You would have to be living under a rock to not know the FANG stocks – an acronym for Facebook, Amazon, Netflix and Google. Every market needs a leader and over the past year in the stock market, the FANG stocks are leading.

Commodity markets also need a leader. What do I mean by a “leader?” I am talking about a particular market or story line that establishes a bullish or bearish tone in the market. Sometimes the leading story line is obvious – the 2012 drought comes to mind. Other times the lead originates from less direct outside forces. Back in 1980, for example, the Hunt brothers were trying to corner the silver market. At that time, if you wanted to know what soybeans would do on any given day, you checked the silver market first. Energy markets led corn in the mid-2000s and, until the FANG stocks took charge last year, commodity traders had a sharp eye on the stock market.

The first six months of 2017 were noteworthy for their lack of a clear leader in the grain markets.

Corn is king and an obvious choice for market leader, but the king could find no direction in the first half of the year. Dec’17 futures traded in a 30-cent range from harvest through the end of June. No volatility! Crop prospects are mixed and the U.S. seems to be stumbling towards yields that fall short of trend. This keeps the bears away. The bulls like knowing that corn stocks will fall in the U.S. and worldwide. Lower stocks yes, but still a comfortable level of corn supplies.

The soybean market ought to be leading. Six million more acres than a year ago! Stocks will build and, relative to demand, reach levels not seen in over a decade. Big news, but the price response has analysts scratching their heads. An unrelenting barrage of negative news and early summer low prices were off just 10% from winter highs. The price recovery from early summer lows offered yet another good opportunity for producers to price new crop soybeans. The soybean market seems to be stuck in a range and searching for direction. Does this look like a market that wants to lead?

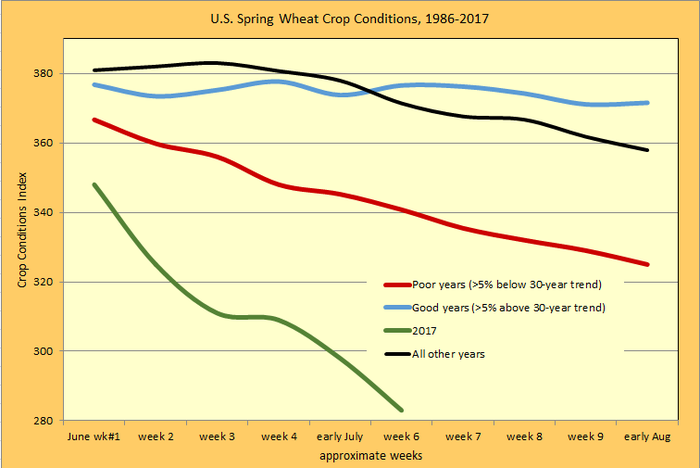

Which brings us to a relatively small crop traded at a small exchange: spring wheat futures at the Minneapolis Grain Exchange. The Northern Plains – particularly the Dakotas and Montana – are in severe drought. Spring wheat conditions are the worst seen since 1988. Prices exploded! The new crop Sep’17 contract rose from a mid-May low of $5.45 to over $8.50/bu. in early July. The MGEX set volume and open interest records and other grain markets finally took note. We found our leader!

Longer term, the spring wheat market is not large enough to stay in a leadership position. However, this small market served up a serious price jolt and a reminder; grain supply and demand is in a delicate balance. Corn and soybean crops are not pre-destined to produce record yields every year. Demand remains strong. The year ahead promises to show us better prices and opportunities.

Source: USDA/NASS Crop Progress reports and Edward Usset. The crop conditions index is based on weekly USDA crop ratings. An index of 500 reflects a crop in excellent condition, 400 is good, 300 is fair, 200 is poor and 100 is very poor.

About the Author(s)

You May Also Like