June 2, 2020

Farmers may need a little help understanding the Coronavirus Food Assistance Program before visiting their local USDA Farm Service Agency. So, the University of Missouri Extension economists have prepared an online overview to help.

Sign-up for direct relief because of the COVID-19 pandemic began May 26 and ends Aug. 28 at local USDA Farm Service Agency offices.

MU Extension agriculture economist Scott Brown says payment details are complicated, and “everyone won’t be happy, but they will be happy to see payments headed their way.” Not all commodities are eligible.

Related: Complete coronavirus coverage

CFAP by the numbers

Eligible farmers and livestock producers will receive 80% of their calculated payment now under the CFAP plan. The remaining 20%, not to exceed the payment limit, will come later this year, depending on remaining dollars available under the allotted $16 billion available through CFAP.

Eligible commodities must have suffered a 5% or more price decline or serious supply chain disruptions because of COVID-19. Income restrictions apply for individuals and different legal entities.

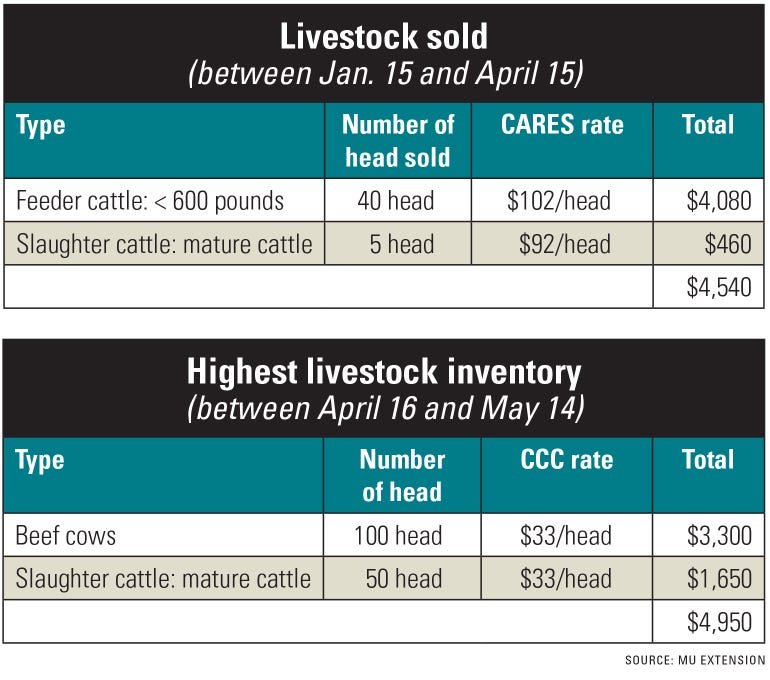

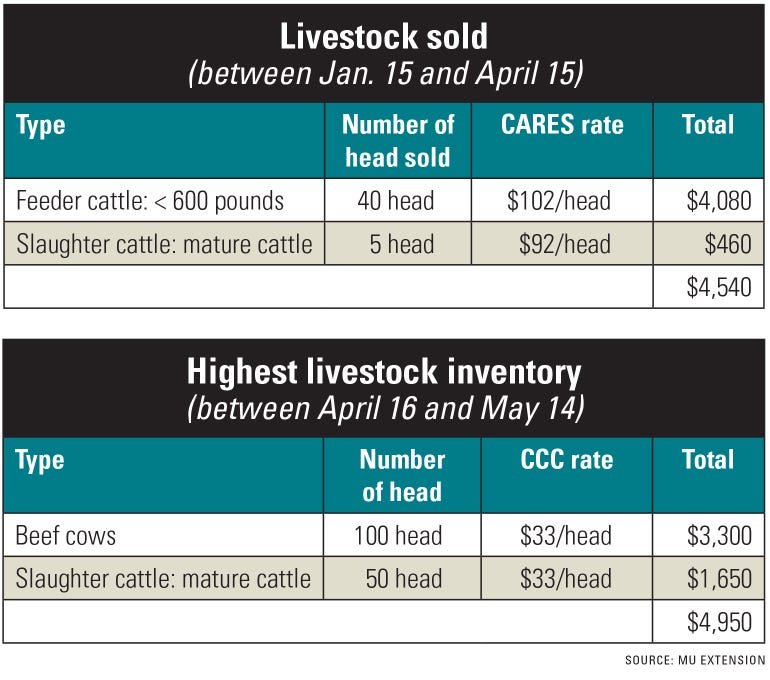

BEEF CASE: MU Extension ag business specialist Wesley Tucker says this is an example of how to calculate the payout from CFAP. However, not all cases with these exact numbers will receive more than $9,000. Visit with MU Extension or FSA offices to see what you can expect.

MU Extension agriculture business and policy specialists created the educational pieces to help producers understand the program before they visit their local FSA offices during unusual work environments because of the COVID-19 pandemic. The MU Extension guide offers eligibility requirements, examples, videos and calculators.

How to apply for CFAP

Producers must make telephone appointments with FSA representatives or email them. They also may apply online.

If you are an existing customer, much of the required information likely will be on file at the FSA office. If not, prepare by having your personal information, tax identification number and direct deposit information.

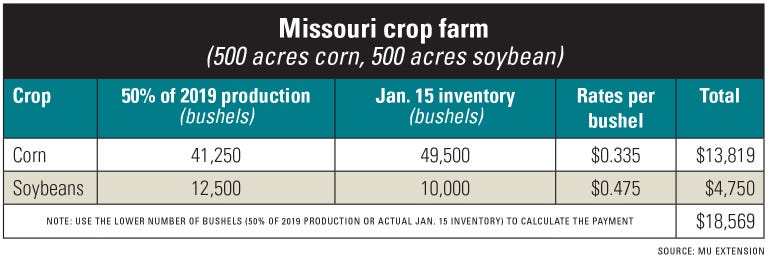

CROP PAYOUT: MU Extension worked up this example for corn and soybean growers.

Be prepared to explain your farm operating structure and have information regarding your adjusted gross income compliance certification to ensure eligibility. Applicants will self-certify, but should keep records for spot checks and audits.

Apply at farmers.gov/cfap.

Extension available by email

Those who are not computer savvy or have questions may contact MU Extension ag business and policy faculty:

Scott Brown, [email protected], 573-529-9200

Karisha Devlin, [email protected], 660-216-4008

Joe Horner, [email protected], 573-882-9339

Ryan Milhollin, [email protected], 573-882-0668

David Reinbott, [email protected], 573-837-2358

Mary Sobba, [email protected], 573-581-3231

Wesley Tucker, [email protected], 417-326-4916

Source: University of Missouri Extension, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

Read more about:

Covid 19You May Also Like