A flurry of farmer selling developed last week and this week in the Midwest when gains in the soybean market pushed new-crop cash prices to profitable levels with some close to or above $10 a bushel.

Although a year away, many of those prices should pencil out profitably for farmers who have managed input costs and cash rents. See the Weekly Soybean Review.

While the rally has been exciting for farmers, Farm Futures advised caution before selling too much of next year’s crop.

“Assuming yields of 47.2 bpa and $456 costs, selling 20% cash soybeans for $10 gives you a small profit, if yields or prices don’t go down. If they do, you’re at risk of losing money overall” said Farm Futures senior grain analyst Bryce Knorr.

“Growers are on the hook for the first 15% of revenues if they take revenue protection crop insurance at 85% of trend adjusted yield. Most don’t, so they have even less protection against a decline in revenues from lower prices or yields,” he said. “I’ve recommended starting with a modest sale at $10.50 November 2017 futures to provide a little more cushion.”

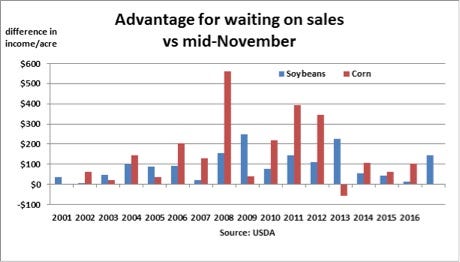

Also, he says even higher prices may be ahead.

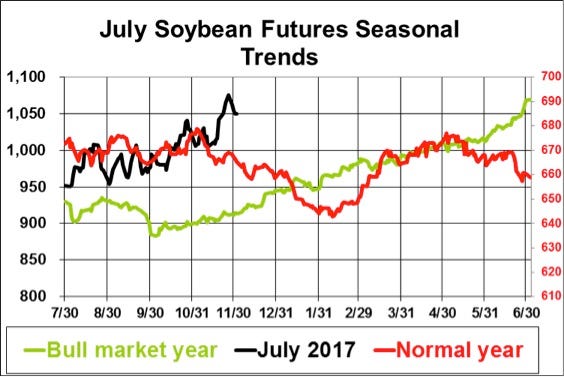

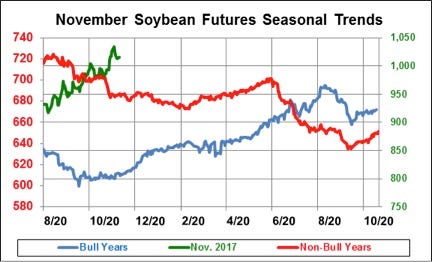

“History also suggests better pricing opportunities are ahead in 2017 – that’s the trend 12 of the last 13 years. Seasonal trend charts for old- and new-crop soybeans continue to look bullish,” he said.

In the cash markets, new-crop soybean sales was active during the higher market early last week and were active again on Monday and Tuesday.

“We had quite a bit of selling once we got back to about $10,” said a central Illinois dealer, who was paying $10.02 on Tuesday morning.

Another Illionois dealer said new-crop sales were active on Monday but slowed on Tuesday as farmers were either content with their coverage for 2017 or awaited more gains at the CBOT.

In Iowa, farmer sales of new-crop were active on Monday where soybeans for fall 2017 delivery were bringing from $9.50 to $9.70, depending on location, but business had slowed by Tuesday.

The rally in Chicago soybean futures followed recent big export sales to China, higher vegetable oil markets in Asia and talk of dry conditions in Argentina where soybeans will be harvested in about three months. Two days into this week, USDA reported China has already bought nearly 23 million bushels. In addition, unknown destinations, which could be China, took nearly 14 million that will be split between the 2016 and the 2017 harvests.

In addition, the domestic crush in the first half of 2016 topped expectations.

CBOT soybeans closed higher on Tuesday but down from the highs earlier in the day, with November up 3 at $10.27-1/2. That is up 4.5% from a month ago.

Meanwhile, new-crop corn sales have been light as cash prices, some near $3.60 a bushel basis central Illinois, have not generated much excitement among farmers.

Check out the charts below for more insight.

About the Author(s)

You May Also Like