In the wheat sector, 2021 seems to be starting off eerily similar to 2020. A dry winter in the Plains paired with above average temperatures could cause even more winterkill this year compared to last, especially if an Arctic blast sends temperatures into sub-zero territory without adequate snow cover.

But there is still some time to decide the fate of the U.S. winter wheat crop in 2021, despite dry long-term forecasts. Spring – and hopes of warmer weather and replenishing rains – is within sight and wheat growers have more to be optimistic about this year than last.

U.S. wheat growers are not alone in worrying about winterkill – Russia is facing its fair share of concerns over poor crop conditions as well. Rising domestic food prices in Russia led analysts to downgrade wheat export quota estimates. SovEcon expects an 11% cut, or 165.3 million bushels, to the current quota, shrinking Russia’s exportable supplies to 1.3 billion bushels for the 2020/21 marketing year.

But despite shrinking supply prospects and rising world wheat prices, Russian farmers remain slow to sell their wheat, due in large part to potential losses incurred by the new export tax to be implemented in mid-February 2021. SovEcon expects many farmers to delay sales until the export tax expires in July 2021.

Good news for exports

What does an export slowdown from the world’s top wheat exporter mean for U.S. wheat growers? A lot of the opportunity will come down to timing.

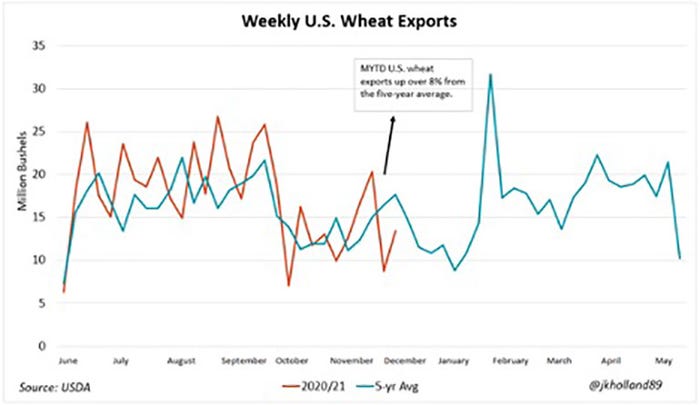

Wheat export loading paces out of U.S. terminals continue to thrive, even amid seasonal slowdowns. Chinese wheat purchases – which are eight times higher in the first third of the 2020/21 marketing year compared to the prior year – are the driving force behind marketing year to date shipping paces that are over 8% higher than the five-year average.

To be sure, the U.S. will need to see more international demand, particularly from top buyer Mexico. Marketing year to date wheat exports to our southern neighbor are 23% lower than a year ago. A falling dollar and high corn prices may warm Mexico to U.S. wheat purchases in the months to come.

All about timing

U.S. wheat exports tend to pick up momentum in late January through late October. Multi-year lows for the dollar underpinned unseasonably strong loading paces for wheat at U.S. export terminals. And as exportable supplies from Russia and Ukraine dry up, smaller buyers will be more likely to turn to the world’s residual supplier of wheat – the U.S.

But if Russian farmers wait until July to sell their wheat, the window for U.S. wheat growers’ export opportunities could shrink by several months. U.S. wheat farmers will do well to watch Russian farmer sales and capitalize on strong international wheat demand between now and the summer.

Ongoing economic unrest in Argentina – the world’s number seven supplier of wheat – could also open doors for U.S. wheat exporters. A dock workers’ strike over low wages amid rising inflation lasted several weeks, slowing grain flows out of the country. Further economic strife between dock workers and grain companies would likely send international wheat buyers to the U.S. if strike activity persists in the South American country.

About the Author(s)

You May Also Like