This year has been a challenging one for soybean producers across Tennessee. Trade disruptions and record national average yield has pushed cash prices well below $8.00 in many locations in Tennessee. Additionally, the extended wet weather in late September has impacted soybean quality. Damage is ranging from minor with small discounts to extensive damage with loads getting rejected at elevators and barge points.

Farmers experiencing any of the following should contact their crop insurance agent immediately and report the issue: 1) notice quality issues in standing soybeans, 2) have cut a portion of a field and had quality dockage at the elevator, 3) or had a load rejected.

A crop insurance adjustor is supposed to visit the field(s) in question within 24 hours of filing a claim to determine the extent of the damage and the steps forward.

Quality issues will be difficult to overcome when marketing the crop. For example, damage discounts to cash prices can be $1 to $1.50 for 5 to 9 percent damage, resulting in cash soybean prices well below $7.00 per bushel.

However, producers with quality discounted soybeans face two other potential issues. First, production for crop insurance purposes can be adjusted for lower quality to increase the likelihood of an indemnity payment (decreased production). According to the 2018 RMA handbook, when the acceptable record provides moisture, foreign material, dockage, test weight, quality, grade, etc., the reported production can be adjusted. However, if such information is not included on the acceptable production evidence, production will not be adjusted. This can be a double-edged sword, as production adjustments (from quality) could generate a crop insurance indemnity payment for 2018 but may have an adverse effect on APH (historical yield for crop insurance purposes). Consult your crop insurance agent to determine short- and long-term implications.

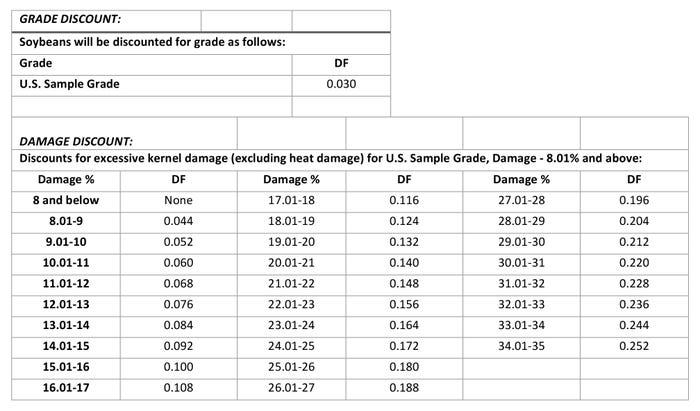

For example, the crop insurance discount factor (DF) for 14.0 percent kernel damage is 0.084 (see table below). The DF for U.S. sample grade is 0.030 (0.084+0.030 = 0.114) or (1.000 – 0.114 DF = 0.886 = Quality Adjustment Factor [QAF]). One thousand bushels of actual production would be adjusted by the QAF to: 1,000 bushels × 0.886 = 886 bushels (for crop insurance purposes, not cash sales). This could increase the likelihood of a crop insurance indemnity for producers with discounted soybeans, due to the reduction in 2018 production for crop insurance purposes.

Examples of crop insurance discount factor tables from the special provisions of insurance are:

Adjusted production for crop insurance purposes could lead to issue number two. The Market Facilitation Program (MFP) provides soybean producers with payments of $1.65/bu on half of their 2018 production or $0.825/bu on full production. MFP payments are made on actual 2018 production. The production will need to be certified at FSA. If adjustments are made to 2018 crop insurance production (adjusted lower), producers may need to use alternative or additional documentation to support/verify certified 2018 production at FSA to obtain the full MFP payment they are eligible for.

For example, if you had actual 2018 production of 50 bu/acre and a DF of 0.114 (QAF =0.886) for crop insurance purposes, then your crop insurance production would be 44.3 bu/acre (50 x 0.886). However, if you used only your crop insurance record to declare production for MFP payments, you would be short changing yourself by $4.70/acre ([50-44.3] x $0.825). Thus, producers should make sure that their certified production at FSA, for MFP payments, is prior to any production discounts made for crop insurance purposes.

Lastly, maintaining documentation will be important for verification, should RMA or FSA make the request.

This year has produced an extremely challenging set of circumstances for soybean producers in Tennessee. However, given the low-price environment and quality discounts to cash prices, producers need to avoid further adverse effects or leaving money on the table through crop insurance or MFP payments. All producers are encouraged to work with crop insurance agents and FSA service centers to obtain the best possible outcome available under these challenging circumstances.

About the Author(s)

You May Also Like