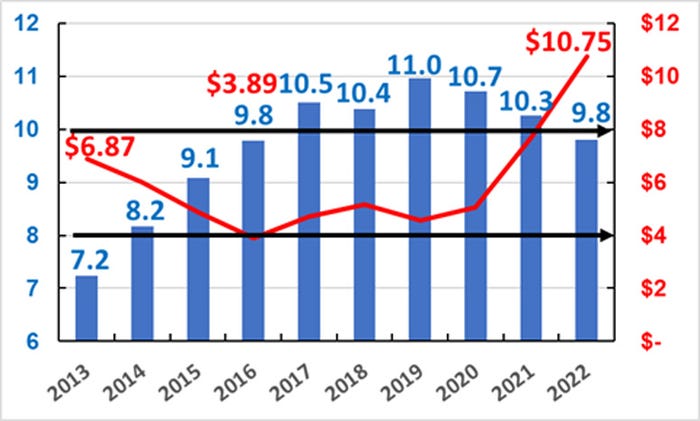

The U.S. average annual wheat price reached a peak at $7.70 in the 2012/13 wheat marketing year. Average annual wheat prices trended downward and bottomed out at $3.89 in the 2016/17 wheat marketing year (Figure 1). During the marketing years 2015/16 through 2020//21, average annual wheat prices were between $3.89 and $5.16.

The U.S. average annual price was $5.05 for 2020/21, $7.07 for 2021/22, and is projected to average $10.75 for the 2022/23 wheat marketing-year.

As wheat ending stocks increased from 7.2 billion bushels in 2013/14 to 9.8 billion bushels in 2016/17, the U.S. average annual price decreased from $6.87 to $3.89.

Wheat ending stocks peaked at 11 billion bushels during the 2019/20 marketing year, and the average annual wheat price was $5.05.

A price dilemma is that, during the 2016/17 wheat marketing-year, world wheat ending stocks were 9.8 billion bushels and the average annual price was $3.89. Compare that to the fact that 2022/23 marketing-year ending stocks are projected to be 9.8 billion bushels, and the price is projected to be $10.75.

There are basically three reasons for relatively high wheat prices with relatively high wheat stocks. Higher prices were set up during the 2018/19 wheat marketing-year. During each marketing year 2013/14 through 2017/18, world wheat production set a new record. 2017/18 wheat marketing year production was 27.8 billion bushels compared to 26.3 billion for 2013/14.

For each of these five years, 2013/14 through 2017/18, world production averaged 916 million bushels more than wheat use.

Figure 1. World wheat ending stocks and U.S. Average Annual Price.

Figure 1. World wheat ending stocks and U.S. Average Annual Price.

(Wheat ending stocks in billion bushels)

World wheat production for the 2018/19 marketing year was 26.85 billion bushels and use were 26.90 billion bushels. For the first time since 2012/13, world wheat ending stocks didn’t increase.

During the 2019/20 wheat marketing-year, production was a record 28 billion bushels and use was 27.2 billion bushels. World wheat ending stocks peaked at 11 billion bushels, and the average annual price was $5.05.

In the 2020/21 wheat marketing year, world wheat production was a record 28.5 billion bushels and COVID-19 changed the market systems. Between 2020/21 and 2021/22, world wheat use increased from a record 27.2 billion bushels to a record 28.5 billion bushels.

The increased wheat demand may have been caused by wheat users buying ahead of needs rather than on an as-needed basis. Whatever the cause, wheat use increased and for the 2020/21, 2021/22 and the projected 2022/23 marketing-year, wheat use is projected to be equal to or greater than production. Increased demand (use) resulted in wheat prices increasing from the $5 range to around $8.50.

Russia’s invasion of Ukraine is reported to be responsible for the prices above $8.50.

How long price will remain relatively high is anybody’s guess. My best guess is that without additional loss in world wheat production, prices will stay in the $10 to $12 range. A Russian/Ukraine settlement could result in a $2 loss in price during the 2022/23 marketing year and a wheat price of $8 during the 2023/24 marketing year.

About the Author(s)

You May Also Like