Continued downward revisions to the U.S. wheat crop sent futures prices in Chicago, Kansas City, and Minneapolis rallying up $0.12-$0.21/bushel after USDA released the Quarterly Grain Stocks report on Thursday.

USDA also added 1.4 million bushels to June 1 wheat stocks, suggesting slower than anticipated usage paces earlier this spring. The adjustment points to slightly larger old crop ending stocks, though amidst this year’s drastic crop shortfall due to drought in the Northern Plains and Pacific Northwest, the adjustment will likely have little impact on tightening new crop wheat supplies.

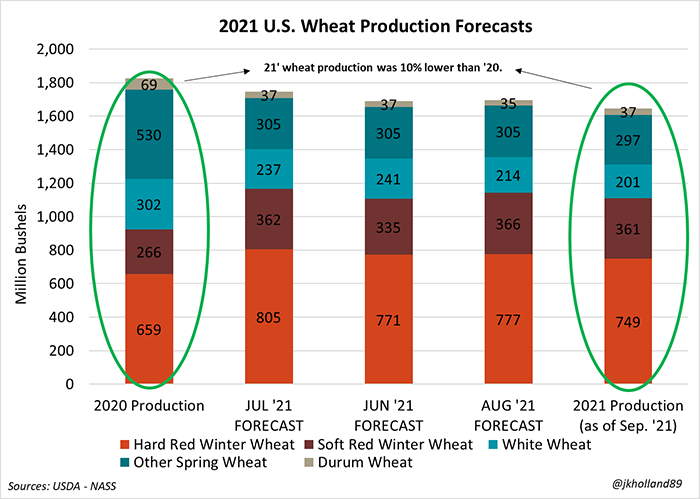

Ever-shrinking 2021 crops

But the large focus held steady on the 2021 Small Grains Summary after Thursday’s reports. USDA cut another 51 million bushels of 2021 wheat production from August 2021 estimates, dropping 2021 production to 1.65 billion bushels. Hard red winter wheat (-27M bu.) and white wheat (-13M bu.) made up the majority of USDA’s cuts.

Summer 2021 wheat harvest came in nearly 10% smaller than the 2020 crop. Losses to the hard red spring wheat (233M bu.), white wheat (101M bu.), and durum wheat (32M bu.) overshadowed a combined 185-million-bushel increase for hard and soft red winter wheat crops this year.

Provided USDA leaves new crop import values fixed at 135 million bushels and usage rates at 2.06 billion bushels in the October WASDE report, ending stocks could shrink to 564 million bushels, pushing the new crop STU ratio down to 27.4% from 29.8%.

That would be the tightest ending wheat supply situation the U.S. has seen since 2013/14 (24.2%). And with usage rates on the rise, that could put a lucrative floor under wheat prices as winter sowings for the 2022 crop ramp up across the Heartland.

Demand surprise?!

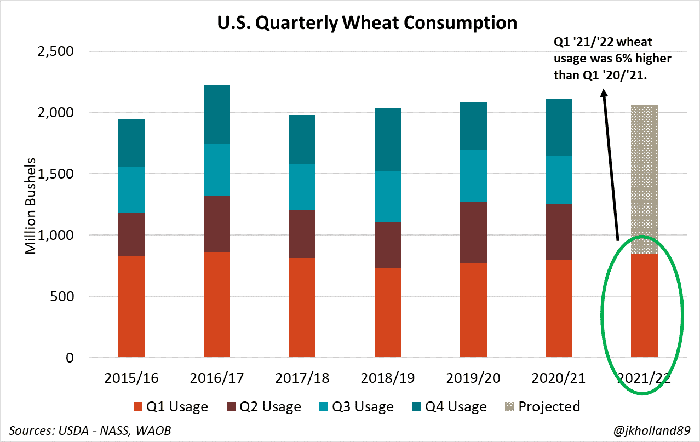

Using a little Redneck Economics (translation from previous articles and speeches: back of the napkin math), I calculate Q1 21/22 U.S. wheat usage at 846 million bushels. This is the highest absolute Q1 usage rate since 2016/17 (857 million bushels). Quarterly wheat usage rates typically are at the highest point in the first quarter, averaging 38% of annual usage over the past five years.

But at current demand levels, this year’s Q1 consumption rate is at 41% of estimated new crop usage – the highest level reaching back to 2015/16 (43%). The other three quarters historically jockey for remaining usage volumes at varying rates leaving few clues about whether high consumption rates will continue to trend through the remainder of 2021/22.

But increasing livestock feeding and human consumption rates leave more room for demand opportunities in the months ahead even with a smaller crop. Marketing year to date export volumes are 19% lower than the same time last year but even with peak export season already in the books, there is still room for optimism.

Top exporters Russia, Canada, the European Union and the U.S. all suffered production losses this year that could shake up global export markets over the next nine months. The U.S. is a residual supplier of wheat on the global market. As long as the dollar does not continue higher, U.S. exporters could capitalize on non-traditional international wheat buyers in the coming months.

And after repairs were made to terminals in the Gulf earlier this fall, export capacity will be able to recoup some of the shipping losses endured during Hurricane Ida outages through the rest of the marketing year. For growers with wheat on hand, demand appreciation may offer a lift to futures prices even in the face of smaller stocks.

About the Author(s)

You May Also Like