The 2020/21 marketing year is already off to a better start than just seven months earlier. While many factors help determine market prices, export demand for corn has been one of the most significant drivers behind recent price rallies. Our corn outlook will provide an in depth look at exports as well as other factors influencing corn prices.

What’s behind Chinese demand for U.S. corn?

China ended a costly nine-year corn support price program in 2016 that encouraged excessive corn production. Reduced acreage in the years following depleted China’s state corn reserves, which is especially problematic in 2020/21 as corn usage rates soar to just shy of 11 billion bushels – the highest level on record.

Drought conditions followed by typhoon damage in China’s northeastern corn belt this summer eroded yield prospects. The world’s second largest economy is notoriously tight-lipped about agricultural production, but several market indicators suggest the 2020 domestic corn crop may not be able to meet rising demand, driven in part by hog herd rebuilding after African Swine Fever.

Chinese corn futures notched a new record high in mid-October as state reserves continue to shrink amid tightening stocks this year. November corn futures on the Dalian exchange hit $9.67/bushel, as panic buying ensued while end users hurriedly sought to find available corn supplies.

As of mid-October, Chinese corn prices were 30% higher than a year ago, but it likely won’t limit demand. Year-over-year, China’s hog herd has expanded by nearly a third as of September. And with increasing consumer demand for animal protein amid reduced pork availability, Chinese consumers have expanded their palate for chicken as well.

With a new layer of constraints limiting domestic corn availability, China turned to the world market to satiate its appetite for corn. Chinese corn imports soared at over 39.4 million bushels for September 2020, according to monthly Chinese customs data. Tight supplies and production concerns have led the world’s second largest economy to purchase nearly 263.8 million bushels year-to-date from international sellers.

This volume is significant because China’s annual tariff-rate quota (TRQ) is currently set at 283.5 million bushels per year for corn imports – a level they are likely to exceed at current shipping paces. China has never surpassed the entire quota, but analysts expect officials in Beijing to issue more quotas to source enough corn to quell rising domestic corn prices amid food security concerns.

With China’s outstanding corn export sale volume from the U.S. reported at 347 million bushels in the October 15 U.S. weekly export sales report, market signals clearly favor continued corn demand – and possible oversight from the World Trade Organization (WTO) – from China going forward.

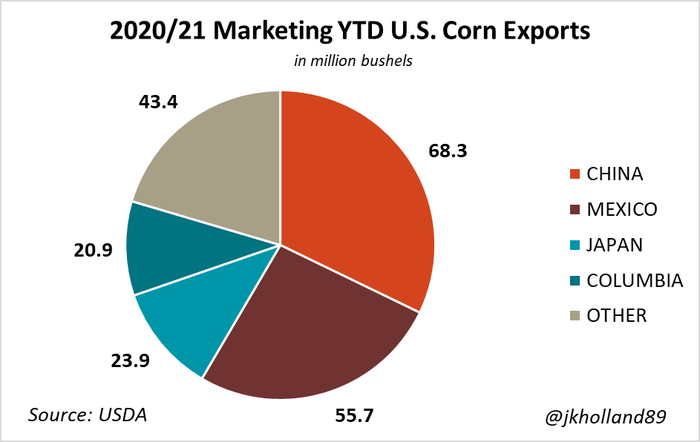

That is great news for U.S. corn export loading paces, which are over 72% higher in the first seven weeks of the 2020/21 marketing year compared to a year ago. Of the 212 million bushels of U.S. corn launched into international shipping channels in the first seven weeks of the 2020/21 marketing year, over 68 million bushels have already been sent to China. China has already purchased over four fifths as much corn in the first seven weeks of 2020/21 than they did in the entire 2019/20 marketing year.

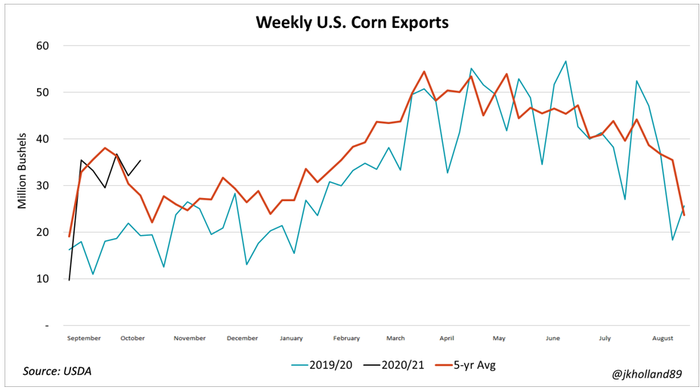

Despite strengthening demand from China, corn exports during harvest season remain nearly 4% lower than the five-year average. Shipments to top 2019/20 corn buyer Mexico have only tallied 55.7 million bushels early in the 2020/21 marketing year, down 10% from the same period a year ago. U.S. corn export volumes typically drop off in early November as other crops in the Northern Hemisphere enter export channels.

