Corn bears remain in control with the JUL17 contract pulling back by over -15 cents from last Fridays high. Most bears see the recent rounds of rain as "re-charging" the soils and limiting the chances of a crop damaging drought.

Many inside the market are wondering how far producers will have to fall behind their traditional planting pace before the trade begins to sit up and take notice. Last week the USDA reported 6% of the U.S. corn crop as planted vs. the 5-year average of 9%. today could get a bit more interesting as we start to fall further behind.

The average pace is thought to be at or just north of 15%, whereas we will probably only have 9% to 11% planted. From there the historical average starts advancing rather quickly, jumping to 30%, then 50% by the end of the first week in May, and to around 70% planted by May 15. I'm certainly not saying it can't happen, because I've seen the U.S. producer get faster and faster and much more advanced in the past several years, but it feels like the weather will need to turn more cooperative and provide a slightly larger window of opportunity.

Demand domestically remains strong with ethanol continuing to lead the growth story. Weekly export sales were alright but towards the lower end of the range. There is some talk of cheaper wheat and more poor quality creating stronger competition for corn. Personally I don't see "demand" as the problem, rather it's the reality that we are swimming in supply, especially with South America hitting a recent home run.

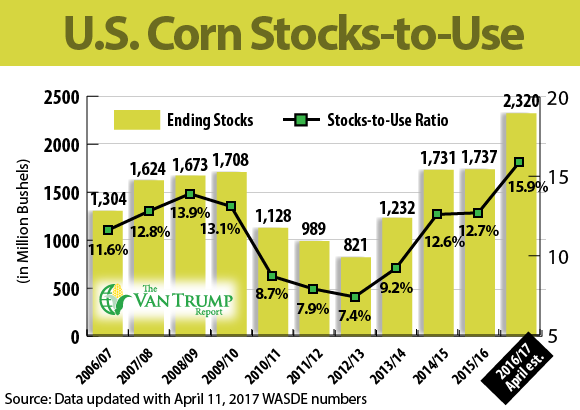

Yes, U.S. planted acres have pulled back an approximate -4.0 million compared to last year, but we are still looking at a healthy 89 to 90 million. As you can see from the graphic below"stocks-to-use" offers up little in the way of bullish rhetoric. It's now all about U.S. weather. If we catch some widespread "uncertainty" there's perhaps +50 cents of upside with the funds begin positioned aggressively short. If weather cooperates I feel there's perhaps another -50 cents of downside. In my opinion it's still a coin-toss...

GET MORE OF MY DAILY REPORT HERE

About the Author(s)

You May Also Like