August 22, 2017

A quarter-century after the collapse of the USSR, Russian farmers are finally poised to beat the record for grain production that the country set during the Soviet era. The harvest will total at least 130.7 million metric tons this year on bumper wheat and corn crops, said Vladimir Petrichenko, director general of Moscow-based consultant ProZerno … Those estimates may go higher still as Siberia collects more grain, with potential for wheat output to reach 85 million tons, Petrichenko said.—Source: Bloomberg

On July 5, 2017, Oklahoma and Texas Panhandle wheat prices ranged from $4.80 to $5.10. The price range at this writing is between $3.40 and $3.68. The $1.40 reduction is mostly Russia’s fault.

In the May 2017 World Agricultural Supply and Demand Estimates (WASDE), 2017/18 Russian wheat production was projected to be 2.46 billion bushels. In the August WASDE, the projection was 2.85 billion bushels. Adding almost 400 million bushels of Russian wheat to the world’s hard wheat supply has resulted in lower prices.

The August WASDE also projected that Russia will be the No. 1 exporter of wheat for the second year in a row. Until the 2016/17 wheat marketing year, records show the U.S. as the only No. 1 exporter of wheat.

During the 1960/61 marketing year, the U.S. exported 41 percent of the world’s exported wheat, while Soviet Union (USSR) countries exported 11.5 percent. During the 2017/18 marketing year, the U.S. is projected to export 14.8 percent, Russia 17.5 percent, the Ukraine 8.9 percent, and Kazakhstan 4.2 percent of the world’s exported wheat.

RUSSIAN CHANGES

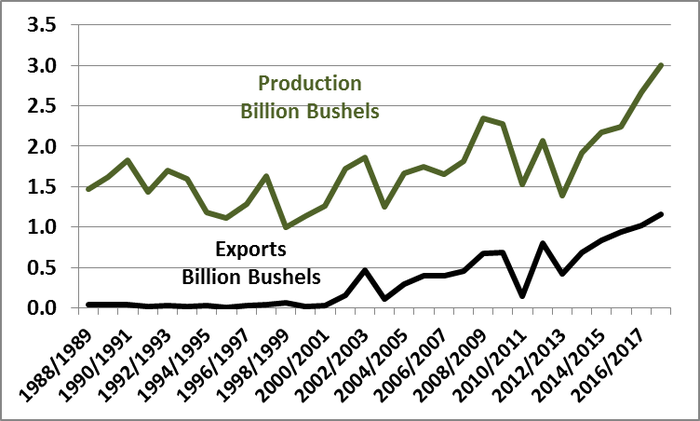

Russia is projected to export 1.16 billion bushels, compared to 980 million bushels for the U.S (Figure 1). Total exports from Russia, the Ukraine, and Kazakhstan are projected to be 2.13 billion bushels, 31 percent of the world’s wheat exports.

Between 1988 and 2001, Russian wheat production ranged between 1.0 billion bushels and 1.7 billion bushels (Figure 1). Between 2002 and 2018, Russian production ranged between 1.3 billion bushels and projected 3.0 billion bushels. Production during the last two years has been 2.7 billion bushels, and a projected 3.0 billion bushels.

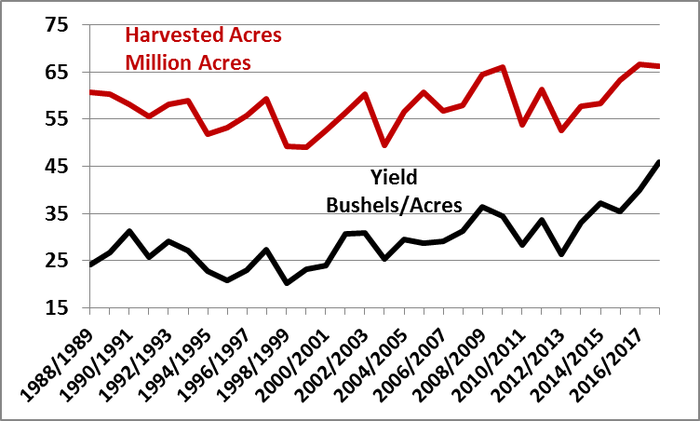

Since 2003, Russian harvested wheat acres have ranged between 54 million and 65 million acres (Figure 2). Yield was 25 bushels per acre in 2003, and is projected to be 45 bushels per acre (maybe as high as 50 bushels) for the 2017/18 marketing year. Yield is the biggest reason for higher Russian wheat production.

SEASONAL BOTTLENECKS

A recent Reuters news article reported that record high Russian grain production has resulted in “seasonal bottlenecks in Russian’s grain export infrastructure.” The article went on to say, “Owners of Russia's grain infrastructure are likely to have quite a profitable season, and may see a sharp increase in investment from newcomers …” The odds are that Russia will remain the No. 1 wheat exporter for years to come.

last year, and wheat prices increased. But weather supported kernel development, and their wheat production may turn out 7 percent higher than expected. So, wheat prices decreased.

Weather could, just as easily, have resulted in lower than expected Russian production, and prices might have continued to increase.

Lower wheat prices are mostly due to higher production — and are mostly Russia’s fault.

FIGURE 1

FIGURE 2

About the Author(s)

You May Also Like