More importantly, corn exports have been unseasonably high this early in the export calendar. Export volumes typically peak in early April to mid-May. The recent uptick in export demand is a positive sign for demand-driven price movement and could provide additional basis opportunities for corn fresh off the combines as harvest season winds down.

The ethanol glass ceiling

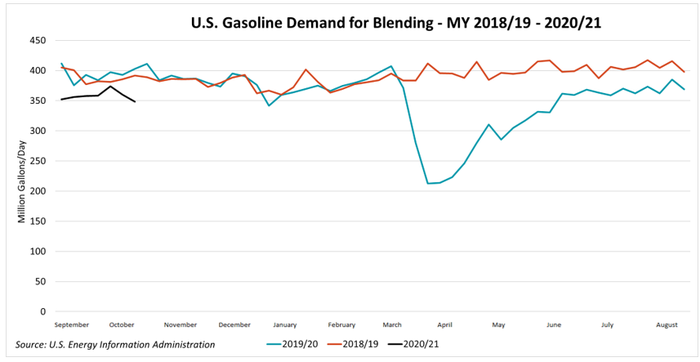

After the collapse of ethanol and fuel demand in the darkest days of the pandemic, ethanol production and demand climbed within 10% of pre-pandemic levels by the time summer ended. However, ethanol demand by blenders has yet to break past 34.4 million – 36.3 million gallons/day, where it has traded at for the past 15 weeks.

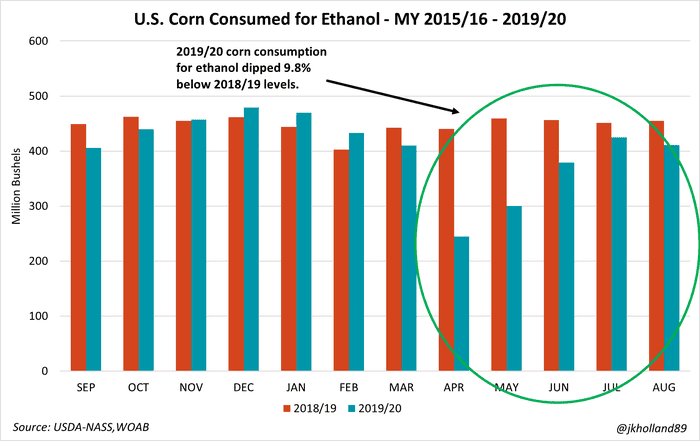

Quarterly U.S. Bioenergy Statistics report data released in late October showed 4.582 billion bushels of corn were consumed in the 2019/20 marketing year for ethanol production. The estimate is 524 million bushels fewer than ethanol corn consumption in 2018/19 due in large part to a reduction in fuel demand amid the pandemic.

Fourth quarter ethanol production only consumed 1.2 billion bushels of corn, up from 955 million bushels in March – May 2020. Fourth quarter output volumes tend to be the highest of the year, as the June – August reporting months fall in the peak summer travel period. But this year’s fourth quarter production estimates were the second lowest of the year as markets readjust to pandemic-era demand.

Only 34.9% of all corn used in 2019/20 was used for fuel ethanol production, the lowest level since the 2008/09 marketing year. Production remains tight compared to pre-pandemic levels as lower blending and export volumes mute any measurable usage gains. Capacity continues to tighten to adjust to the new market conditions, with ending ethanol stocks in July 2020 at 830.9 million gallons – the lowest level since December 2016.

What does this mean for ethanol production going forward? Likely more of the same – sideways production volumes 6% - 14% lower than pre-pandemic levels in early 2020. As a large part of the workforce remains homebound to curb the virus’ spread, fuel consumption will continue to be an average of 9.5% lower than pre-pandemic demand.

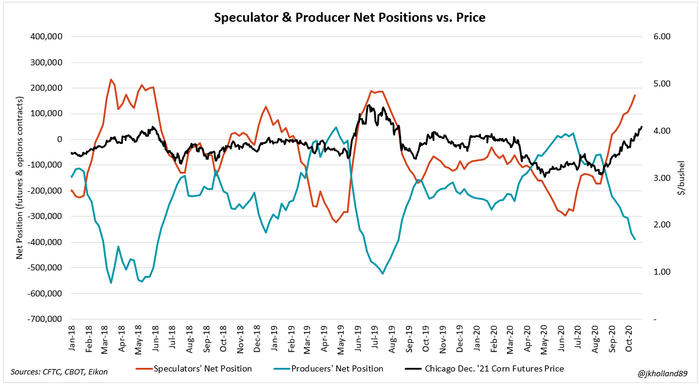

Speculators renew interest in corn

Managed money funds fueled the recent uptick in grains futures prices after becoming net buyers of corn, soybeans, soybean meal, soybean oil, Chicago soft red wheat, and Kansas City hard red wheat in recent months. Speculators may be just settling into the agricultural commodity sphere as inflationary concerns stoke interest in inflation-resistant commodities.

