For the second time in the past year, the agricultural supply chain has been partially upended in many parts of the country. But instead of the pandemic, this time Mother Nature is to blame. While the current cold snap is on its way out the door, it has caused dramatic industry upheaval along the way.

Logistical headaches

Across the country, grain flows are being disrupted as the snow and extreme cold delays shipments with snow-blocked roads and ice-covered rail tracks. Icy rails and frigid temperatures reduce the efficacy of air brake systems on trains, which could limit volume capacity of trains, according to Mike Steenhoek, executive director of the Soy Transportation Coalition.

“More locomotives will be required to transport a given volume,” Steenhoek explains. “The route to the Pacific Northwest is experiencing significant delays. These are overwhelmingly rail movements.”

The Arctic blast has quickened ice formation on several key Midwestern waterways, including the Mississippi. Ice buildup on the Illinois River led to the American Commercial Barge Line (ACBL) to stop barge shipments on the river.

At the Marseilles Lock and Dam on the Illinois River in north central Illinois, the Rock Island Army Corp of Engineer District reported complete ice cover measuring four inches thick for three miles upstream. “As that occurs, the navigation channel becomes narrower and more restricted – necessitating width limits on barge flotillas,” Steenhoek points out.

The Rock Island District began enforcing width restrictions at all locks on the Illinois River on February 11. “This will drive the industry off the river and cease river operations,” the ACBL said in a statement last week.

Related: Deep freeze snarls ag shipments

Grain processing stalls as energy pipelines go dry

The cold snap continues to constrict the energy sector, with ethanol feeling the squeeze. Soaring natural gas prices amid reduced production and intensified demand during the ongoing cold snap sent many ethanol producers across the Midwest slowing production. Natural gas is a key energy source for ethanol plants.

Slowing oil refinery activity in the U.S. Gulf due to the lower temperatures could also reduce demand for the fuel additive, handing the ethanol industry another heavy blow over the past two weeks of subzero temperatures across the country.

The rising prices have led to negative ethanol margins. A Reuters report estimates current profit margins for Corn Belt ethanol producers at -$3.42/gallon – the lowest since 2010. Some plants are even looking to sell natural gas stocks to other users to drum up profits while production stalls.

Snowstorms and frigid temperatures slowed soymeal processors yesterday. Increased natural gas consumption due to widespread subzero temperatures drained natural gas pipelines which also fuel crush plants. The winter storm also limited cash market activity.

Soyoil prices rose slightly overnight on short-term production reductions due to the ongoing cold snap. Basis at several Midwestern processors and river terminals has weakened over the past two weeks in response to the additional shipping and energy constraints faced by the grain industry.

Energy prices

The cold snap boosted energy prices to pre-pandemic levels, though at a severe availability cost to consumers. Sky-rocketing residential heating demand over the past week pushed power grids to the limit, causing rolling blackouts and outages to 3.4 million energy customers as of this morning in Nebraska, Oklahoma, Louisiana, Kentucky, Illinois, Texas, Oregon, Missouri, and Kansas.

West Texas Intermediate crude futures prices are up nearly 10% in the last two weeks to $60.38/barrel at last glance on the rising heating fuel demand. Cash prices for gasoline and ultra-low sulfur diesel fuel continued higher yesterday as several oil refineries in the U.S. Gulf halted operations due to the cold. Propane prices were already on the rise before the cold snap as the pandemic commissioned a surge of outdoor heat lamps to enable safe social contact in the winter months.

A Bloomberg report estimates over 3 million barrels of daily oil processing capacity were taken offline across the country as of yesterday, with several large refineries in the Gulf region leading the way. To put it in perspective, refiners in the Gulf supply over 60% of fuel to the East Coast.

Saudi Arabia announced plans this morning to ramp up oil output in the months to come as the pandemic recovery takes hold across the globe. The Middle East oil behemoth will reverse last month’s plans to cut over 1 million barrels/day of production during February and March.

The Saudi’s announcement will likely mitigate the cold snap’s short-term effect on energy prices, which are at risk of falling as the thermometer begins to rise.

Winterkill concerns tighten 2021 wheat supply outlook

Wheat prices traded at least 1% lower this morning, with many market participants cashing in on yesterday’s 3% gains after winterkill damage was largely priced into the market yesterday. "Many in the market fear that those very cold temperatures will have killed enough U.S. winter wheat crop to tighten 2021 supply,” Tobin Gorey, director of agricultural strategy at the Commonwealth Bank of Australia, told Reuters overnight. “But not everyone is quite so convinced that the losses will be large."

Dormant winter wheat plants are more likely to withstand freezing temperatures with adequate snow cover. But with 93% of the U.S. High Plains in some sort of dry or drought condition according to UNL’s Drought Monitor, many fields across the Plains did not have enough snow cover to protect the crop.

