Mark Twain propagated the phrase which best describes the reaction to USDA’s wheat figures on Friday: “There are three kinds are lies: lies, damned lies, and statistics.”

One of the most shocking findings in USDA’s September 30 reports was NASS’s sweeping cuts to 2022 U.S. wheat production. The markets were prepared for slightly lower figures across the board ahead of the report, but even the lowest pre-report trade estimates missed all of NASS’s cuts except white wheat production.

The biggest misses came from additional cuts to hard red winter wheat production, which faced yield headwinds due to persistent drought this year, but also to soft red winter wheat production estimates.

NASS issued significant cuts to both winter wheat yields and harvested acreage in Friday’s report, which saw winter wheat production contract by nearly 8% from previous estimates (and 14% from last year) to 1.104 billion bushels.

What changed? NASS was able to factor in prevent plant acreage data from the Farm Service Agency as well as other failed acreage reports to the Risk Management Agency to arrive at a more representative estimate of 2021/22 winter wheat acreage.

Acreage was on everyone’s mind in NASS’s traditional #StatChat, featured an hour after reports are released and hosted by Lance Honig, NASS’s crop branch chief. Honig explained that FSA data was the primary driver of lower winter wheat production estimates in Friday’s reports.

Good afternoon and welcome to today's #StatChat. I'm @LanceHonig and I'd love to answer any questions you have about today's reports. As always I'll end my tweets with LH.

— National Agricultural Statistics Service (@usda_nass) September 30, 2022

Similar to the September 2022 Crop Production report for corn and soybeans, NASS also used field survey data to reconcile objective yields with farmer surveys for Friday’s report. In essence, NASS finally had the data available to more accurately quantify both acreage and yield for wheat production relative to previous forecasts.

Spring wheat production volumes were met by additional confusion on Twitter, especially after condition ratings throughout entire the growing season trended favorably. But a cold and slow start to the season took over half a million acres out of production and yields didn’t bounce back from the cold – or a dry 2021 growing season – as much as the trade was expecting.

All told, 2022 U.S. wheat production shrunk by 133 million bushels from USDA’s previous estimates released in August. That will likely lead to USDA’s World Ag Outlook Board cutting 2022/23 wheat usage in the October 2022 World Agricultural Supply and Demand Estimates report.

Nearby December 2022 Chicago soft red winter wheat futures closed 3% higher on Friday to $9.2325/bushel on the tightened supply sentiments. Nearby Kansas City hard red winter wheat contracts gained 2.6% in Friday’s trading session and spring wheat futures on the Minneapolis exchange rose 1.8% as a bullish era dominates current wheat trading.

Bearish wheat usage overshadowed by small crop bulls

September 1 wheat stocks were about the only item that was reported to be in line with pre-report trade estimates. Markets were expecting 1.776 billion bushels of wheat to be on hand in the U.S. as of Sept. 1 and USDA’s figure met the mark with precision.

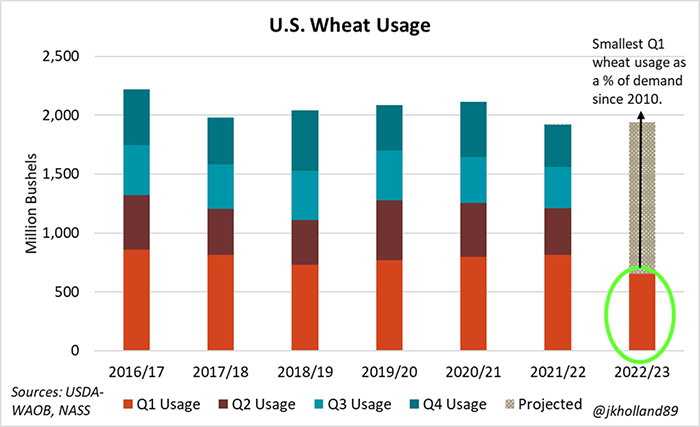

Production volumes tightened beginning wheat stocks for the 2022/23 marketing year, so Q1 wheat usage rates only amounted to 653 million bushels or 33.6% of USDA’s current forecasted demand of 1.943 billion bushels for the year.

That is one of the smallest first quarter wheat consumption rates by absolute volume in the past 33 years. As a percentage of projected usage, it is the smallest Q1 wheat usage rate since the 2010/11 marketing year. For perspective, over the past seven years, Q1 wheat usage has averaged 39.3% of total marketing year wheat consumption.

Markets were already dreading potential NASS revisions to June 1, 2022 supplies, which have gyrated corn and soybean prices in past Quarterly Stocks reports. But in Friday’s report, wheat revisions were the big mover while corn and soybean adjustments were minimal. USDA added over 11 million bushels of wheat stocks to June 1 volumes, due in large part to late submitted reports from commercial storage facilities.

Since USDA’s massive cuts were made to new crop production and June 1 stocks still count as old crop for wheat, these revisions were largely a function of reduced wheat consumption early in the 2022 calendar year. This is not surprising, considering high wheat prices and a strong U.S. dollar over the past seven months have limited U.S. wheat’s attractiveness on the global stage.

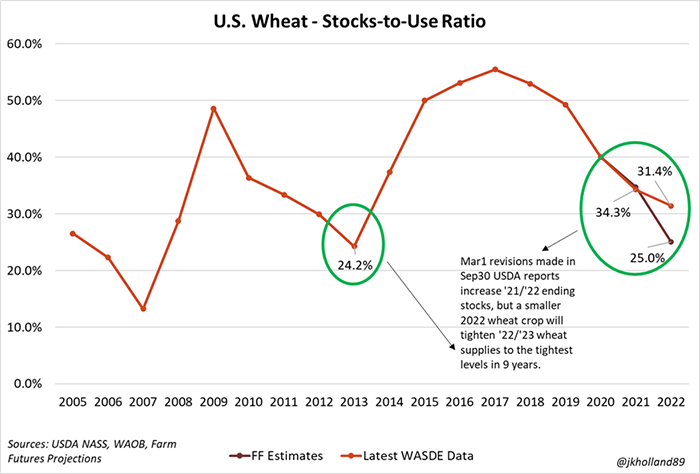

The lower usage increased 2021/22 wheat ending stocks and mitigated a fraction of the 2022 short crop’s losses. Two consecutive years of drought-riddled production shortfalls have tightened U.S. stocks considerably.

My calculations find that current marketing year stocks-to-use ratios will shrink from 31.4% to 25.0% in USDA’s October 2022 WASDE report. That means 2022/23 wheat supplies will likely shrink to the tightest level since 2013/14.

But despite some demand headwinds in Friday’s report, the surprisingly smaller 2023 wheat harvest overpowered any potential bearish price movement that could have crept into the wheat market on Friday. Wheat is in a bull market, but it will need more fodder if prices are to continue moving higher. The Russian-Ukrainian conflict presents the best opportunity for bullish price action in the short term for the wheat market.

About the Author(s)

You May Also Like