Several scenarios could play out in the months ahead that will impact your grain and livestock markets and there is not a person or a computer that can predict how these future events will play out, nor how they will impact the dollar value of the commodities you produce.

When it comes to marketing, it is difficult to keep missed opportunities from haunting the decisions you make going forward, and while we should look forward to the “what if” scenarios that could play out this summer, you have got to make sure you are positioning your operation to avoid turning these marketing opportunities into “could have beens”.

Beyond price prediction, respect the possibilities

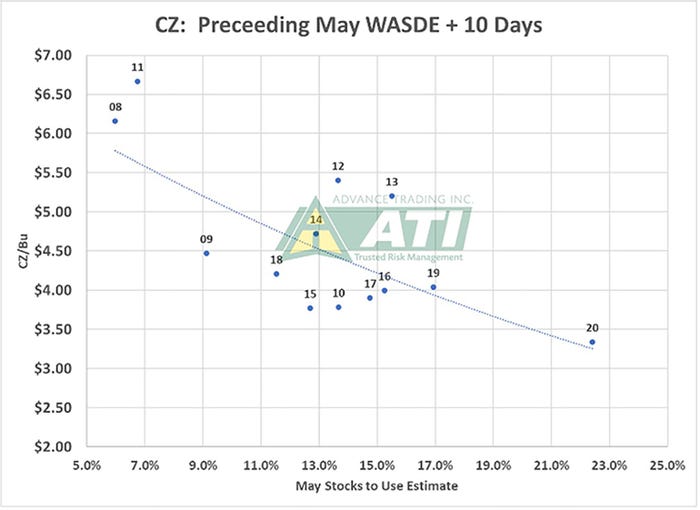

Below is one of my favorite graphs that illustrates the dynamics and potential ahead. Looking at corn specifically and in true Keep It Simple fashion, we will just use the ending stocks-to-use ratio compared to the price history of new crop corn. The graph highlights the parabolic nature of price when ending stocks get tight, and we have seen this type of market activity since last summer. If more production dominos fall, prices will have to move even higher than they are today in order to ration demand.

Although, everything can change quickly, right?

And while it does not feel like this bull market is getting tired just yet, rewind the clock and we are reminded how quickly things can change. It was not too long ago many analysts and the USDA painted a seemingly forever-burdensome carryout picture for corn and soybeans, and it was difficult to argue against them at the time.

We just do not know when, but at some point, the stocks-to-use ratio usually comes back into a better balance. American farmers have a history of ‘meeting demand,’ you are the best farmers in the world and you, as well as your neighbors, are incentivized to produce as many bushels as you can. Don’t underestimate your ability to do so.

Possibly the biggest ‘what if’ out there today: will Mother Nature give you the chance this year?

As the year unfolds, uncertainty fades

Each day that passes brings more information. Information about the Safrinha crop in Brazil, the growing season in the U.S., and other areas of the northern hemisphere; what type of global supplies the U.S. farmer will be competing against, as well as how both domestic and foreign demand are shaping up. We also have plenty of outside factors like inflation, monetary policy, trade wars – or actual wars. With each day, the market digests the knowns, weighs the unknowns, and uncertainty fades as the supply and demand picture becomes a little clearer.

Defend the decisions you make!

In my opinion, we should all be getting more accustomed to expecting the unexpected. So we need to defend our marketing decisions accordingly. If you prefer to be more aggressive and are making forward sales, make sure you are retaining upside opportunity against those sales by incorporating Call options – because nobody enjoys being on the outside looking in, especially if you have a production short-fall. Others may be more comfortable managing Put option floors and the flexibility that they give you.

Bottomline, there are ways to defend the decisions you make without being blindly bullish or bearish, protecting your operation from marketing “Could have beens” of the future.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like