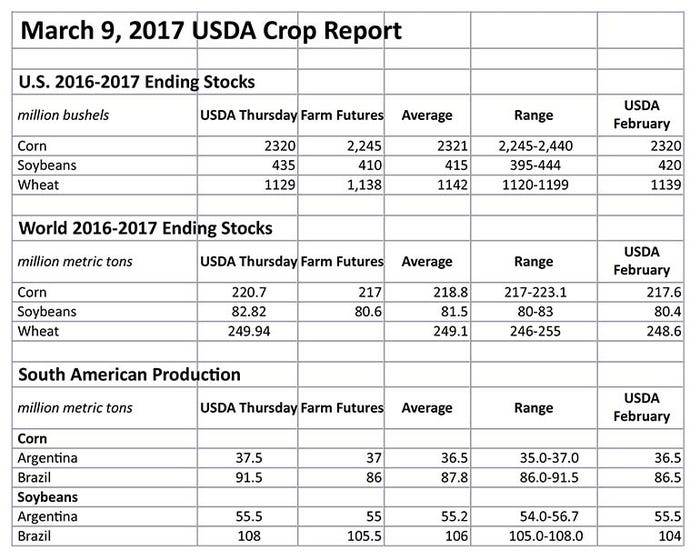

USDA delivered a bearish surprise to the soybean market by raising U.S. ending stocks, which countered trade forecasts for a reduction, and it raised Brazil’s crop by 4 million metric tons to 108 million.

U.S. corn, soybean and winter wheat futures moved lower after the report, led by the soybeans in which the May dropped under the 200-day moving average for the first time since January.

USDA raised soybean ending stocks by 15 million bushels as exports were lowered by 25 million bushels due to the larger crop in Brazil. The drop in exports was partially countered by a 10-million-bushel increase in the soybean crush.

An increase in Brazil’s soybean crop had been expected, but 108 million was larger than most trade estimates. Larger corn estimates for Argentina and Brazil, 37.5 and 91.5 million metric tons respectively, weighed on the corn market.

“The numbers are even more bearish than they look on the U.S. tables, because the government’s big forecasts for Brazilian production of corn and soybeans could linger into the start of the 2017 crop marketing year ,” said Bryce Knorr, Farm Futures senior grain analyst.

Add in the larger Argentina corn crop and Knorr said that puts an additional 235 million bushels of grain on the market.

U.S. corn ending stocks were unchanged at 2.32 billion bushels but USDA still juggled some demand numbers. It raised ethanol use by 50 million bushels and lowered feed and residual use the same amount.

“The agency’s estimate for ethanol usage is in line with what’s been happening lately. But it’s unusual for them to change feed usage now, rather than wait until stocks data comes out at the end of the month,” said Knorr.

Wheat ending stocks were lowered 10 million bushels to 1.129 billion due to a similar reduction in imports.

Global wheat production was raised 2.8 million metric tons mainly due to a 1 million metric ton increase in Argentina’s crop and a two million increase in Australia’s.

World wheat ending stocks increased to 249.9 million metric tons from 248.61 million.

Near midday, Chicago soybean futures were about 13 cents lower in May and July and 10 cents lower in the November. Corn futures were 4-1/2 lower for the day in both May and July and 4 cents lower in December.

July soft red winter wheat was 3-3/4 cents lower and Kansas City’s July hard red winter was down 4-3/4 cents. July spring wheat was up 3 cents.

“It may be too early to toss in the towel on beans, however,” said Knorr. “Some buyers who waited on the sidelines for China to slow down on its imports may be more than willing to step in and buy, especially if they need beans right away and can’t afford to stand in line down in Brazil.”

About the Author(s)

You May Also Like