July 8, 2012

The drought of 2012 continues to spread across the Midwest, prompting more farmers to wonder about their crop insurance coverage. In particular, those who have crop revenue policies could use a "refresher lesson" on how to make crop revenue coverage work in combination with pre-harvest corn and soybean marketing strategies.

Selling Your Guaranteed Insurance Bushels

"This week it became official for many Corn Belt states. Drought conditions have hit," notes Steve Johnson, Iowa State University Extension farm management specialist in central Iowa. "It's only the first week of July and corn and soybean prices have moved considerably higher. We're getting calls from farmers wanting to know about crop revenue guarantees and how to sell their guaranteed insurance bushels."

Johnson provides the following update and explanation of how to use crop insurance along with your crop marketing strategy. "We're trying to get farmers to stay focused on whole farm profitability," he explains. "There are opportunities for farmers to take advantage of these price rallies and make some pre-harvest sales and use marketing tools to protect themselves."

Farmers asking questions about their crop revenue coverage

Most farms today are using a crop insurance product that provides a revenue guarantee on a percentage of their actual production history or APH. The most common product used by Iowa farmers is likely Revenue Protection or RP.

Selling Your Guaranteed Insurance Bushels

Using policies such as Revenue Protection (RP) or Revenue Protection with the Harvest Price Exclusion (RPE) guarantees both yield and price, using farm level APHs. However, RPE does not offer a higher harvest guarantee should the harvest price (futures price average in October) be higher than the projected price (futures price average in February).

The Yield Protection (YP) policy is also a farm-level product, but does not trigger an indemnity unless a yield loss first occurs. The indemnity for both RPE and YP are limited to the projected price only; there's no adjustment should the harvest price be higher than the projected price.

Pre-harvest marketing strategies to consider for 2012 crop

The 2012 projected price is $5.68 per bushel for corn and $12.55 per bushel for soybeans, respectively. Use of RP or RPE guarantees the farm's APH times the level of coverage. These are often referred to as the "guaranteed bushels" or the farm's "insurance bushels."

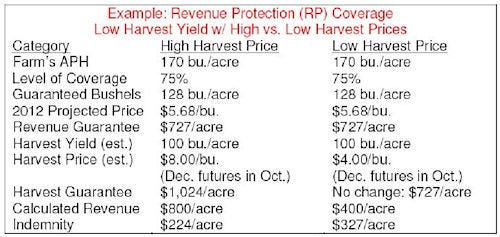

The chart accompanying this article shows an example to help you understand how the Revenue Projection (RP) product works. Say your farm's average APH is 170 bushels acre and you elect the 75% level of coverage; your guaranteed bushels are 128 bushels per acre. To calculate the revenue guarantee you simply multiply the guarantee bushels (128 bushels per acre) times the projected price of $5.68 per bushel to get $727 per acre.

Using RP in 2012 should provide a comfort level in selling bushels for delivery on a portion of your guaranteed bushels. Should a natural peril like drought occur, any shortfall in bushels below 128 bushels per acre should trigger an indemnity payment calculated at the $5.68 per bushel projected price.

Shortfall in harvest--what if drought limits your yield?

Now the proverbial question: "What if I don't raise those bushels that I've committed to delivery?" Use the example above and understand that the harvest yield estimated was only 100 bushels per acre, but your guaranteed bushels were 128 bushels per acre. Your indemnity will simply reflect those missing 28 bushels per acre times $5.68 per bushel or $159 per acre. If you had committed all 128 bushels per acre to delivery, you'll still need to work with your grain merchandiser to "buy back" those extra bushels as soon as you collect your crop insurance indemnity payment.

Most times there will simply be a charge of 10 to 20 cents per bushel since other merchandiser bushels can be substituted for your shortfall. Since you'll be collecting an indemnity payment following harvest reflecting $5.68 per bushel, the impact of "buy back" bushels is negated. Should the harvest price (futures price average in October) be less than the futures price that you contracted bushels for delivery, the "buy back" will be even less and reward your pre-harvest marketing strategy.

Note this indemnity reflects a futures price average, which is to your advantage. That's because the futures prices in most Corn Belt locations tend to be higher than the cash price used for "buy back" bushels. This is especially true at harvest when basis (cash minus futures) tends to be the widest.

Need to understand revenue guarantee vs. harvest guarantee

Where many farms struggle in using crop revenue insurance coverage and pre-harvest marketing of bushels for delivery is the ability to recalculate the revenue guarantee. The example includes two extreme harvest price estimates. The high harvest price is $8 per bushel and generates an indemnity of $224 per acre. The low harvest price is $4 per bushel but creates a much larger indemnity totaling $327 per acre.

That's because in the example, the actual harvest yield is multiplied times the higher of the projected or harvest price to create the calculated revenue. To determine the indemnity, subtract the calculated revenue from the harvest guarantee.

The $8 per bushel harvest price estimate allows for a new harvest guarantee to be calculated, since $8 per bushel is higher than the $5.68 per bushel projected price.

Note: this calculation is not available for the RPE product, since you have an exclusion on the harvest price.

Selling your guaranteed bushels, consider timing those sales

The key is the indemnity for any shortfall in bushels uses the projected price and has a minimum of the $5.68 per bushel. The advantage of the RP insurance policy over the RPE policy is that should the harvest price be greater than the projected price, a new harvest guarantee is calculated.

If you choose to pre-harvest sell bushels for delivery, consider timing those sales when December corn futures or November soybean futures are higher than the projected price. This way you're guaranteed that if you come up short of bushels, you can collect a minimum of $5.68 per bushel for corn or $12.55 per bushel for soybeans, respectively.

Conclusion: "The use of crop insurance revenue products such as Revenue Protection or RP can easily be used in combination with a pre-harvest sales strategy that commits guaranteed insurance bushels to delivery," says Johnson.

Use of forward contracts and hedge-to-arrive contracts are common tools for selling these bushels, he adds. "It's still important to understand how to use a variety of marketing tools. For bushels that you prefer not to commit to delivery, consider protecting the futures price with tools such as futures hedges and/or buying put options."

For farm management information and analysis go to ISU's Ag Decision Maker site www.extension.iastate.edu/agdm and Extension farm management specialist Steve Johnson's site www.extension.iastate.edu/polk/farmmanagement.htm.

You May Also Like