March 9, 2012

Over 80% of Iowa's 2011 tillable acres that were planted to corn and soybeans were covered by Revenue Protection (RP) crop insurance. In addition, most farmers using that product have a high level of comfort in committing "insurance bushels" to delivery. Combining crop insurance revenue products with pre-harvest crop sales has been a common strategy, especially since the odds favor higher corn and soybean futures prices in the spring and early summer months.

However, some farmers still struggle with answers to two primary questions:

What if I don't produce the bushels?

What if the markets move higher after I make sales, and I don't have enough bushels to deliver against my forward cash contracts?

Selling Your Crop Insurance Bushels

Using Revenue Protection (RP) coverage counters both concerns, says Steve Johnson, an Iowa State University Extension farm management specialist. He provides the following information and explanation of how to use the RP insurance product and sell your crop insurance bushels using seasonal price trends.

How to use RP coverage to take care of both of these concerns

Since RP is a farm-level product, you are guaranteed the Actual Production History (APH) times the level of coverage you elect annually on or before the March 15 deadline. With RP coverage, these bushels are guaranteed at the higher of the Projected Price (February average for December corn and November soybean futures) or the Harvest Price (October average for each of the futures contracts).

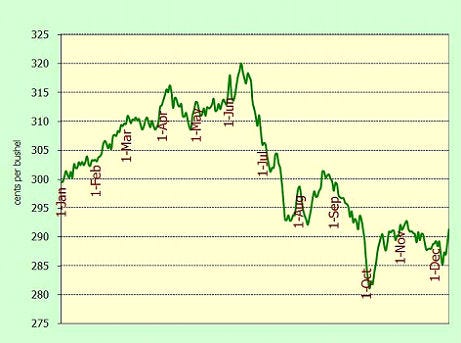

December Corn Futures Trend (1990-2011)

If you can't deliver bushels contracted, you're going to receive an indemnity payment reflecting any missing bushels at the higher of the two futures prices. In Iowa, very few merchandisers will require that you go out and buy substitute bushels. They will simply charge a service fee of 10 to 20 cents per bushel. Any missing insurance bushels are reflected in this indemnity payment received shortly after harvest when yield losses and the Harvest Price are known.

Let's look at an example: the insured has a farm with a 174.7 bu/A actual APH. That's a simple average of the last 10 years corn was grown on that farm. In 2012, many insured farmers will want to consider the Trend-Adjusted APH Yield Endorsement. Let's say the trend adjusted county yield factor for this farm is 2.38

bu/A. The TA Yield for this farm is 193.4 bu/A. This endorsement would increase the APH coverage on this farm by 18.8 bu/A.

Year Actual Yield Yield Adjustment Trend-Adjusted Yield

1999 155 30.94 185.94

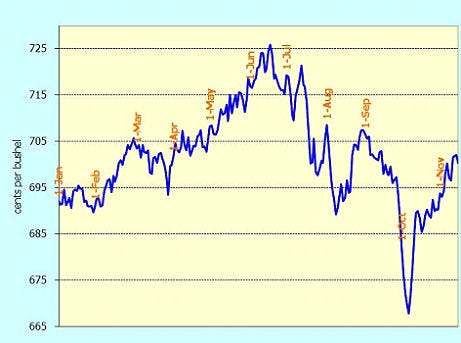

November Soybean Futures Trend (1990-2011)

2000 174 28.56 202.56

2001 167 26.18 193.18

2002 176 23.80 199.80

2003 175 21.42 196.42

2004 198 19.04 217.04

2005 194 16.66 210.60

2007 175 11.90 186.90

2009 148 7.14 155.14

2011 185 2.38 187.38

Avg Yield 174.7 193.5

Source: Iowa Crop Insurance Industry, February 2012

Most insured farmers will elect the higher TA Yield to benefit from the higher revenue guarantee. Another benefit is the additional 15 bushels per acre (193.5 minus 174.7 = 18.8 bushels per acre X 80% coverage) that can be pre-harvest marketed for delivery.

Compare revenue guarantee to crop insurance premiums

The projected price of $5.68 per bushel was not known until February 29. Thus the revenue guaranteed for crop insurance purposes is $794/A or $879/A depending on whether the farmer elects to take the TA Yield (at the 80% level). The premium difference will simply be the additional cost of covering those additional 15 bushels per acre. Again, these are extra bushels that can be committed to delivery.

Another strategy will be to look at the revenue guarantee and compare various levels of coverage using the TA Yield Option. With more bushels, revenue guarantees increase but lower levels of coverage have a higher percent of subsidy. Some farmers might use the TA Yield for 2012 to gain a higher revenue guarantee, but move to a lower level of coverage to save premium dollars.

Selling insurance bushels, interpreting seasonal price trends

Since the use of Revenue Protection (RP) coverage guarantees both bushels and price, many farmers like to pre-harvest sell a portion of these insurance bushels well in advance of harvest.

There is a risk if a farmer commits to delivery all their insurance bushels (APH times level of coverage) should they be unable to plant the crop. The prevented planting coverage is only 60% of the revenue guarantee. Another caution is the Harvest Price reflects futures price, not the cash price. Should the basis (cash minus futures) be positive at harvest, there's a risk of not having an indemnity check large enough to cover all insurance bushels if 100% are committed to delivery.

Look at 22-year history in line graphs for weekly futures price movement from January through December. Note that the seasonals favor higher new crop corn and soybeans prices in the spring months of March through June. The June highs in 2008 and 2011 exaggerate the extreme highs in June that occurred each of those years. Selling insurance bushels incrementally during the mid-February through mid-June (perhaps mid-July for soybeans) period is advised, rather than trying to time all sales for a specific week or price.

Conclusion: "Using Revenue Protection (RP) coverage and the new TA Yield Option will be popular choices for 2012," says Johnson. "You should consider combining these products with a preharvest marketing plan with a comfort level to sell 'insurance bushels' when futures prices are above the Projected Price for either corn or soybeans."

For farm management information and analysis, go to ISU's Ag Decision Maker site www.extension.iastate.edu/agdm and ISU Extension farm management specialist Steve Johnson's site www.extension.iastate.edu/polk/farmmanagement.htm.

You May Also Like