Last month I started my fifth year of teaching “Commodity Marketing” to undergraduates at the University of Minnesota. Teaching is a challenge but it is a challenge I enjoy. I want my students to understand the key driving forces of change in grain markets over the past two decades. The story I tell is straightforward. The key driving forces include, (1) the growth of ethanol production and corn demand and, (2) growing Chinese imports of soybeans.

It’s a good story, but I realize now that my story is incomplete. I failed to emphasize the emergence of new players in wheat – Russia, Ukraine, and Kazakhstan – and the changing landscape of wheat production and trade.

About a year ago, I started to imagine a scenario in the grain market that would lead us away from the bear and back towards better prices. In my mind, the leader in this change would not be corn or soybeans, but wheat. The scenario would go something like this...

After years of shrinking wheat acreage, a serious problem would develop in an important wheat production area. This short crop would be large enough to upset the supply and demand balance in wheat, and send prices sharply higher. Higher wheat prices, in turn, would put a spark in the corn market because wheat is an important feed grain (about 20% of wheat produced worldwide is fed to animals). A reignited corn market, in turn, would upset the soybean market as two major crops battle for acres. Goodbye bear, hello bull.

Summer arrived and my scenario followed the script as written. A butt-kicking drought settled into the Northern Plains. Spring wheat prices spiked and put some life into the corn and soybean markets. However, by summer’s end, the flash fire in wheat was doused and our attention shifted to yet another bumper corn and soybean crop. Prices are essentially back to where we were last spring. What happened?

This is what happened - I failed to comprehend the changing landscape of wheat production and trade.

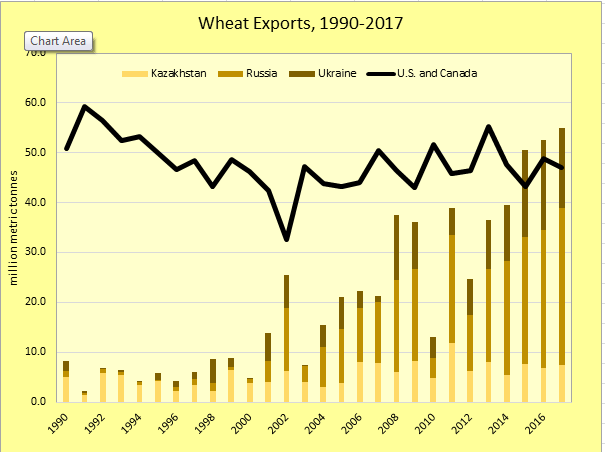

Due to fewer acres and drought in the Northern Plains, the U.S. wheat crop will be the smallest in over a decade. Impacted by the same forces, the Canadian wheat crop will be the smallest in 7 years. Meanwhile, on the other side of the world, Russia is producing its largest wheat crop ever – 5mmt larger than the 2016 wheat crop (and, by the way, their 2016 crop was 9mmt larger than their previous record crop). Ukraine produced their second largest wheat crop and Kazakhstan produced a big crop. These countries produce hard wheats that compete directly with the U.S. and Canadian hard red wheats. Today, their wheat exports exceed those of the U.S. and Canada (see accompanying chart).

The net result? Despite fewer acres, and despite the most difficult drought conditions for the spring wheat crop since 1988, world stocks of wheat will increase for the fifth consecutive year. So much for my bull market scenario.

How does a story of wheat wind up in a magazine titled Corn+Soybean Digest? When a market fails to live up to its potential as a game changer.

About the Author(s)

You May Also Like