A lady walks into a bar and says in desperation rather than humor: “Take my politician, please!” Americans of all political persuasions are looking for leadership that can quickly end this bizarre darkness in which we find ourselves. Politicians and even some of us found ourselves in the draconian position weighing the scales of working for a paycheck against contracting Covid-19.

A General View of the Economy

Consumer spending, the engine of the market, has nearly lifted the U.S. economy out of the COVID hole of the spring months and a resurgent fall and early winter. An anticipated return to government assistance is helping fuel consumer spending before it starts to stutter again. A part of that aid package may be some assistance to agricultural producers.

President-elect Biden has said his top priority is to bring a speedy end to the virus and its economic impacts. Setting aside that 47% of the population may hold different priorities, most interest groups and many Americans will be pushing for those funds. And, that government assistance is bringing business investment back into the mix by doing a couple of things: putting Americans back to work, lowering unemployment, especially long-term unemployment; too, it’s making U.S. business look good as an investment, bringing foreign dollars here, and that’s new money, further improving the economy. These factors may boost our business sector.

Money circulation is an issue that’s being hotly debated among economists and financial experts. The head of the Fed, many on Biden’s Economic Team, and a bipartisan group on the hill agree with analysts who think inflation need not be worried over now. There will be lots of horsepower pushing for lots of emergency and regular and new government program spending to get the domestic economy moving again. And, that will include agriculture–probably through such programs as Broadband, Export Assistance, Renewable Fuels, Rural Development, Conservation, Crop Insurance and Risk Management, Beginning and Small Market Farms. The Federal Reserve is conducting these actions: near-zero interest rates; Securities purchases, for a $6.1 trillion portfolio. The U.S. government appropriated $2.6 trillion, with USDA receiving $2.4886 billion.

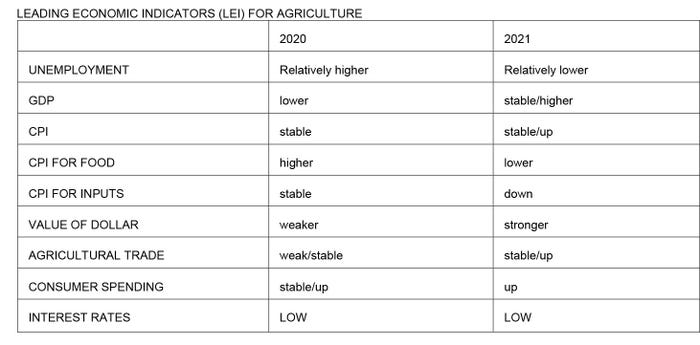

Leading economic indicators (LEI) vary somewhat among agencies, institutions and the private sector. There are also the top five leading indicators: yield curve, durable goods orders, stock market, manufacturing orders and building permits. Many analysts and families who follow the markets tend to have a handful of indicators in common: a measure related to exports–perhaps the value of the dollar; the value of money, such as interest rates; a data point on how the economy is doing, such as Consumer Spending or Gross Domestic Product; cost of inputs, such as cost of energy (this might be a benefit and a cost) or labor equipment costs, etc. A review of LEI predicted by various analysts suggest the stage is set for agricultural producers to take advantage of recovering markets and be poised for profitability.

So, if we soon don’t get COVID-19 under control and on the run, we are likely to see a stable to slow growth in the economy, a weak American dollar relative to our trading partners, more jobs, higher wages, higher exports for a while, and little-to-no inflation. Those folks who stopped looking for work last month, making the unemployment rate look better than it is, will return in the next few months, temporarily driving Unemployment back up just when political will is improving.

But, after punching out COVID with a vaccine, optimism will begin to return. Americans have been here before after the Great Influenza Pandemic of 1918-19, the Great Depression and Dirty Thirties and after WWII. If not personally, this is when the symbols of our history will help us give each other a hand up.

Next is this series: "A tale of two markets," by JJ Jones, Oklahoma State University and David Anderson, Texas A&M University.

Source: is OSU, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like