Seasonal patterns are a dominant theme in grain markets – they even affect our conversations. The conversation at harvest is about yields. It is NOT about next year’s planting intentions – that topic generally waits for the start of a new year. Well, forgive me for being early, but we need to discuss planted acres in 2019. It might help you to plan ahead for next year’s pricing opportunities.

I will start the discussion with a statement and a question. Illinois, Iowa and Minnesota are consistently the top three states for planted soybean acres in the U.S. Which state is fourth? That would the great state of North Dakota. Hold on! North Dakota farmers plant more soybeans than farmers in Indiana, Nebraska, Ohio and Missouri? Yes. And this is not a one-year anomaly – North Dakota captured the #4 spot in 2014 and they have held it for five consecutive years.

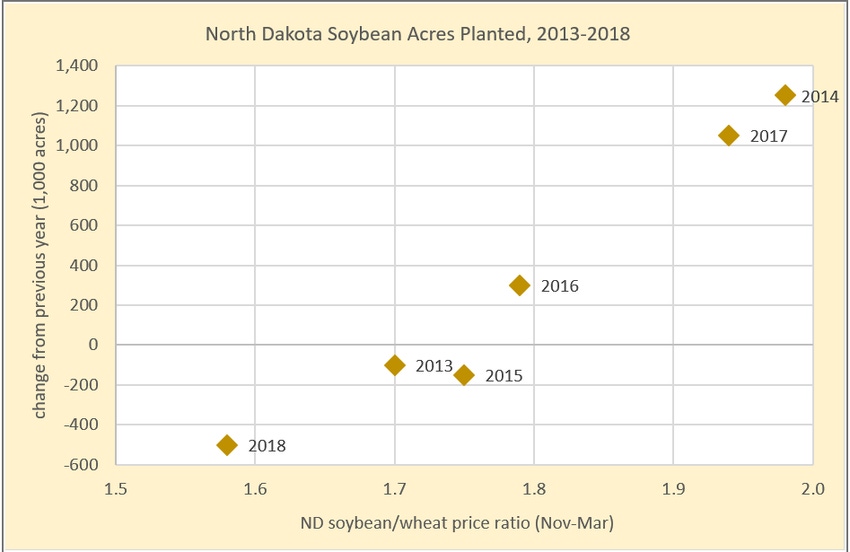

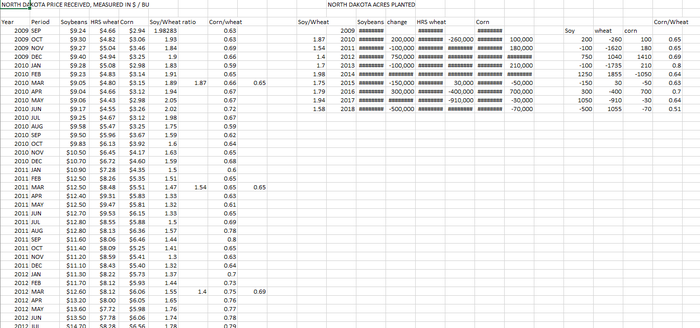

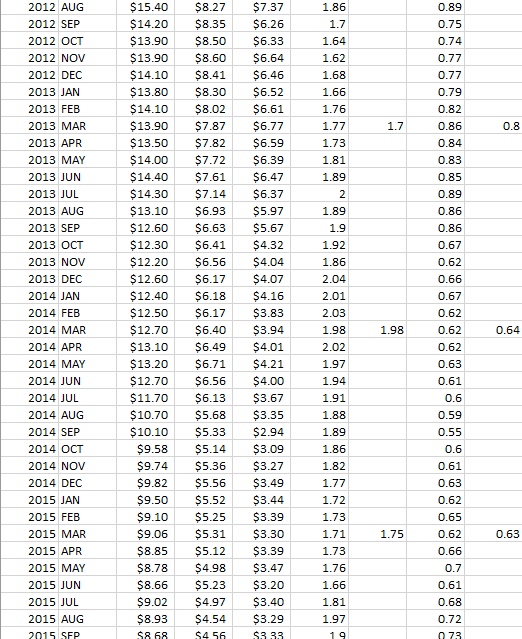

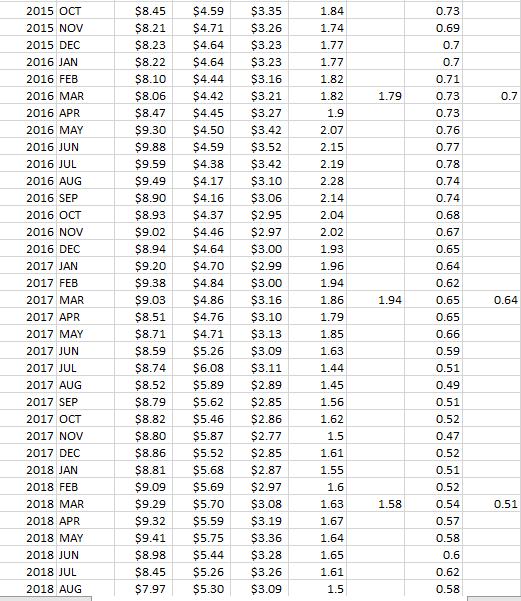

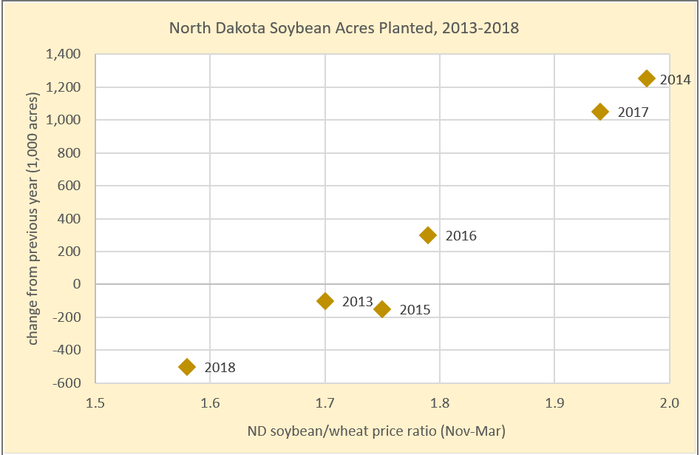

Why the popularity of soybeans (and corn) in North Dakota? Lousy wheat prices, relative to soybean (and corn) prices. As the accompanying chart shows, soybean acres had their largest increases (2014 and 2017) in years when the soybean/wheat price ratio was nearing 2:1, or soybean prices nearly twice the price of spring wheat. Soybean acres can also decrease in years when the ratio is low. See this past year, when the price ratio was less than 1.6:1, and soybean plantings fell by 500,000 acres.

