Submitting a topical column two weeks prior to publication can be a challenge. A lot can happen in the two weeks between my writing a column and you reading it.

For example, on August 10, 2018, I submitted a column, “Wheat is the Leader,” for publication in the September issue of Corn & Soybean Digest. We were just months into a trade war with China. Soybean prices were in a funk but wheat prices were showing some life. I made the argument that a strong wheat market could lead us out of a bear market. Wheat prices were trending higher in July and peaked on August 8. When the article reached your mailbox in early September, prices were already 70 cents lower. Ouch.

A more recent example was just last month. I submitted “Spring Price Rallies in Corn” in mid-February, for publication in March. I made the argument that there was good reason to expect a better pricing opportunity this spring. Need I remind you of the Covid-19 pandemic and economic shutdown that started in early March? Ouch again. Bad timing is my middle name.

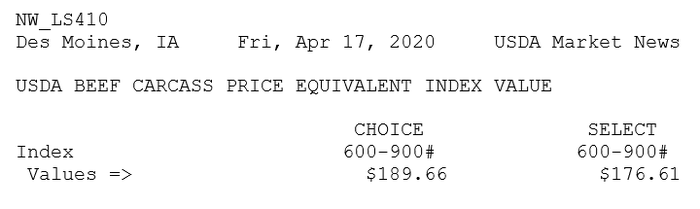

Bad news is too easy to cite today. Cash corn prices are down nearly 25% since the start of the year. Soybean prices are down about 10%. Grain prices are dreadful, but still better than livestock and dairy. Price declines in corn and soybeans look good compared to the cattle, milk and hog markets.

Good news is scarce in the current environment, but if you need some look to basic food grains. Oats and winter wheat prices are higher since mid-February, and close to elevated prices seen at the start of the year. Spring wheat and durum (think pasta) prices are volatile but generally holding steady since mid-February. Stockpiling, labor issues and logistical problems have contributed to rice prices at 7-year highs in Southeast Asia.

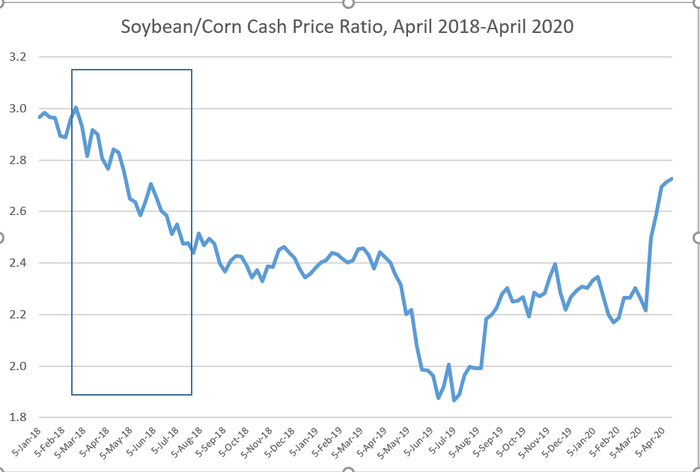

Are you looking an interesting turn of events in the grain market? Take a fresh look at the soybean-corn price ratio. This ratio is at its highest level since the trade war went into effect two years ago (see accompanying chart). The ratio was stuck in neutral (2.2-2.4) – not favoring corn or soybeans – since harvest of last year. As of mid-April, the ratio is fast approaching 2.8 (cash soybean prices 2.8 times higher than corn prices), a level that could encourage more soybean plantings and production. But is the change too late to have an impact on planted acres this year?

Speaking of planting, the season couldn’t come at a better time. Social distancing is easy on a planter, as is market distancing. And some time away from these markets is needed now.

Cash price data from Pipestone, MN. The rectangle covers the period when the trade war was developing.

Read more about:

Grain MarketsAbout the Author(s)

You May Also Like