Goldman Sachs group CEO Lloyd Blankfein recently pointed to commodities as a lucrative investment option in the pandemic era. “From an inflation point of view,” Blankfein posited at a virtual meeting hosted by the CME Group Inc.’s metals division in mid-September, “as an investor, I think investing in material sectors while they’re underappreciated is not a bad thing now.”

The investment community is concerned about rising inflation following the largest monetary stimulus in history. Higher inflation means the Federal Reserve is more likely to raise interest rates to offset the inflation which is expected to follow the largest monetary stimulus in history to combat the pandemic’s economic fallout.

Commodities can be a safe haven for investors during periods of rising inflation, which has been on the upswing since lockdowns relaxed. But recent increases to inflation rates are still below the Federal Reserve’s threshold for potential interest rate increases. Speculative funds will likely remain interested in commodities until these inflationary concerns abate.

Markets were rife with uncertainty as coronavirus cases in rural America surged and Washington struggled to implement another stimulus package. With the Federal Reserve expected to keep current low interest rates in place until 2023, high inflation will likely be kept at bay in the short term, providing plenty of profit opportunities for commodity investors.

Fueled by these concerns, as well as increased demand from China, higher complementary soybean prices, and reduced 2020 harvest volumes, speculative traders have flocked to corn futures and options. Hedge fund managers shrugged off bearish ethanol and livestock demand fundamentals plaguing the corn industry in the pandemic era to increase interest in corn positions.

From August 12, 2020 to October 13, hedge fund managers trimmed a massive 273,809 short positions from corn futures and options. Buying interest has not increased as rapidly as short trimming; In the same time period money managers only added 69,421 long positions to their portfolios. Regardless, the funds rapidly reversed their net selling position to become net buyers of corn as of September 1.

Increased interest from managed money is good news for upward price action favored by farmers – especially at the height of harvest season when prices traditionally trend lower. The managed money net long position continues to widen, up to 170,869 contracts as of October 13.

On the flip side of the coin, producers have steadily built a massive short position over the past couple months, as high prices encourage more cash sales. Commodity funds added 266,396 short positions between August and October, growing their net selling position to 388,968 contracts as of October 13. With a tight carry in the futures market and strong basis prices, farmers had a lot of incentive to continue booking sales as the corn bushels rolled off the combines.

Harvest-time corn balance sheet updates

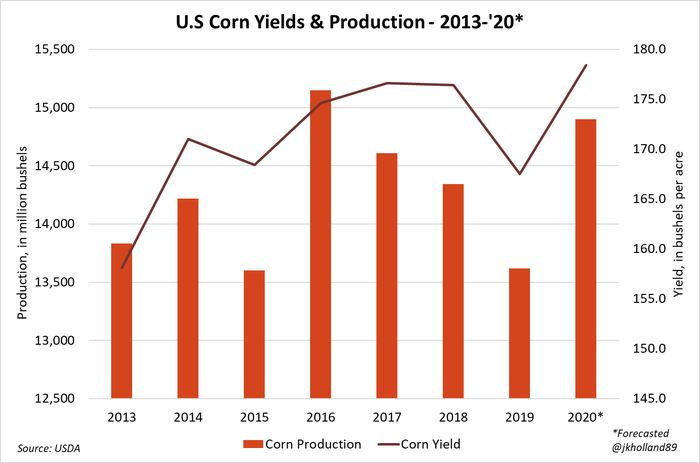

USDA’s September 30 downward revisions to 2019 corn stocks provided a new level of support for corn prices as harvest ramped up. Derecho wind damage, heat stress, and revised acreage has created a drastically different supply environment for corn than when the crop was originally planted this spring.

Despite a pre-pandemic intention of nearly 97 million acres of corn to be planted in 2020, as of October that figure was revised to just shy of 91 million acres. USDA currently estimates 82.5 million of those acres will be harvested this fall.

Snowfall across the Upper Midwest the third week of October harkened memories of a cold and wet 2019 harvest season. But while dry weather at the start of November will allow harvest progress to continue at a rapid clip, the cooler temperatures and added moisture will force farmers to compete with rising propane costs. Depending how far temperatures drop, winter heating fuels are projected 5% - 14% higher this year as more Americans are expected to remain homebound this winter.

Record yields were quickly slashed from 181.8 bushels per acre (bpa) in August 2020 after derecho wind storms decimated the Iowa crop and heat stress took the top off yields across the Corn Belt. Current estimates have deviated closer to trendline forecasts with the October 2020 Crop Production report projecting 178.4 bpa.

