March 9, 2015

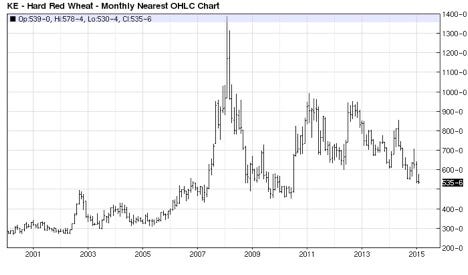

KC wheat contract prices may be divided into three price ranges (tiers): $4.50 to $6; $6 to $8; and $8 to $10 (Figure 1). Several signals indicate that KC wheat contract prices have established a strong propensity to remain in the bottom tier ($4.50 to $6).

KC wheat contract prices broke the $6 support level in September 2014. In late November, KC prices ventured above $6, challenged $7, and then closed below $6 in early January 2015. In late January, KC prices broke the $5.50 support price and are now trading in the $5.20 area. Prices below $5.14 will indicate a target price of about $4.85.

Oklahoma and Texas current cash wheat prices range between $4.80 and $5.00. Forward contract harvest delivery prices range between $4.80 and $5.15. The harvest contract basis (KC July contract price) ranges between a minus 10 cents and a minus 45 cents.

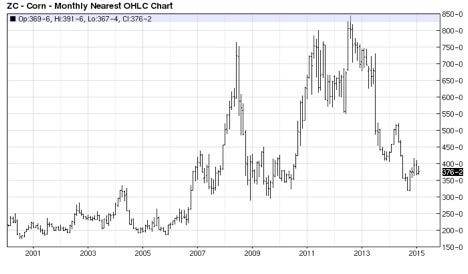

CBT corn contract prices may be divided into tiers with a floor price at $3, and breaks at $4.50, and $5.50 (Figure 2). The CBT corn contract price ceiling is at about $8.00.

For the latest on southwest agriculture, please check out Southwest Farm Press Daily and receive the latest news right to your inbox.

CBT corn contract prices first broke the $4.50 support price in September 2013 and traded below $4.50 until February 2014. Corn contract prices toyed with $5 for a few weeks before finally breaking the $4.50 support price in early June 2014. Corn contract prices have remained, and are expected to remain, below $4.50 though the 2015/16 marketing year.

The reason for this price outlook is that corn ending stocks are projected to remain above 1.4 billion bushels. Corn contract prices less than $4.50 may be associated with ending stocks above 1.4 billion bushels. Prices between $4.50 and $5.50 may be associated with ending stocks between 1.0 and 1.4 billion bushels. Ending corn stocks less than 1.0 billion bushels may be associated with prices above $5.50.

The United States produces about 37 percent of the world’s corn production and exports about 40 percent of the world’s corn exports. These figures are down from about 50 percent of world corn production and 70 percent of the world’s corn exports in 1982.

United States’ wheat production is only about 7.6 percent of world wheat production and U.S. wheat exports are about 15 percent of world wheat exports. In 1982, U.S. wheat production was 17 percent of world production, and U.S. exports were 35 percent of world wheat exports.

The point is that the U.S. is still the major supplier of corn for export, not as dominant as in the 1980s, but still the big player. That situation is not the case for U.S. wheat. United States wheat prices may be affected by foreign wheat conditions more than domestic conditions.

Wheat prices may be in the bottom tier because world wheat stocks are projected to be above average. Also affecting U.S. wheat prices is that U.S. wheat stocks are increasing because competing exporters are selling wheat below U.S. export wheat prices.

All indications are that the world’s wheat supply will remain above average and that U.S. wheat stocks will be close to average. These indications imply that Oklahoma and Texas wheat prices may stay in the $4.25 to $5.75 price range, which is in the bottom tier of prices.

Figure 1. KC Hard Red Wheat: Monthly Nearest Prices Source: BarChart.com

Figure 2. CBT Corn: Monthly Nearest Prices Source: BarChart.com

About the Author(s)

You May Also Like