April 8, 2016

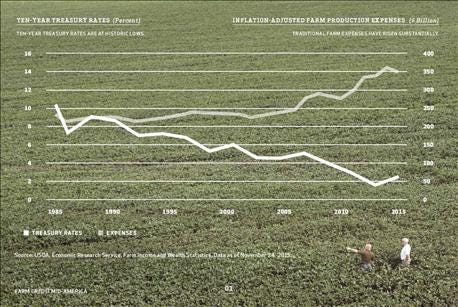

Chart highlights traditional input costs (preferably via an aggregate index) which have gone up sharply versus interest rates (on 10-year treasuries) which have trended down and are at historically low levels. Graph covers the time frame from about 1985 to present.

With a continuing trend of low grain prices and interest rates still hovering near historical lows, we are seeing both critical opportunities and challenges as we move into 2016. When you consider risk management strategies, it’s important to seize available opportunities and be realistic and proactive regarding increasing challenges. While all grain farmers hope for a rebound in grain prices, those who plan for the distinct likelihood of an extended period of low crop revenue and scarce profits will be best positioned for long-term viability and success. While input costs, hedging and diversification are always key management factors, thoughtfully revisiting each in 2016 can help effectively manage the heightened uncertainty and risk in the upcoming production year.

A broader view of input costs

If you had overwhelming evidence that traditional farm input costs—like seed, fertilizer, chemical and fuel—were at historically low prices and you had the opportunity to lock in those prices for many years to come, what would you do? I believe thoughtful and proactive producers would jump all over that too-good-to-be-true opportunity. Well, this is exactly the opportunity that farmers have right now with historically low interest rates. While interest expense may not be viewed as a traditional input cost, most farmers need some form of financing to run their business and the opportunity currently exists to lock in the price of that financing at historically low rates. You can literally lock in the price of your equipment financing for the next three to seven years, or the price of your real estate financing for the next 10, 20 or even 30 years with long-term fixed interest rates. Try doing that with seed, fertilizer, chemical or fuel expenses!

After much foreshadowing, in December 2015, the U.S. Federal Reserve System started to nudge interest rates upward. While the current window of opportunity to lock in a low fixed rate is still very much open, many economists predict a steady series of continuing interest rate increases. After this current window of opportunity closes, there will be a lot of time for reflection. Some will undoubtedly have painful reflection and ongoing second guessing as variable and adjustable interest rates move higher and higher, adding ongoing uncertainty and increasing stress to an already challenging economic environment. Others will have stable, locked-in and historically low interest expense — providing an ongoing and likely increasing competitive advantage — and can focus on managing other volatility and business risks. So, while traditional farm production expenses have risen substantially and remain at stubbornly high levels, locking in historically low interest costs remains achievable, though this window of opportunity will undoubtedly be closing.

Grain price risk - using luck or thoughtful planning

There will always be some crop producers who sell grain in the open market and occasionally fall into high prices that happen to coincide with harvest time or in the summer when they are forced to empty their grain bins. And that may have even happened with increased frequency in recent years. But let’s be objective and honest: Is it luck or a thoughtful pricing and marketing plan? Related considerations include:

Locking in minimal profits, or even a modest loss, is not enjoyable. Neither is riding the open market and ending up with even more adverse results.

During an economic downturn with limited or perhaps no profit margin available, proactive risk management and stability become even more important.

Lenders, landlords, suppliers and other business partners will value producers who demonstrate modern and progressive risk management that reduces uncertainty in the face of heightened volatility and economic stress.

It is worth asking yourself if you’re in the business of farming or riding the open markets. The first already involves material risks. The second is a separate choice that adds significantly more risk.

Luck, even recent luck, is not a sound substitute for a well-reasoned and proactive marketing plan. In contrast, a solid marketing plan with thoughtful forward pricing and hedging strategies provides meaningful price protection and speaks volumes about your commitment to effective risk management.

Diversification - a common risk management technique

Specialize or diversify? Both are valid strategies for farmers. But choose carefully and execute accordingly. For those that choose to specialize, achieving and maintaining high efficiency, including a low cost structure compared to their industry peers, will be key to reasonably assuring long-term viability and success. Higher cost operations will be among the first to succumb to a cyclical industry downturn. Many farm operations will understandably choose to diversify as an effective risk management technique. There are several common diversification strategies, including:

Produce several different crops to increase annual options and flexibility and minimize the risk of one commodity having abnormally low prices in a given year.

Engage in both crop and livestock production. While certainly not always the case, profit margins for crop and livestock production often move in opposite directions as low grain prices lead to low feed costs. When grain prices are unusually low, running crop production through a livestock enterprise can be a desirable and profitable alternative.

Supplement farm operations with off-farm income. A very popular and effective form of diversification, off-farm income can both bolster and help stabilize total income. The typical stability of off-farm wages is frequently a very desirable complement to more volatile farm risks and profitability.

Perhaps one or a combination of the above diversification strategies is right for your farm operation.

Proactive management of interest expense, a sound marketing plan, and thoughtful diversification can all contribute to strong risk management, increased stability and enhanced long-term success.

Read more on trends affecting ag finance.

You May Also Like