January 13, 2016

Data analytics company FarmLink has released a report showing that for the second year in a row, approximately 1/3 of U.S. farm operations could have earned additional revenue in 2015, totaling $8.1 billion.

Revenue opportunities were identified on corn and soybean operations across the Midwest, including top-producing states like Iowa. In Butler County, Iowa, for example, a 2,000-acre corn farm could have realized $218,550 more revenue if productivity had increased to levels achieved on other farms under comparable growing conditions, according to the report.

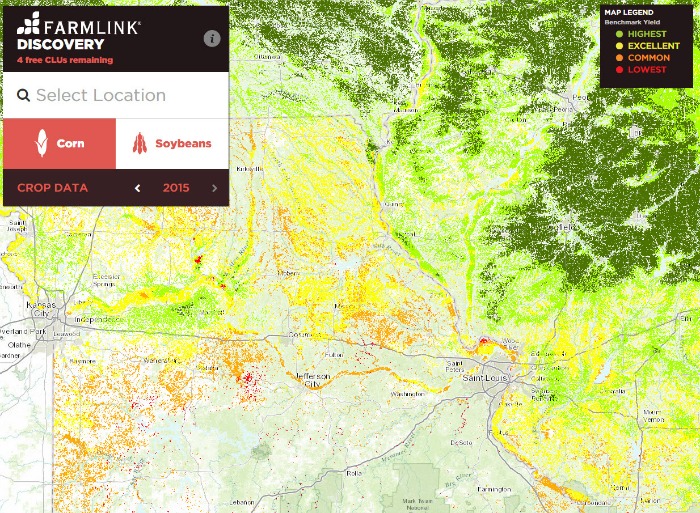

Bob McClure, chief data scientist for FarmLink, says new data tools, such as the company’s Discovery analytics platform, can help farmers identify opportunities in the 2016 season to apply advanced farming practices and maximize investments in seed and other inputs.

“Actionable data – not big data – is the key to increasing revenue for large and small farms, particularly when margins are tight,” says McClure in a news release the company issued earlier this week. “While there’s still yield potential left in the field, top producers use data tools to give them an edge to compete against nature and economic pressures.”

FarmLink has been gathering real-yield data for more than five years through MachineryLink - the combine leasing/sharing service started 15 years ago. Sensors on FarmLink’s fleet of combines collect data, and form the basis of TrueHarvest’s database. Data is aggregated and analyzed using FarmLink’s advanced analytics.

The company says the results come at a time when U.S. farmers are facing economic challenges, citing the USDA’s 2015 Farm Sector Income Forecast that forecasts a decline in net farm income for the second consecutive year after reaching recent highs in 2013.

“High-quality, accurate data can help growers and their advisors validate investment decisions, create a baseline for future performance expectations and establish a plan of action for 2016,” said McClure.

FarmLink’s report is based on more than five years of proprietary benchmark data and 25 years of public data from sources including the USDA, NRCS, NOAA and others.

FarmLink’s TrueHarvest benchmark determines the yield potential range by comparing the yield of a field to a benchmark, and identifying the zones where there is greatest opportunity for profitable improvement

Along with the release of its report, FarmLink also announced it has added yield potential information for individual fields in six additional states to its free data platform Discovery. Those states are North Dakota, Kansas, Nebraska, Indiana, Ohio, and Wisconsin, adding to the existing states of Minnesota, South Dakota, Iowa, Illinois and Missouri.

McClure says the platform is able to validate the effectiveness of farming practices and identify land potential more accurately and faster than public sources, based on its powerful data analytics.

“The next transformation of agriculture is happening right now – driven by the use of data science tools on the farm,” said McClure. “Just as we’ve seen in other industries – like energy, telecommunications and manufacturing – high quality data can level the playing field and allow individuals to achieve greater results faster than ever before.”

To view yield potential for these areas, visit discovery.farmlink.com.

Farm Industry News took this opportunity to learn more about its data analytics platform and how it compares to similar services that are being offered.

Q: How does FarmLink data reach its crop revenue conclusions?

A: FarmLink analysis is based on our complex recipe of private and public data sources, tested and retested, to produce unique indices with an accuracy level greater than 90-95%.

Based on the USDA report, farmers continue to face incredible economic pressure. They can’t afford to do things the same. That’s where insights from high-quality data technology – like FarmLink’s - can help pinpoint where to invest and where to maximize profitability.

Q: From that, you use a benchmarking tool that shows actual yield potential for a field versus what a farmer got, correct? What is factored in after that to reach the profit conclusions?

A: Based on our independent, high quality data set, FarmLink’s TrueHarvest benchmark determines the yield potential range by comparing the yield of a field to a benchmark, and identifying the zones where there is greatest opportunity for profitable improvement. Farmers and their advisors can validate investment decisions, create a baseline for future performance expectations and establish a plan of action for 2016 by using insights from this robust benchmark.

To determine the $8.1B in unrealized revenue conclusions for 2015, FarmLink identified the corn and soybean bushels that farmers could have realized if productivity had increased to levels achieved on other farms under comparable growing conditions.

Q: Any more details on where the data is derived? One source is from the combines, where you get the yield information and location, correct? Do the combine sensors pick up anything other than yield data? And, what are the public sources you use?

A: FarmLink’s data is derived from 800 million yield observations from our managed combine fleet for our proprietary field database, which includes yield information. FarmLink then combines its proprietary data with 20 years of information from the industry’s most trusted sources of public data to create agriculture’s most powerful and highly accurate data set. The public data sets include sources such as USDA, NRCS, NOAA and others. No one else has the robust data set we do.

Q: Who else do you see playing in this space of data aggregation and analytics? And, what makes your service better or different?

A: Our belief is that true precision agriculture is only achieved with precision data. There’s a tech transformation happening right now in agriculture – This is great news for farmers. Agriculture must set the standard to ensure the highest quality, scientifically validated data tools to inform farm management decisions. Anything less could be costly to farmers. While others in agriculture are offering precision ag tools, TrueHarvest is the industry’s only independent and scientifically validated benchmarking tool that allows for accurate peer comparisons and informed management decisions.

For more information about the company, go to www.farmlink.com.

About the Author(s)

You May Also Like