Soybeans traders are waiting to see next Wednesday the latest monthly USDA crop report.

Will gains in U.S. export demand be offset by a reduction in the domestic crush estimate? I'm already hearing talk of +600 to +700 million bushel ending stocks being possible later in the year. The trade is also wanting to know what will happen with planted acreage next year in South America?

Something else of interest will be Monday's USDA planting progress. The bulls are pointing to the fact some key production areas have taken on heavy rainfall and many flooded fields are still couple of weeks from potentially being replanted. Meaning perhaps there could be more "preventive plant" acres than the trade had forecast.

The balance sheet is clearly burdensome but weather here in the U.S. remains a "wild-card". From a macro perspective things have clearly cooled with crude oil at fresh five month lows and gold dropping on thoughts of what appears to be a more dovish Fed.

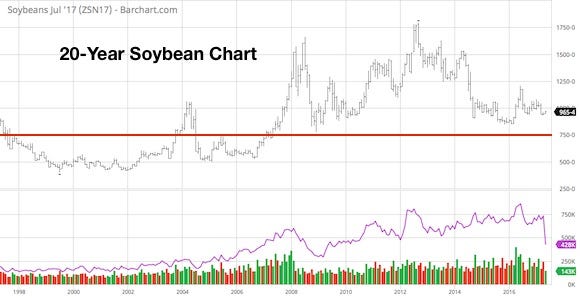

Technically the charts continue to show nearby support in the $9.40 to $9.50 range. Bulls are worried that a close below that level cold open up the cellar door. As a producer, I'm keeping hedges in place.

Don't forget we could be digesting changes to the biodiesel space next week, specifically in regard to imports from Argentina and Indonesia.

About the Author(s)

You May Also Like