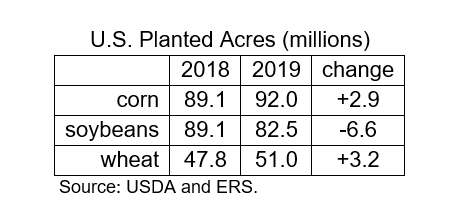

In early November, USDA released some interesting numbers as they work towards an updated Agricultural Baseline Projections report. Normally I don’t pay much attention to ten-year projections because, well, a lot can happen in a decade. Which numbers caught my attention? That would be USDA’s very early projections for planted acres of corn, soybeans and wheat in 2019. Of particular interest is the indication of nearly 7 million fewer soybean acres next year. Look at the numbers.

USDA emphasizes that these figures do not represent an official forecast. However, the process demands a projection, so you can bet that some sharp minds did more than wing-it.

What can we make of a preliminary forecast for a decrease of 6.6 million soybean acres in 2019? This would be the third largest single-year decrease in soybean acres on record… and it looks very reasonable to me. I’ve got a friend who is a grain analyst at a sizable brokerage form. He recently told me that among his broker/analyst colleagues, the opening bid for decreased soybean acres in 2019 starts at 5 million acres, with several people reaching as high as 10 million acres.

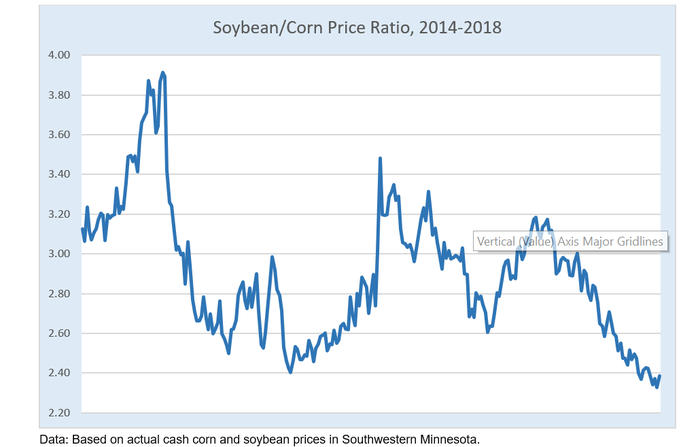

This forecast is also consistent with the current state of corn and soybean prices in Southern Minnesota. As of early November, cash soybean prices, relative to corn prices, are at their lowest level in five years (see accompanying chart). Soybean prices relative to corn say more corn and fewer soybean acres. Soybean prices relative to spring wheat (see last month’s “Plan Ahead” CSD column) say more wheat and fewer soybean acres. Yes, a total of 6.6 million fewer acres looks reasonable to me, but it could get bigger if we don’t find a way to put a trade war behind us.

USDA also released some very preliminary projections for the corn and soybean balance sheets in 2019/10. It is not very encouraging. Take nearly 7 million acres out of production and soybean stocks will decrease by a mere 160 million bushels – a burdensome stocks situation remains! USDA’s early thoughts for corn are surprisingly rosy; 3 million more acres but strong demand could use it all.

I am torn between two questions. As we move forward, can a slowly improving outlook in corn and wheat pull a soybean market out of the abyss? Or will an ongoing trade war and a damaged soybean market drag the corn and wheat markets even lower? I hate being a downer, but it is the latter scenario that bothers me.

I see that Dec’19 corn remains close to $4/bu. September spring wheat futures remain close to $6/bu. Plan ahead.

To check out the first story in the series, click on the link here.

About the Author(s)

You May Also Like