I’m happy to note that I long ago retired from buying grain. Happy because corn and soybean buyers for ethanol and crushing plants have the most difficult job now. Grain producers went into harvest with a powerful combination of a strong cash position and ample storage capacity. The result is frustrated buyers with the job of wresting large quantities of grain from people who have little or no interest in selling.

While I can sympathize with the buyers plight, there is no need to pity the soybean crushers and ethanol producers. They are currently enjoying incredible returns. Was the buyer forced to pay a 25-cent premium to secure grain for processing last week? This is not a problem in the current margin environment.

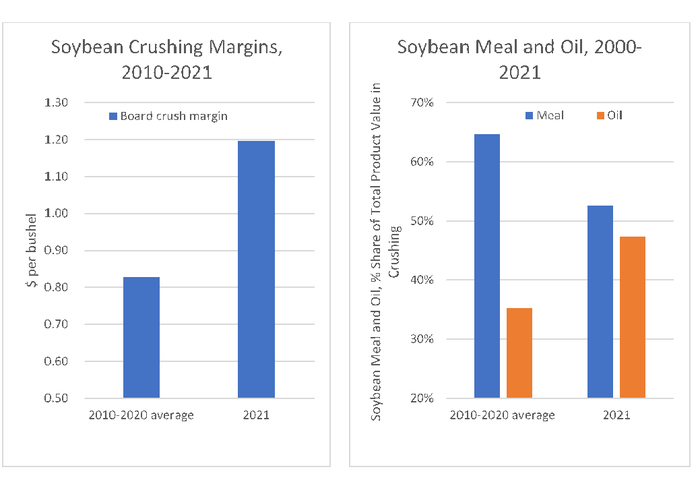

The word on the street is that soybean crushing margins are fantastic. The industry is responding. In a November press release, the U.S. Soybean Export Council noted that crushing margins increased significantly during the second half of 2021 with Q3 margins averaging $1.11 per bushel - up about 50% from the previous year. They also listed seven different announced plans to build new or expand existing crush plants. Slated for completion over the next 3 years, the investment total nears $2 billion.

Data source: CME Group. October 1 closing prices for November soybean futures and December soybean meal and soybean oil futures.

Improved crushing margins are driven by a strong soybean oil market. From 2010-2020, soybean meal and oil share of product value averaged 65% and 35%, respectively. Today, the share of product value is split nearly evenly between meal and oil (see accompanying charts).

Ethanol producers are also thriving. Using a model ethanol plant, the Agricultural Marketing Resource Center (www.agmrc.org) at Iowa State University tracks monthly returns in the ethanol industry. According to their model plant, from August 2018 through August 2021, there were only two months when net returns over fixed and variable costs were positive. In their latest estimate for October 2021, net returns over all costs were $1.19 per bushel of corn. Based on conversations with people in the industry, I suspect they are even better today.

Strong margins in both industries speak to strong demand and a positive outlook for corn and soybean markets. Corn and soybean prices are up 70-80 cents per bushel from their harvest lows. End-of-year basis levels in southern Minnesota are the strongest ever in my 30 years of data. I suspect that the buyer’s job will get a little easier in the new tax year when producers are more agreeable to recognizing income, but not before then.

The grain buyer’s job is not easy.

Source: Ed Usset, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like