May 29, 2020

To provide financial assistance to farmers impacted by the coronavirus pandemic, USDA released details of the federal government’s $16 billion relief package just days before the program sign-up began May 26. Enrollment is taking place through local Farm Service Agency offices. Applications will be taken through Aug. 28 or until funds are exhausted.

The $16 billion available for the Coronavirus Food Assistance Program — allocated by Congress through the Coronavirus Aid, Relief and Economic Security Act — includes direct payments for farmers. Of that total, $9.6 billion is for the livestock industry ($5.1 billion for cattle, $2.9 billion for dairy and $1.6 billion for hogs). The program has $3.9 billion for row crop producers, $2.1 billion for specialty crop producers and $500 million for other crops.

Additional CFAP details and the enrollment process are explained at farmers.gov/cfap.

Iowa State University Extension farm management specialist Steve Johnson says the process for farmers to apply for CFAP payments is a mostly automated process. USDA has created the online application procedure so farmers can enter their data into a spreadsheet, and it will generate the application form. “FSA office staff are fielding questions and helping farmers navigate CFAP,” Johnson says.

USDA is urging farmers to begin the paperwork process using an online calculator. Payments will be coupled to actual production and based on losses producers have experienced due to price declines and supply chain disruptions from COVID-19. To qualify for a payment, a commodity must have declined in price by at least 5% between mid-January and mid-April.

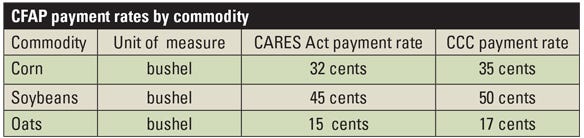

Producers will be paid based on 2019 production or unpriced bushels subject to price risk for crops held as of Jan. 15, 2020. A single payment will be made based on 50% of a producer’s 2019 total production or the 2019 inventory still not sold as of Jan. 15, whichever is smaller. This amount for each crop will be multiplied by 50% and then multiplied by the commodity’s applicable payment rates as shown in the chart below.

For example, producers can be paid on 50% of their 2019 production or their unpriced inventory as of Jan. 15, whichever amount is smaller. Say total production was 100,000 bushels of corn and the producer had 50,000 bushels of corn or more unpriced as of Jan. 15.

The farmer would receive a CFAP payment on 50% of those 50,000 bushels. Half of the bushels would be paid 32 cents from the CARES Act, and the other half would be paid 35 cents from the Commodity Credit Corporation (CCC). That payment would be $16,750, with 80% paid initially. The 20% balance would likely be paid later depending on the total amount of CFAP funds remaining.

Producers must provide the following information as a part of their CFAP application:

total 2019 production for the commodity that suffered a 5% or greater price decline

total 2019 production that was unpriced as of Jan. 15

A YouTube video demonstrates the CFAP application form that can be downloaded, completed, signed, dated and then mailed or emailed to a local FSA office.

Producers should make an extra copy of this CFAP application form submitted for their own records, Johnson says. Attach any proof of how you determined the 2019 total production by crop and the 2019 production that was unpriced as of Jan. 15.

Who is eligible for CFAP?

CFAP is open to all producers of eligible commodities regardless of size. Some farmers may not have traditionally worked on a regular basis with FSA. Once sign-up begins, some may want to contact their local FSA office to schedule an appointment. FSA staff will help them complete portions of Form CCC-902 Farm Operating Plan. Other forms will also be needed to apply for CFAP, although if you’ve dealt with FSA before, it’s likely FSA already has these on file. These forms include:

CCC-901. Identifies members of a farm that is a legal entity. Member information will be completed by legal entities and joint organizations to collect member names, addresses, tax ID numbers and citizenship status.

CCC-941. Reports your average adjusted gross income for programs where income restrictions apply.

CCC-942. Reports income from farming, ranching and forestry for those exceeding the adjusted gross income limitation.

AD-1026. Ensures compliance with highly erodible land conservation and wetland conservation.

AD-2047. Provides basic customer contact information.

SF-3881. Collects your banking information to allow USDA to make direct deposits.

Payment rates, calculations

The Center for Ag Law and Taxation at ISU has information on at calt.iastate.edu explaining the USDA relief program. Kristine Tidgren, director of CALT, says CFAP compensates producers through a combination of $9.5 million from CARES Act funding and $6.5 million in CCC funding. USDA has created a single application and will issue producers a total payment derived from both CARES Act and CCC funds.

CARES Act funds will compensate producers for commodity and livestock losses due to price declines that occurred between mid-January and mid-April, and in the case of specialty crops, for products that were shipped but spoiled and for which no payment was received. Payments will be calculated using payment rates specifically developed for each category of commodity.

USDA will make an initial payment of 80% of the calculated payment. If funds remain available after the initial round of payments, the agency will disburse the remainder of available funding, not to exceed the $16 billion funding limit.

The payment made from CARES Act funds is calculated by multiplying 50% of the producer’s eligible inventory as of Jan. 15 by the act’s payment rate. The payment rate from CCC funds is calculated by multiplying 50% of the eligible bushels by the CCC payment rate. These two calculated amounts will be combined into one payment to the eligible producer.

Specialty crops, livestock

Specialty crops such as vegetables, strawberries, sweet corn and others eligible for payments are listed on the USDA website. CFAP payments are also being made for livestock. Rules for other eligible commodities such as aquaculture and nursery crops will be announced in the future.

For cattle, hogs and pigs, and lambs, payment to the producer is calculated by multiplying the CARES Act Part 1 payment rate per head — specified by species and class — by the volume of sales occurring between Jan. 15 and April 15. CCC funds are used to make a payment to the producer calculated by multiplying the CCC Part 2 payment rate per head — specified by species — by the highest inventory number between April 16 and May 14. Payment rates per head for eligible livestock are listed on the USDA website.

Dairy producers with milk production subject to price risk in January, February or March are eligible for CFAP payments. They may also receive assistance for dumped milk. Payments will be based on a producer’s certification of milk production for the first quarter of 2020 multiplied by $4.71 per cwt. The CCC part of the payment is based on a national adjustment to each producer’s production in the first quarter multiplied by $1.47 per cwt.

Payment limitations

CFAP payments are subject to a per person and per legal entity payment limit of $250,000. This limit applies to the total amount of CFAP payments made for all commodities, Tidgren says.

Payments are attributed to an individual through the direct distribution rules used in other USDA programs. Total CFAP payments attributed to an individual are determined by considering the direct and indirect ownership interests of the individual in all legal entities participating in the program.

Unlike other farm programs, special payment limitation rules are applied to CFAP participants that are corporations, limited liability companies and limited partnerships. These corporate entities may receive up to $750,000 based on number of shareholders (not to exceed three shareholders) who are contributing substantial labor or management to the operation.

General requirements that apply to other FSA-administered commodity programs also apply to CFAP, including conservation compliance provisions. There is no requirement to have crop insurance coverage or coverage under the Noninsured Crop Disaster Assistance Program for an eligible CFAP commodity to be eligible to participate in CFAP.

About the Author(s)

You May Also Like