While that estimate would top historical yield charts by 1.8 bpa (the current record was set in 2017 at 176.6 bpa), the reduced acreage estimates as a result of late season crop damage have shrunk to 14.72 billion bushels, a far cry from May’s 16-billion-bushel projection.

Final production estimates will not be confirmed until January – weather permitting. Recent snow events could reduce test weights in crops in the Upper Midwest where a significant amount of corn remained in the fields as of late October, especially if there are any further weather delays in the region.

New crop ending stocks fell 336 million bushels from September estimates to 2.167 billion bushels in the October WASDE report. While the cut was significant, ending supplies remain at the eighth largest volume in the past 61 years. Demand recovery from ethanol and livestock users will be critical over the remainder of the marketing year to justify increasing production forecasts for 2021.

Price outlooks

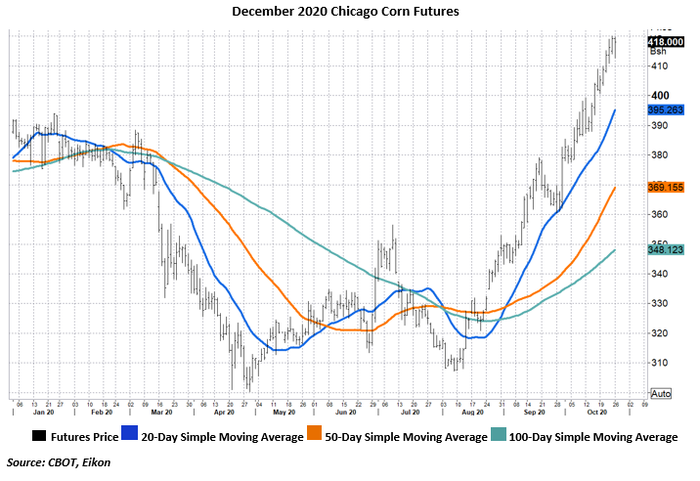

Continued production reductions are just the windfall the corn market needed as far as profitability estimates are concerned, especially combined with higher than expected old crop usage. December 2020 corn futures traded at the Chicago Board of Trade (CBOT) have rallied $1.125/bushel since the derecho winds swept through Iowa in early August, flirting with 15-month highs as of October 23.

A continuation of strong prices will depend largely on steady export demand from China and any potential downward yield projections USDA-NASS forecasts in WASDE reports in the coming months. The upward price momentum was a long-awaited reward to farmers who held on to old crop stocks outside of the marketing window over the past several growing seasons.

Markets are suggesting that action be taken soon. There is little carry in the nearby futures market, an indication that corn may be more valuable now than if it is sold next summer. Furthermore, with a quarter cent difference in July 2021 corn contracts and December futures there is little price incentive currently for farmers to store corn.

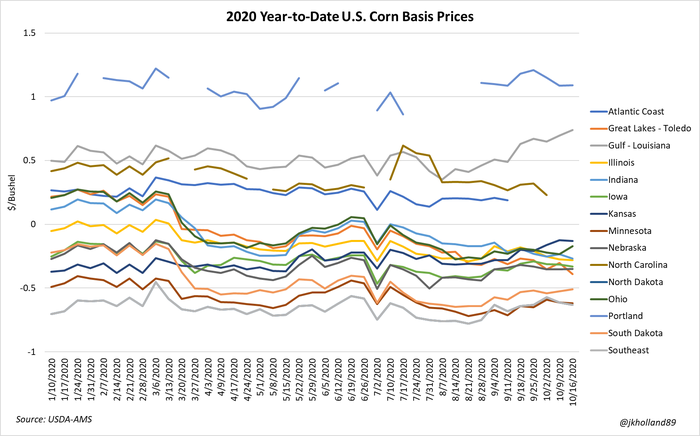

These spreads are, of course, subject to change with market conditions. But marketing is a timing game. And the current corn spreads clearly incentivize farmers to book sales sooner rather than later. Strong basis at export terminals in the Pacific Northwest, U.S. Gulf, and Atlantic coast has forced end users to raise cash offerings during peak harvest season. Basis has strengthened across the Corn Belt during harvest season as a result, offering a bonus incentive to farmers looking to capitalize on storage hedges.

Avoid being lulled into a false sense of security that higher prices during harvest are here to stay. As good as they are, they won’t last forever. Making profitable sales now based on known break evens will help to spread overall price risk across the growing season. Even if USDA further lowers 2020 yields and acreage, booking smaller sales in the final days of harvest – at a profit - will ensure a healthy balance sheet if those adjustments do not happen.

Download a complete version of the outlook with extensive charts and analysis using the Download button at the end of this report.

About the Author(s)

You May Also Like