Grain markets are in desperate need of a new story line. “Flat and low” has dominated the price picture for too long. While hardly a game-changer, USDA recently announced that starting with the May WASDE report, international supply and demand tables for crops will include an aggregate value for a “world less China.” This will focus attention on something that I think could be a game-changer. If you look at the “world less China,” wheat supply and demand fundamentals are close to break-out levels.

Over the past decade, China – the world’s leading wheat producer – has been building wheat stocks. From 2004-2007, China ended each year with 35-40 mmt of wheat stocks. They will end 2018 with nearly 140 mmt of wheat, more than double what they held just 5 years ago and well over their annual usage (for perspective, the U.S. produces just over 50 mmt of wheat). This is a policy decision of the Chinese government – the most populous country in the world places a high value on food security.

China is a big player in the global marketplace. Does it make sense to look at the “World less China?” Here’s how it makes sense. While China is the world’s largest wheat producer, it is a very small player in global wheat trade. Current estimates place them as the 18th largest wheat importer in the world, slotted between Afghanistan and Saudi Arabia. Wheat exports are also small. China’s wheat exports in 2018 are projected to be less than Pakistan and Serbia. China’s footprint in the global wheat trade is very small, and a polar opposite to its dominating role in the global soybean trade.

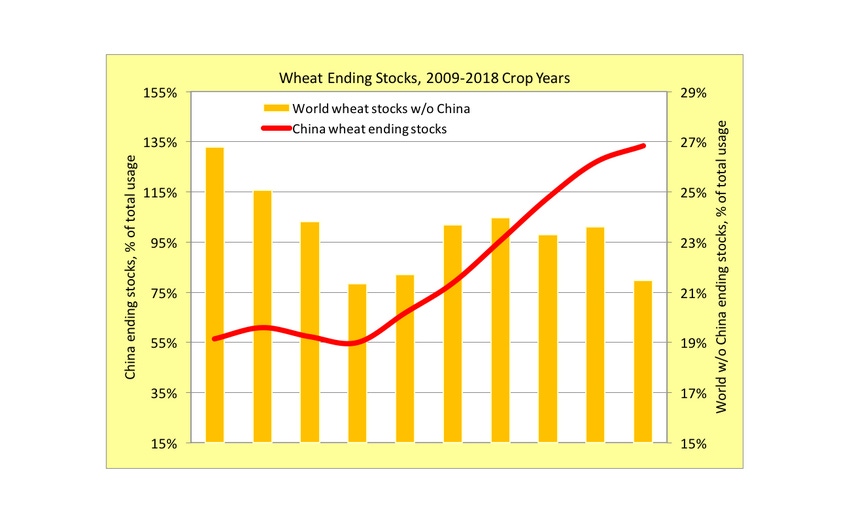

Let’s be clear – world wheat stocks are very large. USDA/FAS estimates place world wheat ending stocks/use at 37.4%, just a rounding error less than 2017, and the second highest level in 50 years. However, the accompanying chart tells a completely different story. Take China out of the equation, and world wheat stocks are very close to the 20% mark, a level that points to a very different, and positive, price environment.

Twice in the past two years, I have written articles that argued (hoped?) that wheat could become the leader needed to pull grain markets out of a bear market (Grains Find a Leader and Wheat is the Leader). It has yet to happen. Soybeans remain the leader, and the trade war remains the dominant story line.

The trade war lays on agricultural markets like a wet blanket, smothering chances for higher prices. If we can get out from under the blanket, we will see a different world.

About the Author(s)

You May Also Like