As the Parisian firemen battled the flames devouring much of the Notre Dame Cathedral, Brazilian farmers readied their case to the administration to ignite new demand for soy and tallow-based biodiesel.

Facing the threat of another crippling truckers’ strike, Brazilian President Jair Bolsonaro last week vetoed a 5.7% increase in wholesale diesel prices. Seeing an opening, farmers applied more pressure to dump another veto: this one being the Mines and Energy Ministry’s nixing earlier this year of a move to jump to an 11% blend this June and a 15% biodiesel blend by 2023, upping the standard obligatory biodiesel blend by 1% a year.

The current Brazilian biodiesel blend is 10%.

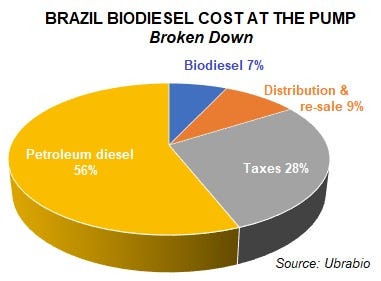

Here’s the case producers will make when they sit with government leaders this week. Brazil imports just about all its diesel fuel. Biodiesel can serve as a shock absorber against rising retail diesel prices. And prices of the petroleum portion of biodiesel blends sold to the public rise and fall like any commodity (farmers are used to that!) They also fall and (mostly) rise with exchange rates. That is, with how many dollars of stuff one’s local currency can buy. But six bimonthly government auctions of biodiesel feedstock for blending with petroleum diesel tend to stabilize prices a bit. So even though the major feedstock- soybean oil- is a dollar-based world commodity, the somewhat infrequent government auctions tend to lock in prices of the biodiesel portion of the blend over two-month periods, no matter the volatility of the petroleum portion.

Get it? As a result, a greater portion of biodiesel in the blend will provide greater overall price stability.

Cheaper product cuts imports

Neat biodiesel is cheaper than petroleum diesel right now across much of Brazil, if it could be bought that way by the consumer. But Anfavea, Brazil’s vehicle manufacturers’ association, says the higher blend may cause engine problems. Perhaps they haven’t been shown the results of the U.S. National Biodiesel Board’s million-mile tests of a 20% blend with major U.S. municipal transit agencies. Or perhaps the Brazilian Mines & Energy Ministry needs to see the data, as officials there fell over themselves to accept Anfeava’s flimsy claims and quash the increase in the biodiesel blend.

That’s too bad for Brazil, as one national biodiesel group points out. They say that the use of biodiesel in that country has meant that the country has had to import 9.9 billion fewer gallons of petroleum diesel since 2008 than it would have had to buy. They add that Brazil’s 51 biodiesel plants help create or sustain 1.3 million jobs, too.

With President Bolsonaro’s cancellation of increased wholesale diesel prices, the market valuation of state-owned fuel company Petrobras lost about $10 billion. On the other hand, the country’s farmers stand to gain a lot more demand if they could just convince government officials to stop fiddling while the economy—ever dependent on diesel-burning eighteen-wheelers—burns.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like