October 18, 2018

The October 11 USDA Wheat Export report showed that hard red winter (HRW) wheat export sales to date are 36 percent less than the same period during the 2017/18 wheat marketing year. The October WASDE (World Agricultural Supply and Demand Estimates) showed that the USDA projects total 2018/19 wheat marketing year HRW exports to be the same as during the 2017/18 marketing year.

Total 2018/19 wheat marketing year hard red spring (HRS) wheat export sales are 10 percent less than during the same period last year. The October WASDE projected that 2018/19 wheat marketing year HRS exports would be 30 percent higher than 2017/18 marketing year exports.

Total U.S. hard wheat exports (HRW + HRS) are 25 percent less than during the same period as in 2017/18. The total marketing year exports are projected to increase 25 percent.

United States HRW and HRS wheat export sales have been “dead in the water.” If USDA WASDE projections are anywhere near correct, export demand must increase. When export demand increases, wheat prices should increase.

Market analysts suggest that export sales are below expectations because sellers of Russian wheat are selling and shipping as much wheat as possible because they fear that the Russian government will place restrictions on wheat export sales. Since mid-July, Russian wheat prices delivered to Egypt have increased about 90 cents per bushel. Oklahoma and Texas wheat prices are about the same as during mid-July.

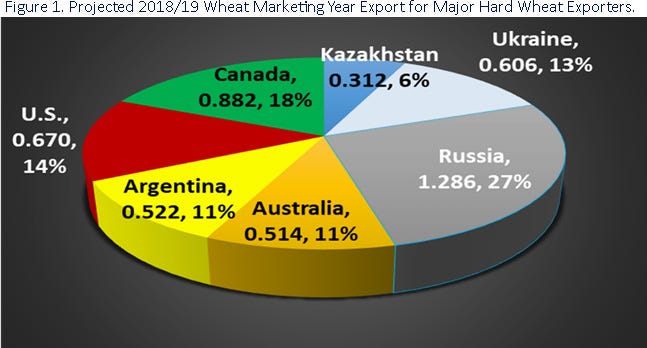

The October WASDE projected that 2018/19 marketing year exports for the seven major hard wheat (HRW and HRS) exporters would be 4.792 billion bushels compared to 4.867 billion bushels for the 2017/18 marketing year. The bushels and percentages for each country (Argentina, Australia, Canada, Kazakhstan, Russia, Ukraine, and the U.S.) are shown in Figure 1.

Russian wheat exports were projected to be 1.286 billion bushels compared to 1.522 billion bushels during the 2017/18 marketing year (a reduction of 236 million bushels). Australian wheat export sales are projected to decline 19 million bushels. Ukrainian wheat exports are projected to decline 47 million bushels. The total reduction in exports for Russia, Australia, and Ukraine is 302 million bushels.

With a 75 million bushel reduction (4.876 - 4.792) in total hard wheat exports (major exporters), this leaves a 227 million bushel potential increase for Argentina, Canada, and the U.S.

The United States hard wheat exports are projected to increase 71 million bushels (mostly HRS). So the questions are: Are the WASDE export projections correct? If the projections are correct, when will U.S. hard wheat export sales increase?

The key is Russian wheat. Russian wheat production is projected to be 2.572 billion bushels. Beginning stocks were 399 million bushels for a total supply of 2.971 billion bushels. Domestic use is the projected 1.488 billion bushels, and exports are the projected 1.286 billion bushels, ending stocks would be 197 million bushels-TIGHT!

Russia exported 336 million bushels during the August/September time period. At this rate, 1.286 billion bushels will be shipped by March 2019. Russian wheat exports will slow down and when they do, U.S. hard wheat export sales should increase, and Oklahoma and Texas wheat prices should increase.

Another key to increasing export sales of U.S. HRW wheat is quality. Not many foreign wheat buyers will purchase hard wheat that averages less than 12 percent protein and 60-pound wheat. Quality is an essential ingredient for wheat export sales.

Without export sales, Oklahoma and Texas wheat prices will remain below the cost of production. With projected export sales, Oklahoma and Texas prices should increase.

About the Author(s)

You May Also Like