Preliminary estimates suggest 10% of the U.S. soft red winter wheat crop and 15% of the U.S. hard red winter wheat crop will suffer winterkill damage. Despite an increase in winter wheat acreage this fall – the first since 2018 – 2021/22 U.S. wheat yields are now at risk of falling short of trendline estimates after the cold snap.

End in sight

About 75% of the continental U.S. is covered in snow, up from 45% a week ago according to data from National Oceanic and Atmospheric Administration’s (NOAA) National Snow Analysis daily report. Temperatures in the Midwest and Plains could rise to the warmest level in nearly two weeks today, according to NOAA’s short-range forecasts.

Highs in the teens are forecast by the end of the day in the Northern Plains and Upper Mississippi River Valley, where subzero temperatures have been the norm over the past week. Temperatures will range between the teens and thirties across most of the lower 48 states today.

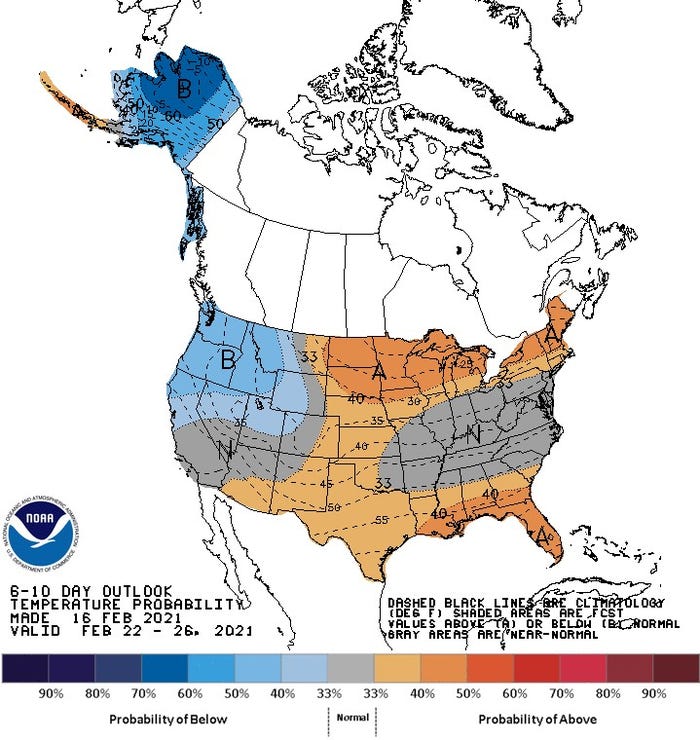

The current cold snap is unlikely to repeat itself. NOAA’s 6-10 day forecast points to a 33% - 40% chance of above average temperatures during the first half of next week across the Upper Midwest and U.S. Plains.

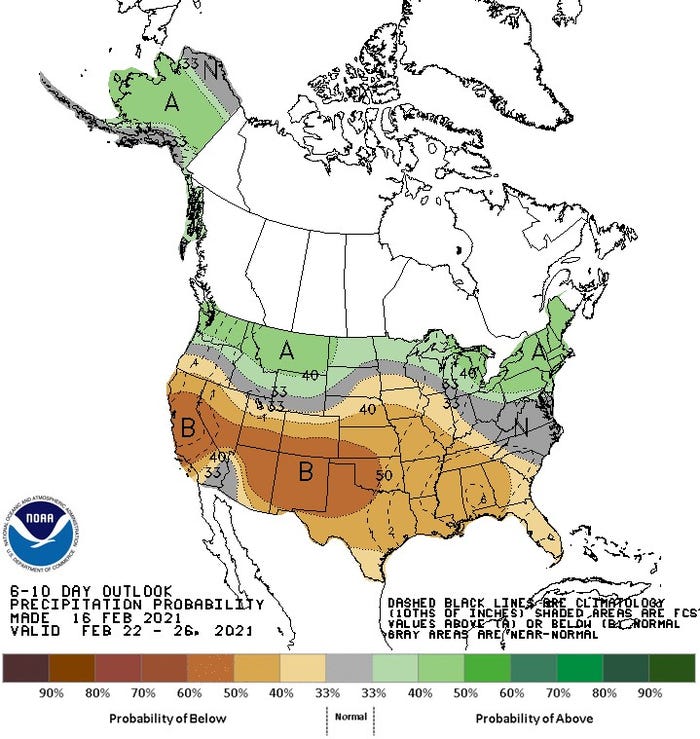

Above average precipitation is likely on the Northern edge of the lower 48 states. But most of the U.S. will see below normal precipitation during the February 22-26 period, allowing some of the snow accumulation to melt.

About the Author(s)

You May Also Like