May 5, 2016

Here we are beginning the third year of a farm bill that will end with the 2018 crop year. This means that discussions on changes and what should be in the next farm bill will likely begin as early as next year. I’m quite sure some discussion within industry, commodity groups and with legislators has already begun.

The 2014 farm bill, although it is referred to as 2014 legislation, did not actually get put in place on farms until the 2015 crop. Producers and landowners had to make base, yield and program elections in 2015 that were then retroactive to the 2014 crop year.

For cotton, this present farm bill has been criticized for essentially providing no “safety net” when compared to the previous 2008 farm bill. This may be an unfortunate but accurate assessment. Reality is the cotton program had to change due to losing the WTO case with Brazil. STAX was considered the best way to provide a safety net and still be WTO compliant.

What makes this an even more bitter pill to swallow is that while the DCP program was eliminated for all crops, including cotton, all other crops except cotton (now called Covered Commodities) got the new ARC/PLC program. As it ends up, compared to the 2008 farm bill, the only change in other crops was giving up the Direct Payment. The CCP program was eliminated but replaced with what appears to be a better PLC/ARC program.

We now have 2 and a half years to consider whether or not this current farm bill provides the type of safety net needed, and if not, look for ways to make improvements. We need to look at the subsidies being provided in other countries and make sure US agriculture is provided a level playing field. We need to look across all commodities and make sure that the farming interests in all parts of the country are treated fairly and programs in place to benefit farms of all types.

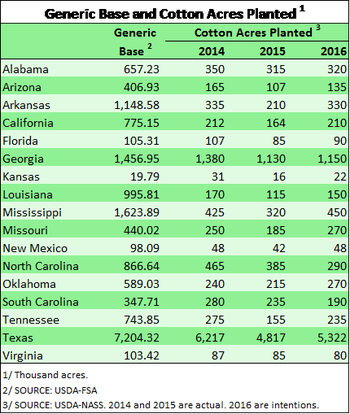

In terms of farming management and acreage flexibility, the Generic Base provision is good. Due to more competitive returns from corn and soybeans in recent years, farms especially in the Mid-South had shifted acres out of cotton. Generic Base allows farms with cotton base ability to continue to plant these and other Covered Commodities and be eligible for ARC/PLC.

I fully understand why cotton leadership moved to establish this provision. For future legislation, hopefully it will still be considered cotton base or the Generic Base continued. Under the current farm bill it at least gives land some value where it otherwise would have none.

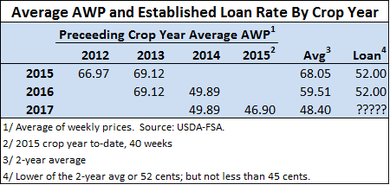

Loan rate may not hold

Under the new farm bill, the Loan Rate is allowed to float between 52 and 45 cents. The Loan Rate must be announced by October 1 and will be the average AWP (Adjusted World Price) for the most recently completed 2 crop years but cannot be above 52 cents or less than 45 cents. The base Loan Rate for the 2016 crop will remain at 52 cents but this may not hold for 2017.

The AWP averaged just under 50 cents for the 2014 crop year and is currently averaging about 47 cents for the 2015 crop. The AWP appears to be on track to average less than 50 cents for the 2014 and 2015 crop years—which will be used to determine the Loan rate for the 2017 crop.

Assuming a 2 to 3 cent drop in the Loan Rate combined with the recent 2 cent reduction in the transportation adjustment from the FE Price to the AWP, this effectively cuts an LDP or MLG by 4-5 cents from what it otherwise would be—all other things being equal.

Worth noting, however, the reduction in the transportation cost adjustment, should it remain in effect for an extended period of time, will raise the AWP used for consideration in future Loan Rate calculations. It’s unfortunate, however, that basing the Loan Rate on the AWP eventually works to provide less protection to the grower during a period of sustained low prices. If prices rebound by 2017 and 2018, all this becomes moot.

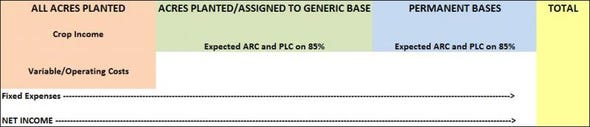

Especially in the Southeast and Mid-South where farm operations can be highly diversified, this new farm bill has many moving parts and this can make annual planning and budgeting more difficult. I’ve recently had opportunities to meet with bankers and Farm Credit lenders and have presented the following “template” or format for how to organize the annual farm plan and budget.

It’s important to not try to combine too many things. Treat things separately, otherwise it can be confusing. There are a lot of different acres, yields, and price components in the mix and some things are based on acres planted and others are not. Keep bases separate and don’t try to mix crop income with payments income.

Don Shurley is professor emeritus of cotton economics in the Department of Agricultural and Applied Economics at the University of Georgia-Tifton Campus.

You May Also Like