"What is important to understand is how your costs compare to the defined crush margin," says John Lawrence, Iowa State University economist.

In his analysis Lawrence defines the crush margin (CM) as the value of the hog less the cost of the pig, corn and soybean meal to finish the pig. Specifically,CMT = 2 x LHFBT - WPT-5 - 10 x CFBT-5 -.075 x SBMF BT-5

* LHFBT is the lean hog futures that expire in month T (or one month after T in the case of off contract months) adjusted for the basis (B) for month T. This price is multiplied by 2 for a 200 pound carcass.

WPT-5 is the weaned pig price at placement, 5 months prior to slaughter. Prior to buying the pig the first week of the placement month the pig price per head is estimated to be 50% of the 5-month-out lean hog futures price not ad-justed for basis. Fifty percent is the average ratio of USDA reported national weaned pig price per head and the 5-month-out LHF.

CFBT-5 is the corn futures price at placement adjusted by the North Central Iowa Basis multiplied by 10 bushels.

SBMF BT-5 is the SBM futures price at placement adjusted by the Iowa soy-bean meal basis multiplied by 0.075 tons or 150 pounds.

At placement, the first week of the month, Lawrence assumes that the weaned pig, corn and soybean meal are purchased in the spot market (S) at the weekly average price. The CM then becomes:CMT = 2 x LHFBT - WPS- 10 x CS -.075 x SBM S

When the hogs are sold in the spot market at time T the selling price is the weekly average price of Iowa – Southern Minnesota barrows and gilts and the final margin is calculated.

What does the crush margin cover?

The purpose of the CM is to serve as a simple indicator of potential returns and not as a measure of profit or loss to any one farm. There are two places that the CM can differ from an individual's return. First, is the weighting in the CM equa-tion. Individuals may have different carcass weights, feed requirements or pig pricing formula.

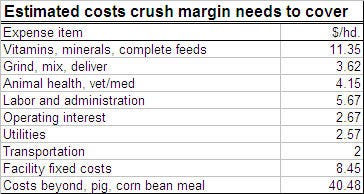

Second, is in the remaining cost that the CM must cover to sustain the enter-prise. The weightings will differ between producers and even between groups of hogs, but the key is to use weightings that are accurate enough to signal the general direction and magnitude of margins.

An individual may have different weighting of pig price and feed use and dif-ferent costs that must be covered. Producers should evaluate how well the CM matches their own costs. For example, the pig pricing formula may add $2/head to the cost and the use of DDGS may reduce the feed costs by $1.50/head for a net difference of $.50/head.

Perhaps the finishing contract cost is $18/head and includes labor, admini-stration, utilities and facility costs. Then the CM would need to cover $41.79/head. Regardless, the CM can act as an indicator of hedging opportuni-ties by alerting the producer when futures prices are in the desired range.

However, it is important to note that the CM accounts for hog, corn and SBM prices together to protect a margin. For example, locking in only hog prices and not corn and/or SBM prices leaves the producer exposed to margin risk.

About the Author(s)

You May Also Like