Soybean traders have experienced an extremely wild ride the past several sessions as the market tries to digest and forecast U.S. weather and new-crop production.

Precipitation totals look to be improved and have taken some of the nearby fear out of the marketplace. In particular areas in South Dakota and Minnesota that have had the trade worried, look as if they are going to get some timely rains. We also continue to hear talk about weaker Chinese buying interest.

I'm not sure that really holds water, as it seems almost every year we hear the same type of rhetoric, only to come back at a later date and hear those comments retracted. In my opinion, Chinese soybean demand seems to be as strong as ever. In fact Reuters reported Thursday, "China signed there second-largest deal for U.S. soybeans, agreeing on to buy 12.53 million tonnes of U.S. soybeans and 371 tonnes of U.S. beef and pork even as President Donald Trump warned about issuing trade sanctions against the country."

Not that this agreement really means anything and seems to be more symbolic than anything, but I don't see Chinese soybean demand going away. Certainly they could buy a few more bushels form South America since they recently harvested a record crop, and that could push back their early buying interest in new-crop U.S. soybeans, but eventually I suspect the Chinese step up to the plate and buy again in bulk.

Bottom-line, Chinese demand should have little influence on this market during the next two months. I would call it "noise" rather than "music". The trade is clearly going to dance to U.S. weather, nothing else will have much influence until we get a better understanding of U.S. production. I still contend it's extremely early in the game, and that a sub-46 bushel average yield, at least in my opinion, is still a very real possibility. I realize we've had record setting soybean production in each of the past three years, but the weather is still an extreme unknown.

As a producer I'm a bit upset that I didn't pull the trigger on another sale vs. the NOV18 contract. I made some small early sales at $9.50 and again at $10.02, but then the market pushed to $10.28 and I didn't pull the trigger. I'm actually upset with myself because I had an earlier target written down on paper at $10.25, but then pulled it and bumped it up to $10.30 when the market started moving much faster. I know better than that...

Hopefully we will get another shot. Staying extremely patient. As as spec I still think there is more room to the upside, and will be looking to initiate a bullish position on a break in price closer to $9.50 per bushel.

GET ALL MY DAILY COMMENTS HERE

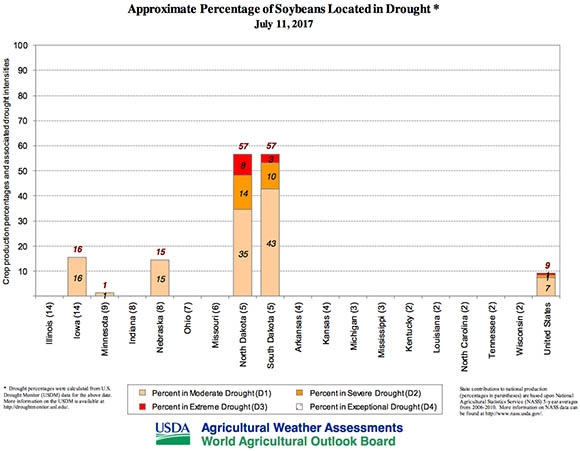

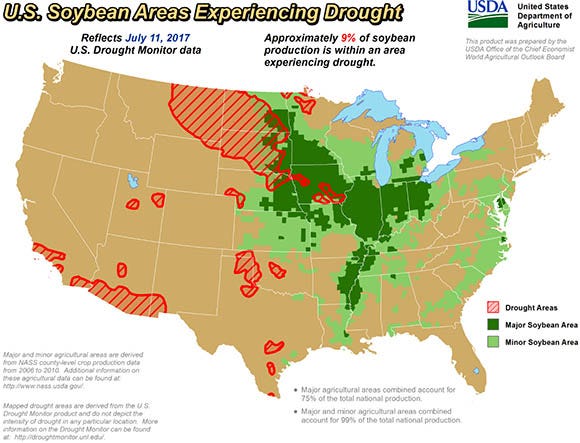

U.S. Soybeans In Drought Areas: The graphic I included below was released yesterday by the USDA. It shows in "red" areas that are experiencing drought, which is overlaid on top of area in "green" that produce the most soybeans. As of right now, and similar to corn, the USDA estimates that about 9% of the U.S. soybean crop is within an area experiencing drought.

About the Author(s)

You May Also Like