June 21, 2018

Wheat producers have said, “I don’t receive a protein premium.” But the current price and basis tell a different story.

The cash wheat price at Burlington, Okla., June 19, 2017, was $4.09. The cash price on June 19, 2018 was $5.07 (98 cents difference).

The basis at Burlington June 19, 2017, was minus 64 cents. The basis June 19, 2018, was 25 cents (89 cents difference). Without protein, the current wheat price at Burlington could easily be $4.09 rather than $5.07.

The market wants hard red winter (HRW) wheat with above 59 pound test weight and above 12 percent protein. The average protein supplied by the 2017 HRW wheat crop was 11.4 percent (Plains Grain, Inc.). The average test weight was 60.8 pounds. Oklahoma’s 2017 wheat crop averaged 10.9 percent protein.

As of June 15, 2018, harvested HRW wheat had averaged 61.4 pounds per bushel test weight and 12.4 percent protein.

SUPPLY AND DEMAND

Two major factors in determining price are supply and demand. Supply may be broken down into two factors: quantity and quality. Quantity is the number of bushels available, and quality may be represented by a combination of test weight and protein. Less quantity and more protein are both price factors this year.

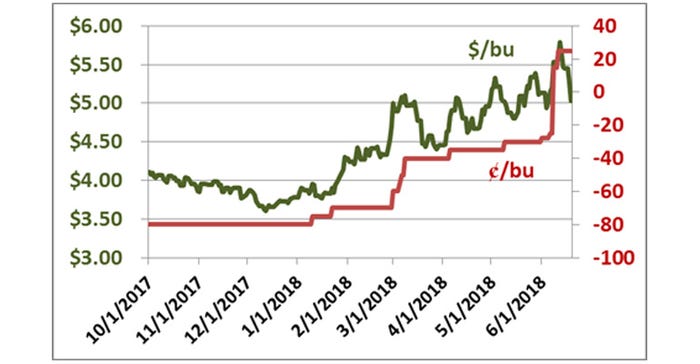

Figure 1, “Burlington, Oklahoma forward contract price and basis: October 1, 2017 through June 19, 2018,” shows daily forward contract prices and forward contract basis for wheat to be delivered at Burlington during the 2018 harvest.

Until mid-January, 2018, wheat prices were between $3.85 and $4.08. The basis remained at a minus 80 cents. As 2018 t production expectations declined and export demand remained relatively strong, prices increased to $5.00 March 7. In early April, prices started an uptrend that peaked at $5.79 June 12.

The basis increased from minus 80 in October to minus 75 in early January. It increased to a minus 40 in early March, to minus 30 in early April, and between June 8 and June 11, the basis went from minus 25 cents to positive 25 cents.

To show the significance of protein and basis, note that Burlington’s 10-year average basis is minus 62 cents off the KC July wheat contract prices, with a minimum basis of minus 137 cents and a maximum basis of a minus 3 cents.

PROTEIN PREMIUM DECLINE?

The 10-year average June (harvest) basis is minus 51 cents, with a minimum average June basis of minus 113 cents (2010) and a maximum June basis of minus 7 cents (2013). As of this writing, the average June 2018 basis is 3 cents, with a minimum minus 25 cents and maximum 25 cents.

If, as the harvests progress north, HRW wheat protein levels average above 12.5 percent, the odds are that the protein premium will decline. My hypothesis is that the basis will decline from 25 cents to a normal minus 20 cents or so.

Side note: Because of a 24-cent spread between the KC July contract price ($4.89) and the KC September contract price ($5.05), a 25-cent basis the KC July contract is the same as a one-cent basis the KC September contract ($5.06). In late June, the market will roll from the July to the September contract, and the basis will change without having an impact on the cash prices.

The point is that there is a protein premium. In some locations, the premium is in the form of additions to the price. In other locations, the premium is reflected by the basis.

Figure 1. Burlington, Oklahoma forward contract price and basis: October 1, 2017 through June 19, 2018.

About the Author(s)

You May Also Like