A quick perusal of nearby and new crop 2019 soybean and wheat prices in North Dakota puts the ratio at less than 1.4:1, a figure that is (literally) off my chart. Soybean prices, in flat price terms and relative to wheat, are awful. Do I think that soybean acres in North Dakota could decrease sharply in 2019? Yes, I do. However, not just in North Dakota, which I use as a bellwether for soybean/wheat ratios all over the country. I expect similar changes In South Dakota and Kansas, two more states where soybean acres have grown sharply at the expense of wheat acres. Soybeans prices are also low relative to corn prices, which tips the balance towards more corn acres at the expense of soybeans.

Here’s where the “plan ahead” comes in. Last year, I wrote a column titled “How to get $4 corn”. With corn prices currently closer to $3 than $4/bu., it still sounds enticing. The steps towards $4 cash corn started with the sale of new crop corn futures at $4.10/bu. Today, new crop Dec’19 futures are close to $4/bu. We are almost there!

By the way, I could have easily titled that column “How to get $6 spring wheat.” With new crop Sep’19 spring wheat futures near $6.20/bu., $6 cash wheat prices should be on your radar.

Jump ahead 3 months, when harvest is last year’s news and the conversation is focused on 2019 planted acres. The market will be anticipating millions fewer soybean acres, most likely to be replaced by corn and wheat acres. Will the chance to sell Dec’19 corn at $4/bu. and Sep’19 spring wheat at $6.20/bu. still be there?

Plan ahead.

About the Author(s)

You May Also Like