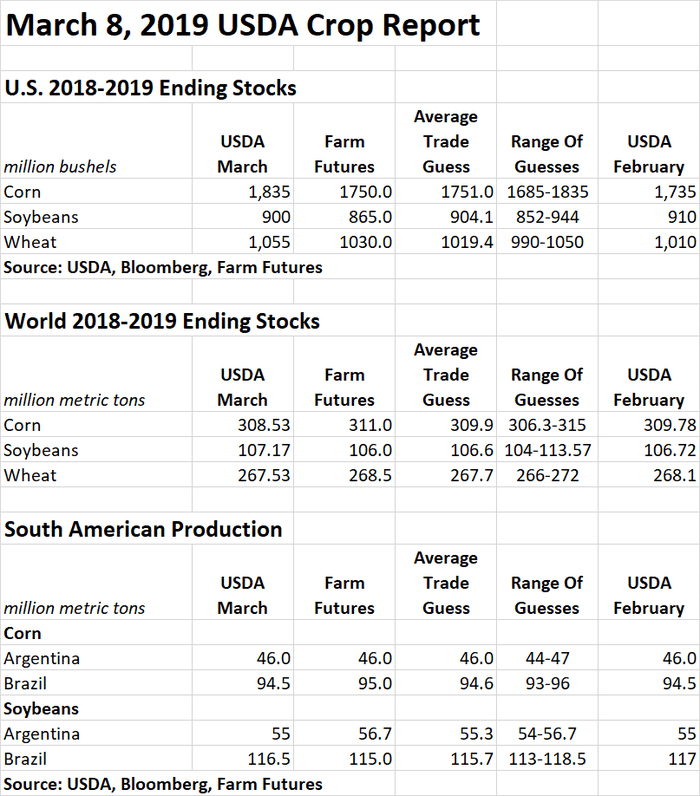

Grain futures grain futures are mixed this morning after USDA raised its forecast of old crop corn and wheat stocks more than expected, offsetting a small reduction in soybean carryout.

The government raised its projection for corn ending stocks by 100 million bushels, well above trade guesses that saw only a small increase coming. USDA cut its forecast for ethanol usage by 25 million bushels, which was hardly a shock given the slow pace of biofuel production recently.

But the agency also slashed its forecast for exports by 75 million bushels due to increased competition from South America, while keeping its estimate of production in Brazil and Argentina unchanged. Boosting carryout to 1.835 billion bushels would knock a nickel off the average price forecast for the 2018, with the midpoint of the agency’s range now $3.55.

Wheat carryout is also higher, increasing 45 million bushels to 1.055 billion due to a combination of increased imports (5 million bushels), lower exports (35 million bushels) and food use (5 million bushels). The midpoint of the agency’s price range for 2018 crop wheat was unchanged at $5.15.

The only cut in the big three crops came in soybeans. USDA lowered its forecast for carryout by 10 million bushels due to stronger brush, putting projected ending stocks at 900 million. The midpoint of the price range for the crop was unchanged at $8.60.

USDA made only a small adjustment to its forecast of South American production, leaving Argentina’s crop unchanged and cutting just 18.375 million bushels off Brazil’s. While local estimates are lower than the government new figure for Brazil, late season rains there helped stabilize conditions.

USDA made no change to its forecast for Chinese soybean imports, maintaining its projection for purchases to fall by 6.5%. But data out overnight from China’s customs agency showed year-to-date imports off 18% as purchases from the U.S. slowed due to the trade dispute between the two countries.

Futures traded both sides of even in the minutes after the report came out, leaving soybeans down 4 to 5 cents, corn down fractionally and wheat up 2 to 3 cents.

May corn ticked below its September low in the wake of the report, posting a new contract low. That could set the stage for a cycle low if the market can turn around. If not, the selling threatens to turn the tide bearish, making it more difficult for the market to rally.

May soybeans sunk to the lowest level of 2019 but held December lows. The battle for the market now could be willpower to hold on while waiting for demand from China to emerge if a trade deal can finally be inked.

Winter wheat contracts are trying to reverse higher after testing long-term chart supports at new contract posted in the minutes after the reports came out.

About the Author(s)

You May Also Like