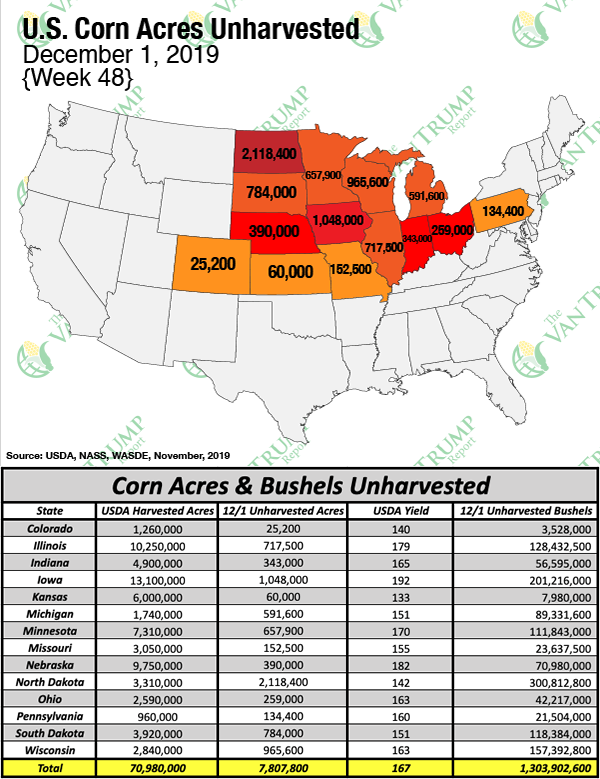

Corn bulls continue to point towards nine million U.S. corn acres that are still thought to be unharvested. Most eyes remain on the acres in North Dakota, Michigan, and Wisconsin. But there are also still many unharvested acres in Illinois, Indiana, Iowa, Minnesota, and Ohio. Unfortunately, we still have to wait until January 10th before we get an updated USDA production estimate. Which means we need another supply-side catalyst to help entice new bullish money.

I could argue that the weather in Argentina might pique a little more bullish interest but I'm doubting it will be strong enough nearby to do much heavy lifting. Keep in mind, the USDA is currently forecasting a 50 MMT Argentine crop vs. 51 MMTs last year vs. just 32 MMTs the year before. The USDA is currently forecasting a Brazilian crop of 101 MMTs with many private sources thinking it's working higher vs. 101 MMTs last year vs. just 82 MMTs the year before. Bottom-line, Brazil looks like it could produce a bit more than last year, while Argentina could produce a bit less. This certainly isn't enough to excite or entice new bullish money-flow.

Of course, a Chinese trade deal that involved the purchase of U.S. corn would provide a significant tailwind, but who knows if or when that card gets flipped over. On the demand front, I could argue that both ethanol and export demand is going to somewhat improve, but again, those headlines don't appear as if they will be strong enough nearby to perform extended heavy lifting. In other words, I suspect rallies might be somewhat limited.

Technically, the MAR20 contract seems content trading between $3.70 and $3.95 nearby or perhaps a bit more extended range of between $3.50 and $4.20 per bushel.

As a spec, I remain a longer-term bull into 2020 and continue to hold a very small bullish position. I still like the thought of buying bigger breaks sub-$3.65 should they occur. As a producer, I have to remain patient.

Check out my 30-day free trial!

The opinions of Kevin Van Trump are not necessarily those of Corn and Soybean Digest or Farm Progress.

The source is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like